DCT Industrial Trust Hikes Dividend More Than 16% (DCT)

By: Ned Piplovic,

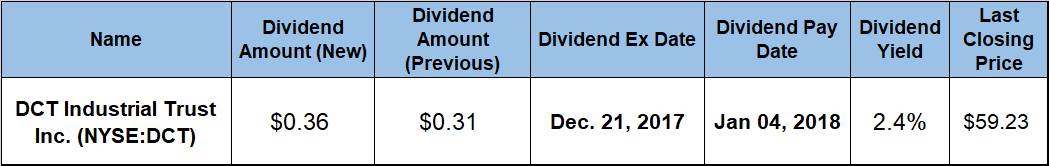

DCT Industrial Trust Inc. (NYSE:DCT) hiked its quarterly dividend for 2018 more than 16% and currently pays a 2.4% yield.

In addition to increasing its income distribution to shareholders, the company grew its share price more than 25% and into all-time record territory in the last 12 months. The combined benefit of rising dividend income and higher share price resulted in the total shareholder return approaching 30% just over the past year.

The company’s next ex-dividend date will be on December 21, 2017, with the next upcoming pay date scheduled for the first week of next year on January 4, 2018.

DCT Industrial Trust Inc. (NYSE:DCT)

Founded in 2002 and based in Denver, Colorado, the DCT Industrial Trust Inc. is a publicly traded, real estate investment trust (REIT) that specializes in the ownership, acquisition, development, leasing and management of bulk-distribution and light-industrial properties located in high-demand distribution markets in the United States. As of November 2017, the REIT owned approximately 400 industrial buildings and approximately 73.7 million square feet of space in 19 key markets across the United States. The REIT’s approximately 870 customers engage in a variety of industries and sectors across a broad range of industries such as medical, consumer products, online retail, logistics, manufacturing and government. Currently, the DCT Industrial Trust is the largest industrial REIT focused solely in North America. With six new facilities currently under construction and 16 land sites under development, the company is well-positioned to continue its business and revenue expansion to support continued asset appreciation and sustain its current dividend income hike pace in the near future.

The company hiked its quarterly dividend 16.1% from $0.31 in the previous period to the current $0.36 payout. This current payout converts to a $1.44 annualized distribution for 2018 and currently yields 2.4%. The company paid a flat dividend for two years after it started paying a dividend in 2006. After cutting the quarterly dividend twice – in 2008 and 2009 – the trust resumed paying a flat $0.28 quarterly dividend for the following six years until 2016, when the REIT started its current streak of consecutive annual dividend hikes.

Since the beginning of 2016, the company hiked its annual dividend at an average growth rate of 8.7% per year. The result of this high growth rate is a 29% total annual dividend increase over the past three years.

The share price experienced a quick 7% drop between $47.43 on December 12, 2016, and its 52-week low of $44.18 on January 30, 2017. After a quick spike and another immediate drop, the share price fell below its December 12, 2016, level to hit $45.85 on March 14, 2017. However, that was the last significant drop for the share price in the past year. After that mid-March dip, the share price rose 34% and reached $61.42 on November 21, 2017, which, in addition to being a new 52-week high, is also the new all-time high for the DCT Industrial Trust’s share price.

After peaking on Nov. 21, the share price reversed direction and pulled back 3.6%. The share price closed on December 11, 2017, at $59.23, which is 24.9% higher than it was one year ago, 34% higher than the 52-week low from the end of January 2017 and 128% higher than it was five years ago.

DCT Industrial Trust’s stock is another equity that rewards its shareholders with a balanced combination of a steadily growing dividend income and capital growth at the same time. While the shareholder’s total return over the trailing one-year period was 29.2%, the DCT stock rewarded investors with an 85% total return over the last three years and a 160% total return over the last five years.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic