Best Dividend Stocks: Tyson Foods, Inc. (NYSE:TSN)

By: Ned Piplovic,

While lacking a decades-long streak of consecutive dividend boosts like many of the best dividend stocks, Tyson Foods, Inc. (NYSE:TSN) has delivered extraordinary dividend growth over the past few years.

However, short-term dividend growth by itself is not sufficient to make investors consider any equity among the market’s best dividend stocks. Nevertheless, the Tyson Food stock also delivers above-average dividend yields when compared to its industry peers. Combined with robust capital gains, Tyson Foods is a stock worth considering as it may potentially become one of the best dividend stocks in the near future.

Many of the best dividend stocks have streaks of consecutive annual dividend hikes that span decades. However, looking at Tyson Food’s track of dividend hikes over the past two decades many impel investors to easily overlook the company’s potential. After all, Tyson Foods did not pay any dividends for the first four decades of its existence. Even after initiating dividend distributions in 1976, the quarterly payout rose at a very slow pace. For the first 13 years of the past two decades, the company paid a flat $0.16 annual distribution before embarking on its current streak of rapid dividend growth over the past seven years.

Best Dividend Stocks: Tyson Foods Financial Results

The positive stock and dividend results stem from strong operational and financial fundamentals. On May 6, 2019, the company reported a 6.8% year-over-year revenue increase from $ 9.8 billion in the same period last year to $10.4 billion. Gross profit rose to $1.2 billion at an even higher rate of 17.4%. Because the cost of goods sold and operational expenses grew slower than revenues over the past year, the company’s earnings increased by more than one third from $315 million last year to the current $430 amount, or $1.17 per diluted share. In addition to strong growth versus the previous year, Tyson Food’s current adjusted earnings per share (EPS) beat analysts’ expectations of $1.14 by 2.6%.

Tyson Foods, Inc. (NYSE:TSN)

Headquartered in Springdale, Arkansas and founded in 1935, Tyson Foods, Inc., operates as a food company through four business segments — Beef, Pork, Chicken and Prepared Foods. The company processes beef and pork into primal and sub-primal meat cuts, as well as case ready beef and pork, and fully cooked meats. Additionally, Tyson Foods raises and processes chickens into fresh, frozen and value-added chicken products. Furthermore, the company also supplies poultry breeding stock, as well as makes and markets frozen and refrigerated food products, including ready-to-eat sandwiches, bacon, flour and corn tortilla products, appetizers, snacks, prepared meals, side dishes, breadsticks and processed meats. The company offers its products under a variety of well-known brands, including Tyson, Jimmy Dean, Hillshire Farm, Ball Park, Wright, State Fair, Sara Lee and Golden Island.

Best Dividend Stocks: Tyson Foods Share Price

After losing nearly 40% of its value during 2018, the share price has followed a steady uptrend since the beginning of 2019. Between the onset of the trailing 12 months in mid-June 2018 and its 52-week low of $50.75 on December 24, 2018, the share price declined 28%. The December 24 closing price marked the share price’s lowest level since January 2016.

However, the share price reversed direction in the last week of December 2018 and advanced nearly 63% before reaching its new all-time high of $82.60 on May 15, 2019. Since its recent peak, the share price experienced a brief drop in late May due to the market’s downward pressures. However, the share price regained almost all those losses quickly and closed on June 12, 2019 at $82.31 — just 0.4% short of the all-time high. The June 12 closing price was 16.9% higher than it had been one year earlier, 16.9% above its 52-week low in late December 2018 and 125% higher than it was five years ago.

Best Dividend Stocks: Tyson Foods Dividends

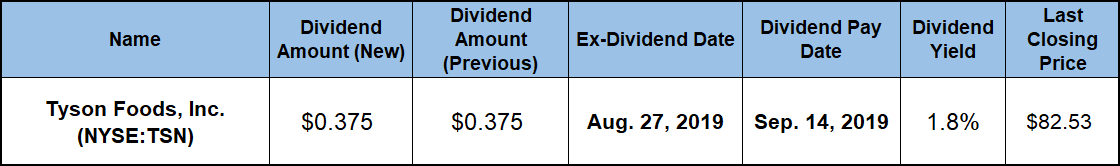

Tyson Food’s current $0.375 quarterly dividend distribution is 25% higher than the $0.30 quarterly payout amount from the same period last year. The new quarterly payment amount is equivalent to a $1.50 annualized dividend for 2019 and currently yields 1.8%. While seemingly low compared to the average yields of some other equities and segment averages, Tyson Food’s current yield is a strong performer when compared to Tyson’s own and industry yield averages.

The current 1.8% dividend yield is 40% higher than Tyson Food’s own 1.3% average yield over the past five years. While trailing the current 1.89% simple average yield of the entire Consumer Goods sector by just a few basis points, Tyson Food’s current yield is more than double the 0.88% yield average of the company’s peers in the Meat Products industry segment. Furthermore, as the second-highest yield in the Meat Products segment, Tyson Food’s current yield even outperformed the 1.17% average yield of the segment’s only dividend-paying companies by more than 55%.

Since 2012, Tyson Foods has enhanced its annual dividend payout amount more than nine-fold. While high compared to customary dividend growth rates, the most recent 25% quarterly dividend boost pales in comparison to the 32.3% average annual growth rate since 2012. Even with a flat annual dividend distribution for two-thirds of the past two decades, Tyson Food’s average growth rate since 1999 is still nearly 12% per year and higher than average dividend growth rates of most other equities on the market.

Additionally, the company’s current dividend payout ratio of 25% indicates that Tyson Foods currently uses only a quarter of its earnings to cover its dividend distributions. Therefore, Tyson Foods has plenty of room to continue increasing its dividend payouts by a 20%-plus annual rate and still keep its payout ratio in the 30% to 50% range. This range is generally considered by investors sustainable over an extended time horizon.

The rising dividend distributions and a strong share price uptrend in 2019 have combined to reward Tyson Food’s shareholders with a total return of more than 17% over the past 12 months. Over the past three years, the total return on shareholders’ investments was almost 43%. Lastly, shareholders more than doubled their investments during the last five years with a total return of more than 140%.

Related Articles:

3 Best Dividend Stocks to Buy Now

The 6 Best Dividend Stocks That Yield More Than 5%

Fidelity’s 5 Best Dividend ETFs

5 Best Dividend Mutual Funds to Buy Now

6 Best Dividend ETFs to Buy Now

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic