Diversified Technology Company Boosts Quarterly Dividend Payout 12%

By: Ned Piplovic,

A diversified technology company boosted its most recent quarterly dividend payout by 12% and will pay its shareholders a 2.1% yield.

The current dividend boost advances the company’s current streak of annual dividend hikes to seven consecutive years. Additionally, the company has failed to enhance its annual dividend only once in the past 13 years.

Over the past 12 months, the company provided its shareholders with a 23.7% asset appreciation and a 26% total return.

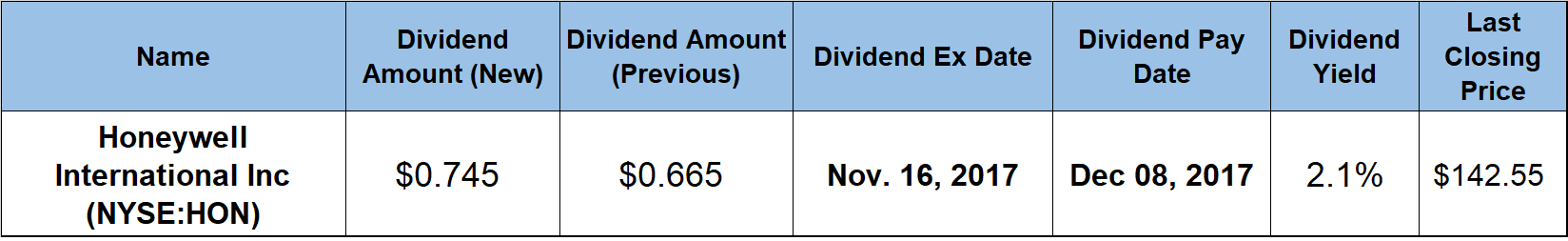

The company’s next ex-dividend date will be on November 16, 2017, and the pay date will follow approximately three weeks later, on December 8, 2017.

Honeywell International, Inc. (NYSE:HON)

Founded in 1920 and based in Morris Plains, New Jersey, Honeywell International Inc. operates as a diversified technology and manufacturing company worldwide. The company operates through four segments: Aerospace, Home and Building Technologies, Performance Materials and Technologies, and Safety and Productivity Solutions. The Aerospace segment supplies products, software and services to original equipment manufacturers and other customers in various markets, including defense, air transport, airlines, aircraft operators and space exploration contractors, as well as automotive and truck manufacturers, and regional, business and general aviation. The Home and Building Technologies segment provides products, software, solutions and technologies that help homes owners, commercial building owners and occupants, as well as electricity, gas and water providers. Some of the products offered through this segment include connected thermostats, home controls, fire and security systems, and air and water purification systems.

The Performance Materials and Technologies segment develops and manufactures advanced materials, process technologies and automation solutions. The portfolio of products and services in this segment include environmentally friendly refrigerants, specialty plastics and high purity chemicals used to make products as varied as bullet-resistant armor, nylon, computer chips and pharmaceutical packaging.

The Safety and Productivity Solutions segment provides products, software and connected solutions to customers that enhance productivity, workplace safety and asset performance. Among the productivity solutions in this segment are rugged mobile computers, voice-enabled software and workflows, bar code scanners and printing solutions.

The company hiked its quarterly dividend distribution 12% from $0.665 in the previous quarter to the current $0.745 payout. The $2.98 annualized dividend yields 2.1%. Compared to the company’s 2.0% average yield over the past five years, the current yield is 4.5% higher.

Without a single dividend cut in the past two decades, the company has a history of relatively consistent dividend growth. The company failed to boost its annual dividend only once since 2005 and has paid consecutive dividend hikes for the last seven years. Over those seven years, the annual dividend amount rose at an average rate of 13.7% per year and the result is a 140% total dividend increase over that period.

The share price exhibited a steady growth with minimal volatility over the past 12 months. After an initial drop of 8.2% in October 2016, the share price rose with only two dips of more than 3.5% – one in mid-April and one in Mid-August – to reach its current peak levels.

A full year of uninterrupted growth ended with the share price closing at $142.55 on October 4, 2017, which is only $0.12 below the $142.67 all-time high closing price from the day before. Over the last 12 months the share price ascended 23.7%. The combined share growth and dividend income rewarded Honeywell’s shareholders with a 26% total return. The total returns over the past three and five years are 65% and 154%, respectively.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic