Bristol-Myers Squibb Hikes Dividend 2.6%, Pays 2.6% Dividend Yield (BMY)

By: Ned Piplovic,

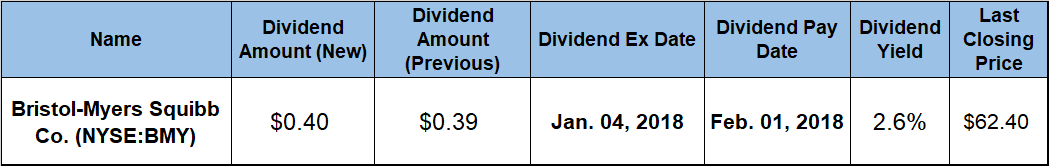

The Bristol-Myers Squibb Company (NYSE:BMY) hiked its quarterly dividend 2.6%, which is the eighth consecutive dividend boost to the company’s annual dividend payout.

In addition to the 2.6% quarterly dividend boost, the company currently pays a 2.6% dividend yield. When combined with the 5.5% share price growth, the company rewarded its investors with a total return of nearly 10% over the past year.

The company will pay its next dividend on February 1, 2018, to all its shareholders of record before the January 4, 2018, ex-dividend date.

Bristol-Myers Squibb Co. (NYSE:BMY)

Founded in 1887 and headquartered in New York City, the Bristol-Myers Squibb Company discovers, develops, licenses, manufactures, markets and distributes biopharmaceutical products worldwide. The company offers chemically synthesized drug and biologic drugs in various therapeutic areas, such as oncology, cardiovascular, immunoscience and virology comprising human immunodeficiency virus infection (HIV). The company’s portfolio of products includes pharmaceuticals for treatment of multiple myeloma, renal cell carcinoma, non-small cell lung cancer, classical Hodgkin lymphoma and several other cancer variants. Additionally, the company offers treatments for stroke prevention, hepatitis B, hepatitis C, rheumatoid arthritis and various psychological disorders, such as schizophrenia, bipolar mania disorder and depressive disorder. In addition to its corporate headquarters in New York, the company operates 15 additional facilities in the United States, two facilities in Puerto Rico, four facilities in Asia and nine facilities in Europe.

Bristol-Myers Squibb grew its quarterly dividend 2.6% from the previous period’s $0.39 amount to the current $0.40 distribution. The current quarterly amount corresponds to a $1.60 annualized payout and a 2.6% yield. This yield is also 4.8% higher than the company’s 2.5% average yield over the past five years. Furthermore, this current yield outperformed the 2.01% average yield of Bristol-Myers Squibb’s competitors in the Drug Manufacturers segment by more than 27% and outpaced the 0.63% average yield of the entire Health Care sector by more than 300%.

The company has been paying dividends since 1900 and cut its annual dividend amount most recently in 2000. The most recent year that the company failed to raise its dividend was 2009. Since then, the company enhanced its annual dividend amount at an average growth rate of 2.9% per year and increased its total annual payout by nearly 30% over the past nine years.

At the onset of the current trailing 12-month period, the share price dropped almost 22% in a span of just two weeks in January 2016. The share price fell to its 52-week low of $46.82 on January 26, 2017. Almost as quickly as it fell, the share price bounced back, recovered 87% of its January loss by March 10, 2017, and traded within 5% of the $55 price level through the end of July. After the beginning of August 2017, the share price trended upward and reached its 52-week high of $65.35 on October 12, 2017. After peaking in mid-October, the share price pulled back slightly and is currently trading approximately 5% below the 52-week high price. On December 18, 2017, the share price closed at $60.97, which is 5.5% higher than its was one year ago, 33.3% higher than the 52-week low from the end of January 2017 and almost double the share price from five years ago.

Over the past few years, the shareholders enjoyed the double benefit of rising dividend income and asset appreciation in the form of significant total returns. Over the past year, the shareholders received a 9.75% total return on investment, with total returns over the past three years and five years reaching at 15.1% and 114.5%, respectively.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic