City Holding Company Hiked its Quarterly Dividend 4.5%, Pays 2.7% Yield (CHCO)

By: Ned Piplovic,

The City Holding Company currently pays a 2.7% yield and it hiked its current dividend payout 4.5% to mark the company’s seventh consecutive annual dividend boost.

In addition to enhancing its annual dividend payout over the past seven consecutive years, the company raised its annual dividends 14 out of the last 16 years with no dividend cuts. City Holding’s share price dropped more than 10% during the trailing 12-month period, but recovered fully to December 2016 levels by the end of 2017.

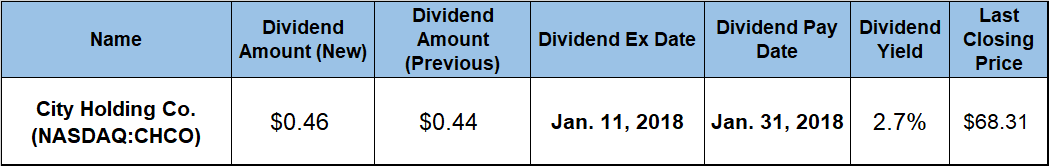

The company’s upcoming ex-dividend date is set for January 11, 2018, and the pay date will occur a little more than a month later on January 31, 2018.

City Holding Co. (NASDAQ:CHCO)

Founded in 1957 and headquartered in Charleston, West Virginia, the City Holding Company operates as a holding company for the City National Bank of West Virginia. The bank offers a range of checking and savings products for both consumer and business customers, as well as mortgages, home equity lines of credit, consumer loans and business loans. Additionally, the bank’s Trust and Wealth Management division provides trust, investment management and other financial solutions to individuals and businesses customers. As of December 2017, the bank had 86 locations throughout West Virginia, Kentucky, Virginia and Ohio.

The City Holding Company boosted its quarterly dividend distribution 4.5% from previous period’s $0.44 to the current $0.46 quarterly amount. This new quarterly payout is equivalent to a $1.84 annualized dividend amount and currently yields 2.7%.

The bank’s current yield lags behind the 3.78% average yield of the Financial sector. High-yielding securities, such as real estate investment trusts (REITs), tend to drive the average yield of the financial sector higher. Therefore, City Holding’s 2.7% current yield is 55.7% higher than the 1.73% average yield of all regional backs in the Mid-Atlantic region, which is more apt comparison.

The company started distributing dividends in 1990 and the most recent dividend cut occurred in 2002. Since then, the company has hiked its annual dividend 14 times in the past 16 years. Even during the most recent financial crisis when most banking and financial institutions cut their dividends considerably, the City Holding Company merely paused its dividend growth, distributed a flat $1.36 annual dividend from 2009 to 2011 and resumed boosting its annual dividends in 2012.

Over the past seven years, the company grew its annual dividend payout at an average growth rate of 4.4%, which resulted in a 35% increase in the total annual dividend amount since 2012. However, the company’s annual dividend rose at an average growth rate of 12% over the past 16 years and the total annual dividend rose more than six-fold since 2002.

While the share price rose 166% since January 2009, the past 12 months have been somewhat disappointing. The share price was on a downtrend since early December 2016 and continued to drop until the beginning of April 2017, when the share price rose sharply and reached $72.78 by April 24, 2017, which was 6.5% higher than at the beginning of the trailing 12-month period on December 22, 2016. Additionally, the April 24, 2017, price was at the time a new all-time high. Unfortunately, the high did not last and the share price started falling again until August 17, 2017, when it reached its 52-week low of $59.94.

Since the August low, the share price initially ascended 22.2% to reach a new all-time high of $73.25 on November 11, 2017, before pulling back 6.7% to close on December 21, 2017, at 68.31. That closing price was marginally higher – 0.8% – than the share price from 12 months earlier, 14% higher than the 52-week low from August and double the share price from five years ago.

While the recent disappointing share-price performance kept the total return to only 4% over the last 12 months, the total return over the past three years was 64% and 120% over the past five years.

Dividend increases and decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic