Dividend Aristocrat Lowe’s Boosts Quarterly Dividend Payout Amount 14.6% (LOW)

By: Ned Piplovic,

As a dividend aristocrat with one of the longest streaks of annual dividend hikes, Lowe’s Companies, Inc. (NYSE:LOW) extended its streak to 56 consecutive annual dividend hikes.

Lowe’s shares its 56-year dividend growth streak with just two other Dividend Aristocrat companies: Johnson & Johnson (NYSE:JNJ) and The Coca-Cola Company (NYSE:KO). Furthermore, only six Dividend Aristocrat companies have current streaks longer than 56 years. The longest current streak in the Dividend Aristocrat group of 63 years belongs to the Dover Corporation (NYSE:DOV).

The Dividend Aristocrat designation denotes an S&P 500 company with a market capitalization of at least $3 billion that has a current record of boosting its annual dividend amount for at least the last 25 consecutive years. As of 2019, only 57 companies, or just slightly more than 11% of S&P 500 companies, qualify for the Dividend Aristocrat designation.

Furthermore, with a dividend boosts streak that exceeds 50 consecutive years, Lowe’s also qualifies for the Dividend King title, which is far more exclusive than the Dividend Aristocrat designation. While more than 11% of S&P 500 companies qualify for the Dividend Aristocrat status, only 13 companies, or 2.6%, have dividend hike streaks long enough to be called Dividend Kings.

Lowe’s history of rising dividend income is clearly a draw for income-seeking investors. However, does the company also offer sufficient asset appreciation to deliver attractive total returns? Over the extended time horizon, the answer is definitely affirmative. However, over the shorter term, the company’s share price has exhibited an increase in volatility and has delivered a flat performance over the trailing 12 months.

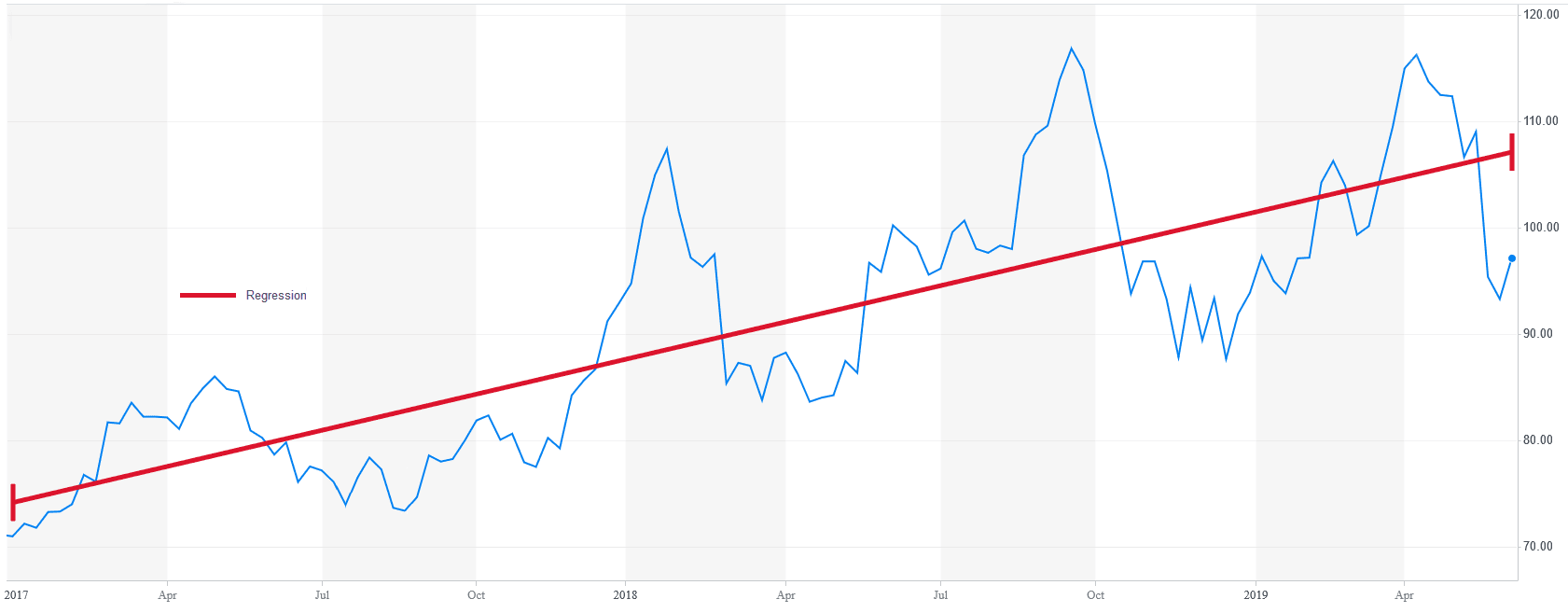

Luckily for investors who are not overly risk averse, the current pullback might turn out to be an opportunity to take a long position in the stock at discounted prices and enjoy the steady dividend income distributions with the possible asset appreciation. The share price appears to have completed the latest in a series of pullbacks prior to an uptrend that might extend for the next five or six months. While experiencing several significant fluctuations, the share price is still relatively close to the average uptrend over the past few years, as indicated in the graph below.

Share price linear regression graph since July 1, 2017; Graph Source: Yahoo Finance

Lowe’s Companies, Inc. (NYSE:LOW)

Headquartered in Mooresville, North Carolina, and founded in 1946, Lowe’s Companies, Inc. operates as a home improvement company in the United States, Canada and Mexico. The company provides home improvement products in various categories, such as lumber and building materials, tools and hardware, appliances, fashion fixtures, rough plumbing and electrical, seasonal living, lawn and garden, paint, flooring, kitchens, outdoor power equipment and home fashions. Additionally, Lowe’s offers installation services through independent contractors in various product categories and extended protection plans, as well as warranty and non-warranty repair services. As of May 2019, the company operated more than 2,220 home improvement and hardware stores. In addition to its stores, the company also sells its products through the Lowes.com and Lowesforpros.com websites and through mobile applications.

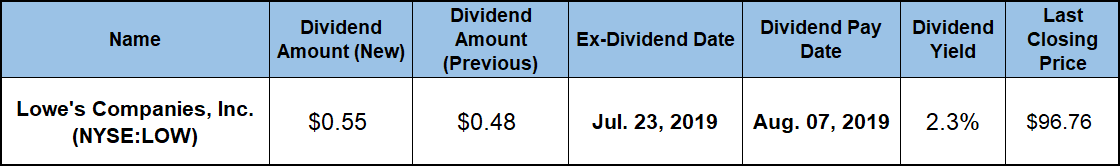

The company’s current $0.55 quarterly payout is 14.6% higher than the $0.48 quarterly distribution from the previous period. The annualized $2.20 dividend for 2019 corresponds to a 2.3% forward dividend yield, which is nearly 40% above the company’s own 1.64% average yield over the past five years. While the company’s current yield is lower than double-digit-percentage yields in some other sectors, such as real estate investment trusts (REITs) or Asset Management sectors, Lowe’s current 2.3% yield is 3.5% above the 2.19% average yield of the entire Services sector and nearly 35% higher than the 1.68% simple average of the Home Improvement industry segment.

In addition to a long streak of annual dividend hikes, Lowe’s also continues to deliver above-average dividend growth rates to its shareholders. Over the past two decades, the company increased its annual dividend amount more than 73-fold, which corresponds to an average growth rate of 24% per year. While the average annual growth rate over the past 10 years is slightly lower at 20.2%, the company still enhanced its total annual payout 530% over the past decade. Investors interested in taking advantage of the upcoming quarterly dividend hike should take a long position in the Lowe’s stock before the ex-dividend date on July 23, 2019. Lowe’s will distribute its next dividend distribution to all shareholders of record on the August 7, 2019, pay date.

Over the first 90 days of the trailing 12 months, the company’s share price advanced 18% to reach a new all-time high in September 2018. However, the uptrend reversed, the share price quickly returned all the gains dropped nearly 27% before reaching its 52-week low of $85.96 on December 24, 2018. This low was even 13.4% lower than the share price level from the beginning of the trailing 12-month period.

However, after another trend reversal and a 36.3% gain, the share price reached a new all-time high of $117.18 by April 15, 2019. The continued volatility pushed the share price 17% below the April peak to close on June 7, 2019, at $96.76. While 2.5% lower than it was one year earlier, less-than three weeks ago the share price was trending nearly 12% higher versus early June 2018. Additionally, the share price has gained 5.3% over the past eight trading sessions. Furthermore, even with the decline since mid-April, the share price is 113% higher than it was five years ago.

While lacking a high dividend yield or a steep share-price growth rate, Lowe’s offers its shareholders a balanced combination of steadily rising dividends and moderate asset appreciation. The dividend income manged to offset the small one-year share price decline to bring the total loss over the past 12 months to within 0.5% of the break-even point. However, longer-term analysis lessens the impact of share price fluctuation timing and indicates significantly better rates of return on shareholders’ investment. Over the past three years, Lowe’s delivered a total return of nearly 30%. Furthermore, with a total return in excess of 117%, the shareholders more than doubled their investment over the past five years.

Related Articles:

5 Best Dividend Aristocrats to Buy Now

The Dividend Aristocrats Investing Strategy and Stocks List

The Best Dividend Aristocrats ETFs

Why Invest in the Dividend Aristocrats?

The S&P 500 Dividend Aristocrats — Everything You Need to Know

What are the Dividend Aristocrats?

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic