Canadian Electric Utility Hiked Quarterly Dividend 6.2%, Pays 3.7% Yield

By: Ned Piplovic,

A Canadian utility company boosted its quarterly dividend 6.2% over the previous period and rewarded its shareholders with a 3.7% forward dividend yield.

This current dividend payout boost extends the company’s record for consecutive annual dividend hikes to 44 years. In addition to the long-term rising dividend payouts, the company provided investors with a 16.4% share price growth over the past 12 months.

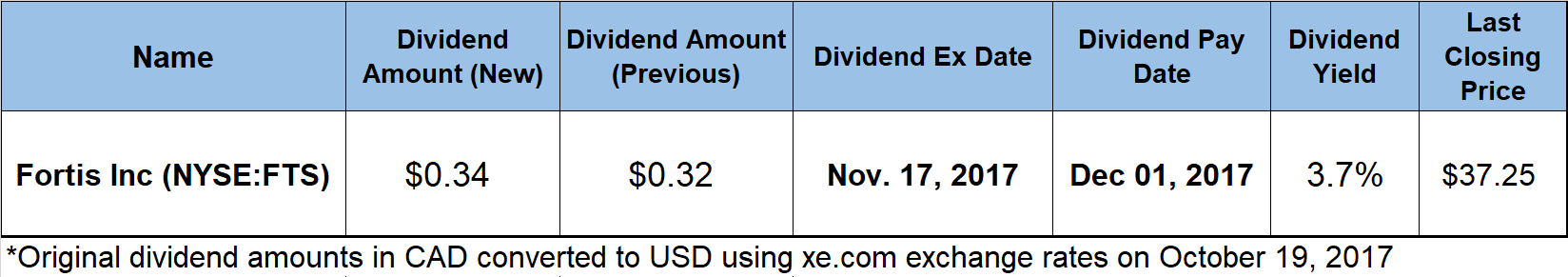

The next ex-dividend date of the company, Fortis Inc. (NYSE:FTS), will be November 17, 2017, and its pay date is scheduled to follow two weeks later on December 1, 2017.

Fortis, Inc. (NYSE:FTS)

Tracing its origin to the formation of the St. John’s Electric Light Company in 1885, Fortis Inc. operates as an electric and gas utility company in Canada, the United States and the Caribbean. The company and its 8,800 employees serve more than three million utility customers in five Canadian provinces, nine U.S. states and three Caribbean countries. Currently, the company operates through four business segments – Regulated Independent Transmission, Regulated U.S. Electric & Gas, Regulated Canadian & Caribbean and Other Energy Infrastructure. Fortis has assets of approximately $48 billion and had revenues of $6.8 billion in 2016. Three business units – ITC Holdings, UNS Energy and FortisBC Inc. account for 74% of company’s total assets. The remaining 26% of assets are distributed among seven smaller business units. In addition to providing electricity to end-users, Fortis also sells wholesale electricity to other entities in the western United States, owns gas-fired and hydroelectric generating capacity totaling 64 MW, and distributes natural gas to almost one million customers in approximately 135 communities in British Columbia, Canada.

The company’s current quarterly dividend distribution of $0.34 (CA$0.425) is 6.2% higher than the previous quarterly dividend of $0.32 (CA$0.40). This current quarterly dividend payout is equivalent to an annualized $1.36 (CA$1.70) payout and a 3.7% dividend yield. The current dividend yield is 58% higher than the 2.31% simple average yield of all the companies in the utilities sector.

This most recent quarterly dividend hike marks the company’s 44th year of consecutive dividend boosts. Over the last two decades, the company maintained an average growth rate of 6.3% per year. Consequently, Fortis enhanced its total annual dividend amount by more than 240% since 1997.

The share price initially dropped 8% between October 17, 2016, and its 52-week low of $29.40, which it reached on November 16, 2016. However, after the November 2016 bottom, the share price rose almost 28% on its way to its new 52-week high of $37.58 on September 8, 2017.

After peaking in early September, which was also a new all-time high, the share price dipped almost 5% to $35.77 on September 25, 2017, but recovered just as quickly and closed on October 18, 2017, at 37.25, which was less than 1% below the September peak. The $37.25 closing price on Oct. 18 is also 16.4% higher than its was 12 month ago and 26.7% higher than the November 2016 52-week low.

The company provided a new five-year outlook on October 16, 2017, and announced that it will increase its five-year capital investment almost 10% to approximately $14.5 billion for the 2018 through 2022 period. The capital expansion comprises mostly low-risk and highly executable projects. These projects are fully funded through cash from operations, debt raised at the utilities and common equity from the company’s dividend reinvestment plan.

In addition to the current quarterly dividend declaration, the company also announced that it will extend its 6% dividend growth target through 2022, which should make the FTS stock a desirable pick for dividend income. Fortis has scheduled a conference call for Friday, November 3, 2017, at 8:30 a.m. (Eastern Time) when it will release its third quarter 2017 financial results.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic