Cohen & Steers Infrastructure Fund Offers 8.7% Dividend Yield (UTF)

By: Ned Piplovic,

The Cohen & Steers Infrastructure Fund, Inc. was forced to cut its annual dividend payout twice after the 2008 financial crisis but has been growing its dividends steadily since then and currently offers an 8.7% dividend yield.

The fund boosted its annual dividend amount for the past five consecutive years and its current yield outperforms average industry yields. While the fund’s dividend continues to grow, the share price declined in 2018 below its own level from one year ago but has been rising lately and has managed to pull back equal with the price level from early April 2017.

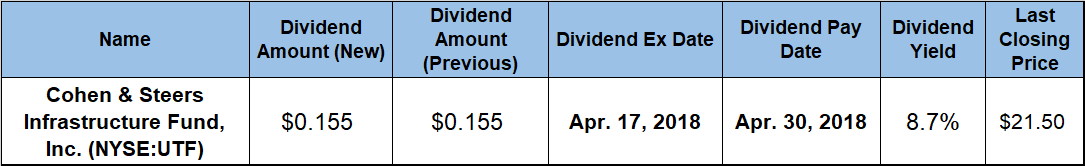

The fund’s next ex-dividend date will occur on April 17, 2018, and the company will distribute its next monthly dividend on the April 30, 2017, pay date to all its shareholders of record prior to the ex-dividend date.

Cohen & Steers Infrastructure Fund, Inc. (NYSE:UTF)

Established on March 30, 2004, the Cohen & Steers Infrastructure Fund is a non-diversified, closed-end management investment company. The fund’s primary investment objective is high current income through investment in securities issued by infrastructure companies. Infrastructure companies typically provide the physical framework that society requires to function on a daily basis and are defined as utilities, pipelines, toll roads, airports, railroads, marine ports and telecommunications companies. As of December 31, 2017, the fund had $3 billion in total assets under management spread across 179 individual holdings. The top four holdings — Crown Castle International Corp. (NYSE:CCI) with 5% share, NextEra Energy Inc. (NYSE:NEE) with 4.3% share, Enbridge, Inc. with 4.1% share and American Tower Corporation (NYSE:AMT) with 3.9% — account for 17.3% of fund’s total assets.

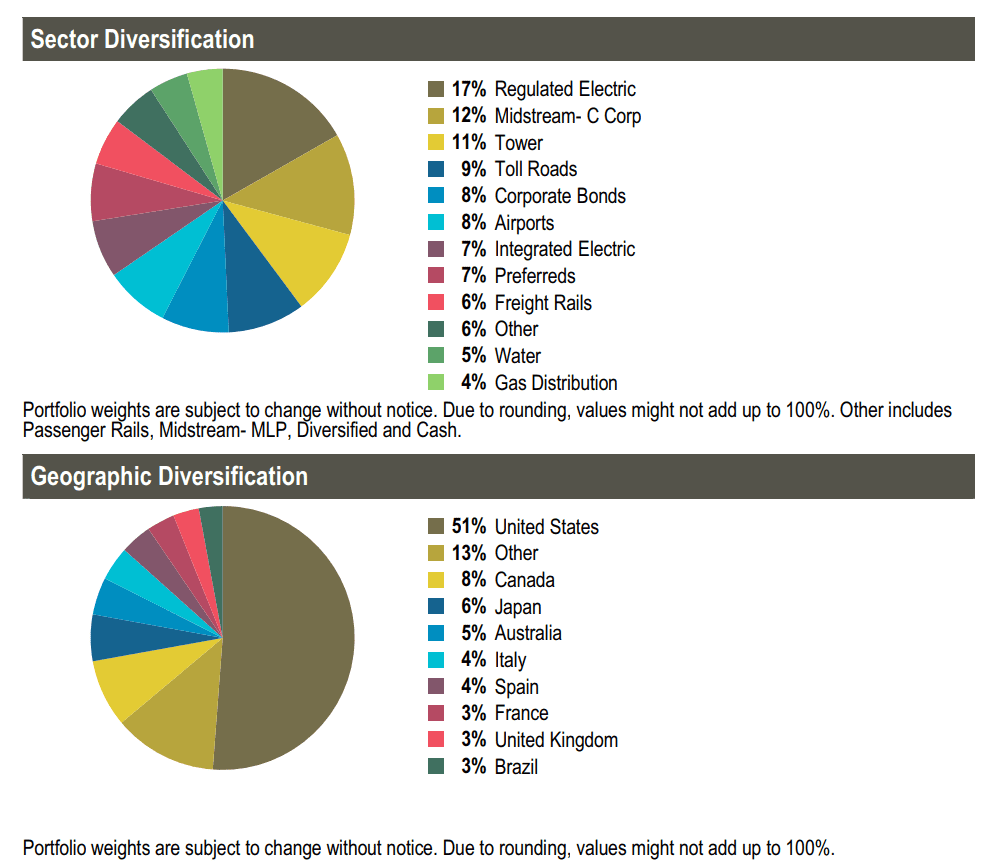

The top 10 holdings account for 30.6% of total assets. The fund has three sectors with double-digit-percentage share and those three sectors combined account for 40% of total assets — Regulated Electric with 17%, Midstream C Corp with 12% and Tower with 11%. Geographically, the fund has 59% of its assets invested in the United States — 51% — and Canada — 8%. The remaining sector and geographical asset distributions are provided in the accompanying chart below.

Chart Source: C ohen & Steers Infrastructure Fund, Inc. Factsheet, www.cohenandsteers.com

The share price opened its trailing 12-month period with a 10% rise from $21.62 on April 4, 2017, to $23.80 by June 16, 2017. After the quick escalation, the share price leveled off and traded flat, mostly in the $22.75 to $23.50 range, over the following six months. However, the share price jumped up 7.1% from $22.86 on December 19, 2017, to its 52-week high of $24.19 on January 9, 2018.

Unfortunately, the fund’s share price was caught in the overall market selloff and lost nearly 13% of its value over the subsequent 30 days. The price continued to decline until it lost a total of 14.5% from its January peak and reached its 52-week low of $20.93 on March 23, 2018. However, since its 52-week low, the share price has been rising slowly and grew 2.7% to close at $21.50 on April 3, 2018. This closing price is just $0.12, or 0.6%, below its level from one year ago.

The fund’s current $0.155 monthly dividend payout is 15.7% higher than the $0.134 payout from the same period last year. This current monthly payout converts to a $1.86 annualized payout for 2018 and yields 8.7%, which is 9.5% higher than the fund’s own 7.9% average yield over the past five years. The fund’s current yield outperforms the simple yield average of the entire Financials sector by 130% and the average yield of all the companies in the Closed-End Equity Fund segment by 8.6%.

Following two dividend cuts — in 2008 and 2009 — the fund hiked its annual dividend twice and then paid the same $1.44 annual dividend through 2013. Since the fund started raising its annual dividend again in 2014, total annual payout amount grew at an average rate of 5.3% per year and rose a total 30% over the past five consecutive years.

Over the last 12 months, the fund rewarded its shareholders with a 9.5% total return. Additionally, long-term investors enjoyed a 19.3% total return over the past three years and a 46.5% total return over the past five years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic