ConAgra Brands Boosts 2018 Annual Dividend 3% (CAG)

By: Ned Piplovic,

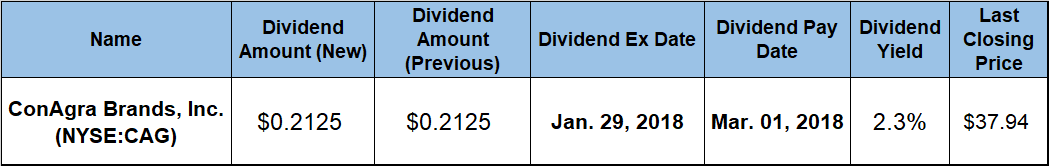

Following a dividend cut in 2017, ConAgra Brands, Inc. (NYSE:CAG) hiked its annualized dividend 3% for 2018 and currently offers its shareholders a 2.3% yield.

Despite a dividend cut in 2017, the company has a positive long-term record of boosting annual dividends 70% of the time over the past two decades. Additionally, while the overall share price fell slightly over the past 12 months, the share price is trending nearly 14% higher over the past two months and technical indicators suggest that the uptrend is likely to continue in the near term.

The company’s next ex-dividend date is set for January 29, 2018, and the pay date follows a little more than a month later on March 1, 2018.

ConAgra Brands, Inc. (NYSE:CAG)

Founded in 1919 and headquartered in Chicago, Illinois, ConAgra Brands, Inc., manufactures and distributes ready-to-eat, refrigerated and frozen food products. The company operates through Grocery & Snacks, Refrigerated & Frozen, International and Foodservice segments. While the Grocery & Snacks segment primarily offers shelf stable food products, the Refrigerated & Frozen segment provides temperature controlled food products through various retail channels in the United States. The International segment offers food products in various temperature states for retail and foodservice channels outside of the United States. Additionally, the Foodservice segment offers food products packaged for sale to restaurants and other foodservice establishments in the United States. ConAgra Brands, Inc. markets its products under multiple brands, which include Marie Callender’s, Reddi-wip, Hunt’s, Healthy Choice, Slim Jim, Orville Redenbacher’s, Alexia, Blake’s, Frontera, Bertolli and P.F. Chang’s.

The company’s current $0.2125 dividend distribution is 6.25% higher than the $0.2 quarterly payout from the same period last year. The current quarterly distribution yields 2.3% and is equivalent to a $0.85 annualized payout. Over the past two decades the company cut its annual dividend payout only three times. Unfortunately, the company’s current rising dividend streak is only one year because one of those cuts happened in 2017, when the company reduced its total annual distribution 17.5% from $1.00 to the $0.825 total annual payout for 2017. During the past two decades, the company hiked its annual dividend 70% of the time, reduced its annual dividend only two other times – in 2006 and 2007 – and paid a flat dividend in three years – 2014 through 2016.

ConAgra Brands’ 2.3% yield outperformed the 1.75% average yield of the company’s peers in the Processed & Packaged Goods segment by 28%. Additionally, the company’s current yield exceeded the 1.56% average yield of all the companies in the Consumer Goods sector by 44%.

The ConAgra’s share price rose 6.5% early in the current trailing 12-month period from $38.95 on January 5, 2017, to its 52-week high of $41.50 on March 15, 2017. After peaking in mid-March, the share price fell nearly 22% and reached its 52-week low of $32.43 on Aug. 29. After the late-August low, the share price continued trading slightly above 52-week low levels and reached $33.32 by the beginning of November, which was just 2.75% above the August low.

However, since reaching the $33.32 point, the share price rose almost 14% in less than 60 days and closed on January 4, 2018, at $37.94. While that closing price is still 8.6% below the March peak and 2.6% below the price level from one year earlier, it is 17% higher than the 52-week low from late August 2017.

The combination of a dividend cut in 2017 and a share price drop of 2.6% over the past year handed the company’s shareholders a 3.5% total loss for the trailing 12-month period. However, the recent share price trend shows promise. ConAgra’s investors have received total returns of 45% for the current three-year period and 81% for the latest five-year period.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic