Canadian Tire Corporation Hikes Quarterly Dividend Nearly 40% (CDNAF)

By: Ned Piplovic,

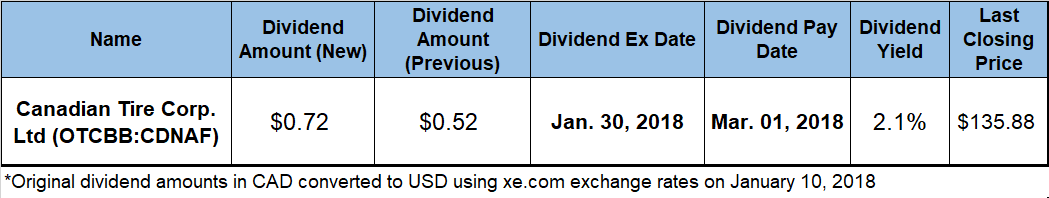

The Canadian Tire Corporation Limited (OTCBB: CDNAF) continued its streak of rising dividends for seven consecutive years with a 38.5% boost to its quarterly dividend payout in the first quarter of 2018.

Despite rising dividend payouts, the company’s current forward dividend yield of 2.1% is slightly depressed by the rising stock price, which is up more than 25% in the past 12 months. While the yield might seem low, the combined total return of dividend distributions and share price growth reached nearly 30% over the last year.

The company’s next ex-dividend date is set for January 30, 2018, and the pay date follows a little more than a month later, on March 1, 2018.

Canadian Tire Corporation Limited (OTCBB:CDNAF) and (TSE: CTC.A)

Founded in 1922 and headquartered in Toronto, Canada, the Canadian Tire Corporation, Limited provides a range of products and services through a portfolio of retail and service brands in Canada. The company’s retail segment operates the Canadian Tire general merchandise stores — nearly 300 retail stores, more than 80 car washes, 5 vehicle lubrication facilities and 84 propane stations, 91 PartSource automotive parts specialty stores and 296 Petroleum retail gas and convenience store locations. Additionally, the company operates a real estate investment trust (REIT) under the CT REIT name that owns, develops and leases income producing commercial properties. As of December 31, 2016, the REIT’s portfolio comprised 295 retail properties, 4 distribution centers, a mixed-use commercial property, and 3 development properties with a gross leasable area of approximately 25 million square feet. The company’s Financial Services segment markets Canadian Tire-branded credit cards, insurance, identity theft products, interest savings accounts and guaranteed investment certificates.

The company hiked its quarterly dividend 38.5% from $0.52 (CA$0.65) in the previous quarter to its current $0.72 (CA$0.90) quarterly distribution. This new quarterly payout equates to a 2.1% forward dividend yield and a $2.88 (CA$3.60) annual distribution amount.

The company started distributing dividends to its shareholders in 1990 and completely avoided dividend cuts in the past two decades. In addition to avoiding dividend cuts over the past two decades, the company boosted its annual dividend payout 70% of the time.

Since 1999, the company grew its annual dividend payout at an average rate of 11.6% per year. In the past 15 years, the company failed to raise its annual dividend only once and over that period managed a 15.8% compounded annual growth rate of its total annual dividend amount.

Since 2010, the Canadian Tire Corporation hiked its annual distribution at an average growth rate of 20% per year for eight consecutive years. The total dividend growth over the eight-year period was almost 330%. Over the past 15 years, the company enhanced its annual distribution nine-fold.

Despite being suppressed by the rapidly rising share price, the company’s current 2.1% is still 43% above the 1.48% average dividend yield for all the companies in the General Merchandise/Department Stores industry and 55% higher than the 1.37% average yield of the overall Services sector.

As indicated above, the company’s share price experienced significant growth over the past 12 months. The share price pulled back 1.3% in the first few weeks of the current trailing 12-month period and hit its 52-week low of $105.05 on February 1, 2017. After the February bottom, the share price jumped nearly 10% by the end of April, only to reverse trend immediately and lose more than 65% of its gains by the beginning of August 2017.

Since early August, the share price rose with minimal fluctuations, gained more than 22% and reached its new all-time high of $135.87 as of market close on January 9, 2018. The $135.87 closing price was 27.6% higher than it was one year earlier, 29.3% higher than the 52-week low from the beginning of February 2017 and nearly double the price from five years ago.

Dividend increases and decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic