Contrarian Dividend Investing Offers the Key to Profiting From Gold and Other Undervalued Assets

By: Paul Dykewicz,

Contrarian dividend investing offers ways to profit from gold and other undervalued assets that currently are out of favor, according to key market forecasters who spoke at the recent FreedomFest conference held in Rapid City, South Dakota.

FreedomFest and the concurrent Global Financial Summit were held in that city for the first time and drew record attendance of early 2,800 people who learned about the current outlook for gold stocks and other top contrarian dividend investing strategies right now. Gold stocks offer a ripe opportunity for investors seeking to buy contrarian investments, said Adrian Day, president of Adrian Day Asset Management, of San Juan, Puerto Rico.

The price of gold currently is modest, and its outlook appears strong, Day told FreedomFest attendees during a presentation. Gold miners are making strong free cash flow and the companies have stronger balance sheets than a decade ago, Day added.

Contrarian Dividend Investing Features Gold Mining Stocks

On nearly every valuation metric, the gold stocks are selling in their historically lowest 25 percentile, Day told attendees. When gold prices rise and generalist investors take an interest in the precious yellow metal again, the stocks should have outsized returns, Day said.

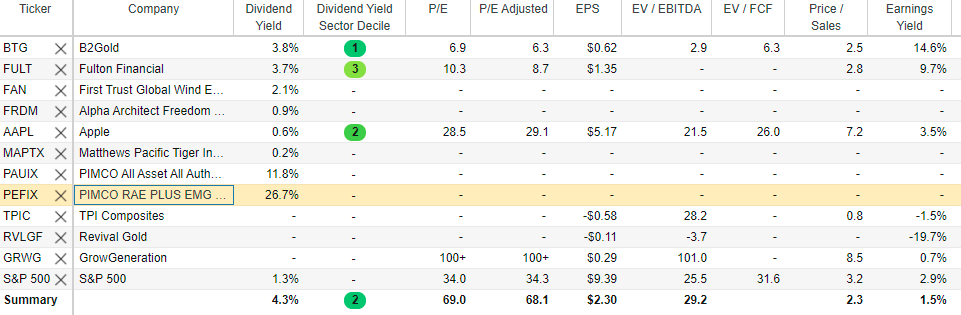

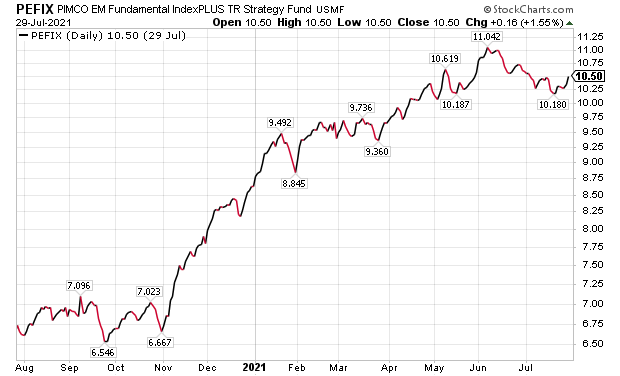

B2Gold Corporation (NYSE:BTG), a gold mining company headquartered in Vancouver, British Columbia, operates mines in Nicaragua, Namibia, Mali and the Philippines, as well as owns other properties for explore for gold and other precious metals. Mark Skousen, PhD, the editor of the monthly investment newsletter, Forecasts & Strategies, calls describes the stock as “speculative” but is choosing to recommend it as a contrarian dividend investing opportunity.

Source: Stock Rover. Click here to sign up for a free two-week trial.

Contrarian Dividend Investing Strategy Reveals Hidden Value in B2Gold

However, B2Gold is down 23.75% so far this year through the close of trading on Friday, July 30. The stock also is down 36.96% in the past 12 months, but Skousen correctly forecast to FreedomFest attendees the share price would start to recover soon. Since he spoke a week ago, the sock price has begun to advance.

Skousen is not alone in his outlook. The Raymond James investment firm still rates BTG “outperform,” partly due to its expected record gold production for the second half of 2021 as its profit margins top 36%.S

Chart courtesy of www.StockCharts.com

B2Gold has total assets worth $3.5 billion, with $550 million in cash and only about $67 million in debt. The gold stock currently is selling for below seven times earnings in an industry with an average price/earnings ratio of 20, counseled Skousen, who also heads the Home Run Trader, Five Star Trader, TNT Trader and Fast Money Alert trading services.

Mark Skousen, PhD, a descendent of Benjamin Franklin, meets with Paul Dykewicz in Philadelphia.

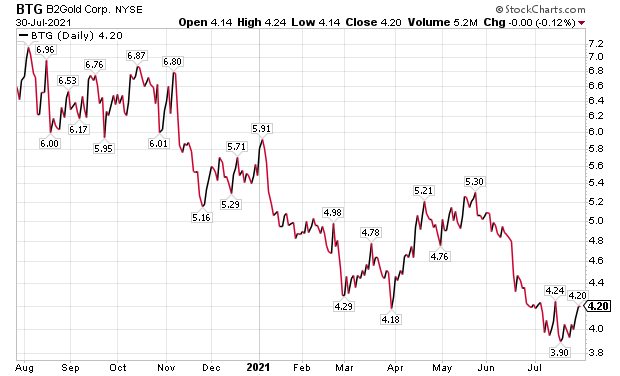

Revival Gold Emerges as Another Contrarian Dividend Investing Choice

Jeff Phillips, a junior mining specialist who is President of Global Mining Development, recommended Revival Gold Inc. (OTC:RVLGF) during his appearance at FreedomFest during a discussion of gold stocks on Friday, July 23. The stock has the potential to double or even triple in the next year, Phillips told the attendees.

“I think Revival can do that without gold going up much,” Phillips said. “If gold moves higher, then investment potential only gets better.”

Chart courtesy of www.StockCharts.com

Contrarian Dividend Investing Features Previously Productive Idaho Gold Mine

The junior gold mining company recently announced new drilling at its Beartrack-Arnett Project in Idaho. A key advantage is that Revival Gold is seeking to evaluate the restart of a previously productive mine that already has significant infrastructure in place.

This move follows a recent resource update that lifted the gold resource for the project to 3 million ounces, Phillips continued. Revival Gold also is in the middle of a 5,000-meter drill campaign. The expected presence of 3 million ounces of gold may lead Revival Gold to officially announce the planned restart of the Beartrack Gold Mine.

Beartrack is a past-producing open pit heap leach mine that was operated by Meridian Gold [now Yamana Gold (NYSE:AUY)] and produced roughly 600,000 gold ounces. The mine was closed in 2000 as a result of low gold prices, below $300 an ounce, Philips said.

Contrarian Dividend Investing Detects Junior Mining Stock in an Advanced-Stage Project

But the yellow metal is now at more than six times those prices, Philips continued. The Beartrack/Arnett opportunity for Revival Gold and its investors seeks to gain exposure to an emerging gold area play in one of the safest mining jurisdictions in the world — the United States, he added.

Beartrack is advanced-stage, “brownfield” gold project that holds important advantages compared to typical “greenfield” mineral exploration projects. Those pluses include reduced risk, huge discounts on capital costs and a shorter time horizon from exploration to production, Phillips said.

Brownfield projects offer economic advantages to both the company and its shareholders. The brownfield projects also involve a known resource and a proven producer. In contrast, a greenfield exploration project carries the risk of operating literally in uncharted territory, typically with limited geophysical data and drilling.

Rob Arnott, chairman of Research Affiliates, LLC, which advises on over $195 billion in investment assets, told FreedomFest attendees that money flows matter. As a result, he advised that they look around and see what is “not expensive,” he added.

“Emerging markets value stocks seem to trade at relatively low multiples and pay 5% dividend yields,” Arnott said.

Inflation appears to be on the rise and becoming a growing factor for investors to weigh, Arnott said. Whether inflation will stay between 2-3% or rise to 5-10% seems dicey to forecast, he added.

Contrarian Dividend Investing Could Include PAUIX

One of the three largest personal holdings of Arnott is PIMCO All Asset All Authority Fund (PAUIX). It offers a double-digit-percentage dividend yield and seeks maximum real return, while preserving real capital and prudent investment management.

With the fund focuses on out-of-mainstream asset classes and a value-oriented, contrarian investment process, it can help investors enhance their long-term return potential, while improving portfolio diversification, reducing volatility and adding an explicit inflation buffer.

The fund is up 13.46% so far this year and 25.24% for the past 12 months, as of July 30. It also has a hefty dividend yield of 11.8%.

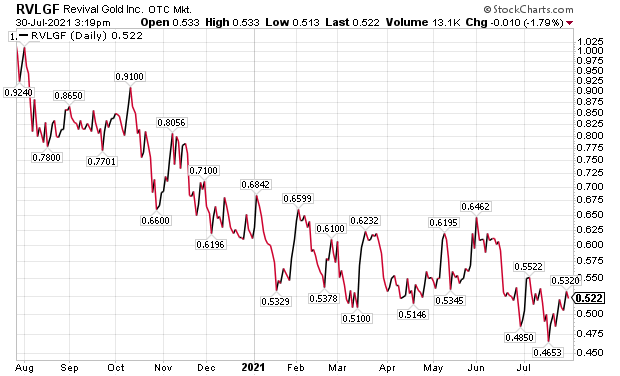

Another one of the fund’s that composes Arnott’s top three personal investing positions is dividend-paying PIMCO EM Fundamental IndexPlus TR Strategy Fund (PEFIX). It currently offers a 26.7% dividend yield.

Chart courtesy of www.StockCharts.com

This fund offers a one-stop-shopping way to allocate money to (1) diversify markets away from mainstream stocks and bonds, (2) protect against renewed inflation and (3) seek a solid real return over and above inflation, even if U.S. markets falter, Phillips said.

Emerging Markets PIMCO Fund Offers Contrarian Dividend Investing Opportunity

PEFIX provides value allocation to emerging markets, while seeking to boost real returns and preserve capital through prudent management. This fund focuses on out-of-mainstream asset classes and uses a value-oriented, contrarian investment process to help investors enhance their long-term return potential, while improving portfolio diversification, reducing volatility and adding an explicit inflation buffer, according to PIMCO.

The fund has jumped 21.44% so far in 2021 and 55.37% for the past 12 months, as of July 30.

The fund emphasizes holding assets that are fundamentally attractive, while shifting away from popular asset classes when they are overvalued. The fund is managed to achieve high real returns (above inflation) that are consistent with its secondary benchmark of the Consumer Price Index (CPI) +6.5% over a full market cycle.

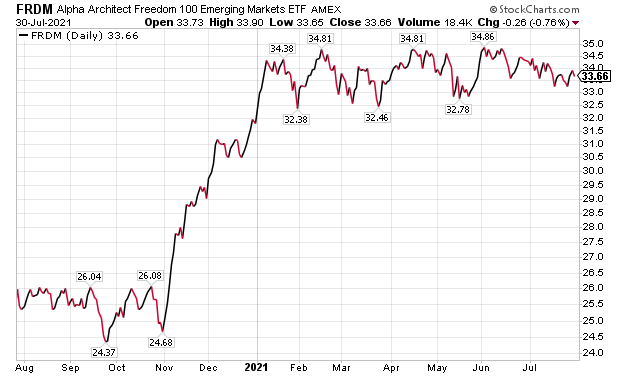

FRDM Is Another Fund to Buy for Contrarian Dividend Investing Strategies

Freedom 100 Emerging Markets ETF (FRDM) is a freedom-weighted emerging markets fund. It also is one of Arnott’s top three personal holdings, he told me, and is designed to invest in in emerging markets that respect freedom and use equal weighting of the fund’s assets.

The fund is up 5.84% so far this year and 32.72% for the past 12 months. It also offers a current dividend yield of 0.9%, as of July 30.

The stock selection process of FRDM identifies a portfolio that generally holds 100 emerging market stocks. The Index stock selection algorithm is fully automated, while the index seeks to invest in countries with higher human and economic freedom scores.

Chart Courtesy of www.StockCharts.com

Pension Fund Chairman Discusses Contrarian Dividend Investing

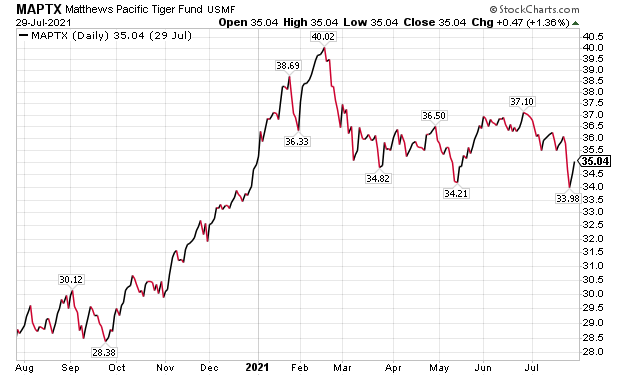

Retirement Watch leader Bob Carlson said he likes the emerging markets and prefers to invest in actively managed funds that focus on particular regions.

“The emerging region I favor most now is Asia,” Carlson said. “It has higher growth potential, more diversified economies and is more politically stable than other emerging regions. The governments are in better shape fiscally than most others.”

The risk in Asia is that the region is heavily affected by what’s happening in China, Carlson cautioned. China’s government recently has been asserting more control of major businesses and is becoming increasingly restrictive, he added.

The question now is whether it will exert enough control to decrease growth and corporate earnings, Carlson said.

“I think that’s unlikely, but investors aren’t so sure,” Carlson said. “Most Asian markets and mutual funds are flat for the year to date and down over more recent periods.”

Pension fund and Retirement Watch chief Bob Carlson answers questions from columnist Paul Dykewicz.

Carlson said his preferred fund at this time is Matthews Pacific Tiger (MAPTX). It focuses on larger growth companies in the region and is actively managed. It is up 0.29% for the year to date but is down 4.00% over three months. The fund is up 21.66% for the past 12 months, Carlson said.

Chart Courtesy of www.StockCharts.com

Money Manager Offers Her View of Contrarian Dividend Investing

“The perfect contrarian trade is like shorting subprime mortgages going into the 2008 crash: it isn’t enough to go against consensus, you also need a way to cash in big when you’re right,” said Hilary Kramer, who leads the GameChangers and Value Authority advisory services. “Right now, that’s a tricky proposition because the Fed’s easy money has lifted just about every boat on Wall Street.”

Most of the funds that are bleeding money are on the short side, going down as the market goes up and theoretically paying off when the market ultimately falls, Kramer counseled. Unless investors have institutional amounts of capital to keep feeding bearish views, that’s a precarious proposition, she added.

“You might think the market is behaving irrationally but it truly can remain irrational longer than you can remain solvent where these funds are concerned,” Kramer said.

Columnist Paul Dykewicz interviews money manager Hilary Kramer, whose premium advisory services include IPO Edge, 2-Day Trader, Turbo Trader and Inner Circle.

Contrarian Dividend Investing Now Is Limited to A Few Big Themes

The contrarian universe right now is limited to a few big themes, Kramer continued. There is China, which she does not recommend in the wake of Alibaba Group Holding Ltd. (NASDAQ:BABA) CEO Jack Ma’s downfall. If Beijing can pressure the founder of Alibaba, it is clear that shareholder value is not a priority over there right now, she added.

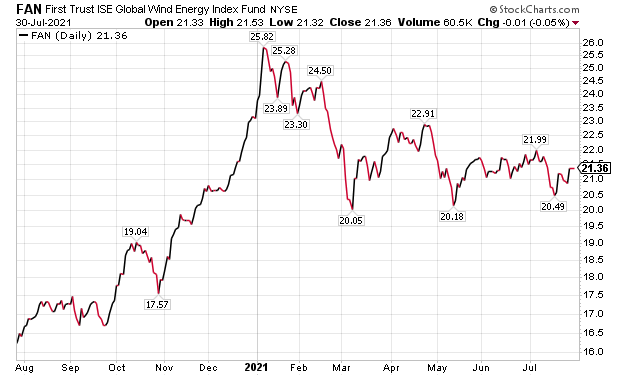

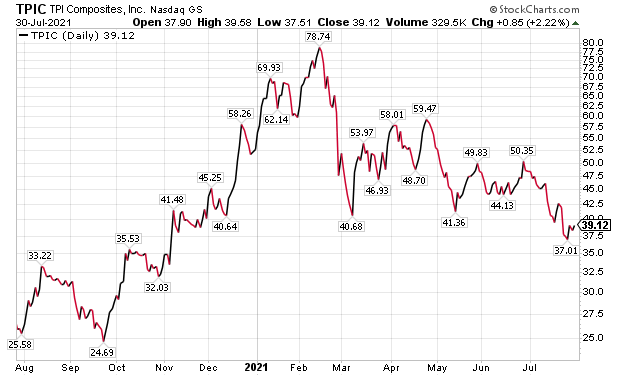

“Then there’s green energy, which is a lot more interesting,” Kramer said. “Consider a diversified fund like the Invesco Solar ETF (NYSE:FAN) or TPI Composites Inc. (NASDAQ:TPIC), a small, relatively obscure company that happens to be the biggest global manufacturer of wind turbines. If you believe oil is coming back, sooner or later high crude prices will make renewables more competitive alternatives… and any sustainability push in Congress will accelerate the process.

Chart Courtesy of www.StockCharts.com

Chart courtesy of www.StockCharts.com

Fulton Financial Offers a Way to Pursue Contrarian Dividend Investing

Other than that, investors are really stuck looking at stocks that have a lot of fans right now but just aren’t as popular as the dividend-paying Apple Inc. (NASDAQ:AAPL) type companies at the top of the market’s food chain, Kramer said. That’s not really contrarian, she added.

“It’s just thinking in terms of relative value,” Kramer said. “On that basis, I like the banks like Fulton Financial Corp. (NASDAQ:FULT) and the cannabis group, which has gotten pounded in the last few months. When money rotates in search of laggards to exploit, I think names like GrowGeneration Corp. (NASDAQ:GRWG) will lead the next leg upward.”

Fulton Financial is a dividend payer, offering a 3.61% dividend yield, while GRWG does not pay a dividend.

Worsening COVID-19 Cases Should Boost Interest in Contrarian Dividend Investing

COVID-19’s increasingly transmissible Delta variant is causing heightened concern among health experts about the spread of the virus across the United States. The variant is blamed for new surges in case numbers and deaths. Genetic variants of SARS-CoV-2 have been emerging and circulating worldwide throughout the COVID-19 pandemic, according to the Centers for Disease Control and Prevention (CDC).

The CDC and the U.S. State Department each raised their warnings to the highest levels on July 19 for travel to the United Kingdom. The CDC cautioned to “avoid” traveling there, while the State Department issued a “do not travel” warning for the United Kingdom.

A variant has one or more mutations that differentiate it from other COVID-19 varieties in circulation. The Delta variant is expected to become the dominant coronavirus strain in the United States, according to the CDC. With more than half the U.S. population not fully vaccinated, public health officials warn that a resurgence of COVID-19 cases can occur, especially this fall when many unvaccinated children return to school.

Progress in boosting the number of people vaccinated against COVID-19 raises hope that new cases and deaths will fall again after the current surge caused by the Delta variant. As of July 30, 190,509,183 people, or 57.4% of the U.S. population, have received at least one dose of a COVID-19 vaccine. The fully vaccinated total 164,184,080 people, or 49.5%, of the U.S. population, according to the CDC.

COVID-19 cases worldwide have hit 197,228,990 and caused 4,206,208 deaths, as of July 30, according to Johns Hopkins University. U.S. COVID-19 cases reached 34,927,584 and caused 612,934 deaths. America has the dreaded distinction as the nation with the most COVID-19 cases and deaths.

Despite COVID-19 vaccine availability, improving economic data and a recent $1.9 trillion federal stimulus package, contrarian dividend investing is gaining interest among investors and independently minded money managers, too.

Connect with Paul Dykewicz

Connect with Paul Dykewicz