Dividend-Paying Automobile Supplier Stocks to Purchase This Year

By: Paul Dykewicz,

Dividend-paying automobile supplier stocks to purchase this year provide an opportunity to acquire shares in companies that trade at lower valuations than original equipment manufacturers (OEMs) such as Tesla Inc. (NASDAQ: TSLA), of Palo Alto, California; Detroit’s General Motors (NYSE:GM), Toyota (NYSE:TM), of Toyota City, Japan; Volkswagen AG (FRA:VOW), of Wolfsburg, Germany, and Tokyo’s Honda (NYSE:HMC).

U.S. House Speaker Nancy Pelosi and her husband, venture capitalist Paul Pelosi, are among investors who have pumped in big money to profit from the sky-high climb of Tesla, according to documentation she filed electronically on Jan. 19 to disclose the purchase of 25 call options in the electric vehicle (EV) manufacturer on Dec. 22 at a strike price of $500 and an expiration date of March 18, 2022. The rapidly ascending shares of Tesla allow investors to collect huge profits by purchasing call options, as Speaker Pelosi reported doing in a Periodic Transaction Report filed with the Clerk of the House of Representatives.

The investment in those options totaled between $500,001 and $1,000,000, she disclosed. Since Tesla’s share price closed at $822.02 on Jan. 29, the call options are trading well in the money — 64.4% above the $500 strike price. Speaker Pelosi and her husband can sell the call options that certainly have soared substantially in value since their Dec. 22 purchase before their expiration for a profit. The call options also give the buyer the right, but not the obligation, to purchase Tesla’s stock at the comparatively low $500 strike price on the expiration date.

Diviend-Paying Automobile Supplier Stocks to Purchase This Year Share in the Growth of Electric Vehicle Manufacturers

Speaker Pelosi, who is a advocate of clean energy policies, should benefit directly from any legislation, regulation or executive orders from President Joe Biden that supports the sale of electric vehicles as an alternative to cars and trucks powered by conventional internal-combustion engines (ICEs). For example, President Biden’s Jan. 20 executive order revoking a March 2019 federal permit for the Keystone XL Pipeline to move oil from Canada to Texas is positive for electric vehicle manufacturers and suppliers but negative for traditional auto makers that currently may not be able to compete effectively with trend-setting EV builders Tesla and GM.

Lawmakers in Congress have been criticized for profiting from trades that could have been based on knowledge of policies and legislation that would not be available to the general public. Such situations can raise questions and complaints by critics about possible insider trader. But astute investors may have been able to foresee that a Biden administration would favor clean energy policies that would help stocks like Tesla and its electric vehicle suppliers.

Speaker Pelosi’s disclosure did not include the exact buy price of the call options, nor is there any documentation that the options have been sold so far. However, Tesla’s soaring share price late Friday morning, Jan. 29, reached 28.6% above the stock’s final price on Dec. 22.

Tesla CEO Elon Musk Enhances Appeal of Diviend-Paying Automobile Supplier Stocks to Purchase

Tesla’s entrepreneurial Chief Executive Officer Elon Musk is the most vocal electric vehicle industry leader touting the clean technology fueling the prospects of OEM suppliers such as American Axle (NYSE:AXL), BorgWarner Inc. (NYSE:BWA) and Magna International (NYSE:MGA). The price objective set by BoA Global Research is $12.50 on American Axle, $55 on BorgWarner and $105 on Magna International. Based on the Jan. 29 late morning prices of each, the projected upside is 36.16% for American Axle, 27.20% for BorgWarner and 49.57% for Magna International.

The price-to-earnings (P/E) ratio for BorgWarner is 24.2, with Magna International almost double that level at 48.5. American Axle currently is losing money and thereby does not have a P/E ratio. Tesla, the industry’s highest profile EV manufacturer, has a stratospheric P/E ratio of 1, 293.87, down 26.05% in just three days from 1,749.66 at the market’s close on Jan. 26.

Income investors will appreciate that Borg Warner offers a dividend yield of 1.60%, while Magna International’s current yield is 2.24%

BoA Global Research predicts publicly traded automobile companies will report fourth-quarter 2020 results similar to the third-quarter’s strong sales and production, “solid results” and favorable product mix and pricing. However, companies may be conservative when giving 2021 financial guidance and such caution may dim the proverbial road ahead for automobile stocks in the eyes of investors who recently had been bidding up their share prices.

BoA Global Research further described fourth-quarter 2020 as a return to “normal” for industry activities like product launches, compared to a “pretty singular focus” by management teams much of last year as they navigated the effects of the COVID-19 contagion.

Top Dividend-paying Automobile Supplier Stocks to Purchase Should Benefit from Increased Production

IHS projects global auto production volume growth of 14% in 2021, rebounding from a base of -16% in 2020, with increases of 25% in North America, 14% in Europe and 6% in China due to sales recoveries in each respective regions. Even though 2020 sales comparisons will be easier to top in the first half of 2021 due to COVID-related production stoppages and downtime last year, supply chain disruptions and other challenges may derail the industry’s “V-shaped recovery” that began to emerge in roughly the past six months.

Many original-equipment manufacturers have announced or alluded to production downtime associated with a tight supply of microchips worldwide. An example that I cited in one of my previous columns featuring automobile manufacturing stocks is a Jan. 7 announcement by Honda of an expected cut to vehicle production due to a semiconductor supply shortage.

While the semiconductor output shortage likely will be “fairly isolated” to first-quarter 2021, BoA Global Research opined that management teams will cite it as a reason to give conservative 2021 financial outlooks. Other reasons to forecast prudently include uncertainty about the return of normal vehicle purchasing, economic activity and the distribution and efficacy of COVID-19 vaccines.

Pension Fund Chairman Discusses Dividend-paying Automobile Supplier Stocks to Purchase

A key problem for investors is that the prices of electric vehicle stocks such as Tesla have soared by “enormous amounts” in a short time, said Bob Carlson, chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets.

“I’d wait for a correction in the big-name stocks and consider taking some positions in less well-known players,” said Carlson, who also heads the Retirement Watch investment newsletter.

One area to consider is stocks focusing on the commercial rather than the consumer electric vehicle market. They include Romeo Power, Inc. (NYSE: RMO), and Hyliion Holdings Corp. (NYSE: HYLN), Carlson continued.

Pension fund Chairman Bob Carlson answers questions from Paul Dykewicz before social distancing became standard after the COVID-19 outbreak.

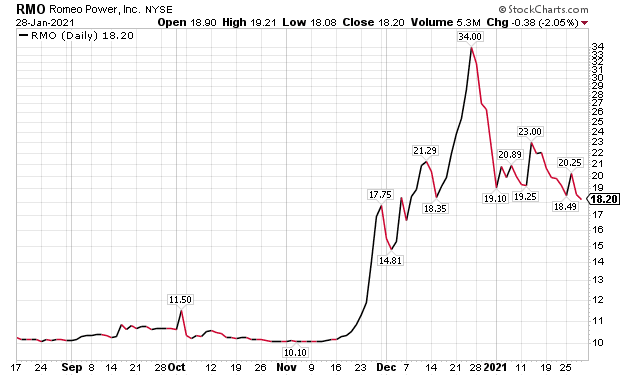

Dividend-paying Automobile Supplier Stocks to Purchase May Include Romeo Power

Los Angeles-based Romeo Power Inc. (NYSE: RMO), an energy-technology company that designs, engineers and produces energy-dense, commercially available lithium-ion battery packs, has attracted Carlson’s attention. Founded in 2016, Romeo Power’s mission is to electrify the industrial transportation sector by focusing on supplying lithium EV batteries to the medium-duty, short haul and heavy-duty, long haul trucking markets.

Chart courtesy of www.stockcharts.com

Romeo Power announced on Jan. 4 that it launched a program to find partners to support the fleet electrification strategy of privately held Heritage Environmental Services, Inc. Romeo Power and Heritage revealed plans to select leading-edge commercial battery electric vehicle (BEV) value chain participants, such as OEMs, integrators and ePowertrain providers, to join them.

The goal is to form long-term production partnerships with program participants that deliver the best solution for Heritage’s requirements, its officials said. All participants will be required to use Romeo Power’s energy technology and battery management system in their vehicles.

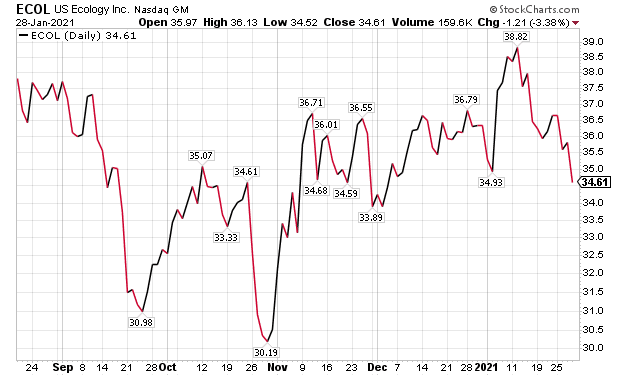

U.S. Ecology May Partner with Dividend-paying Top Automobile Supplier Stocks to Purchase

Heritage and its affiliates intend to buy 500 BEVs for fleet use between 2022 and 2025, with the goal of electrifying up to 2,000 trucks. The program will start with the selection of partners in first-quarter 2021 to prepare for Heritage taking vehicle deliveries in 2022.

Plus, U.S. Ecology Inc. (NASDAQ-GS: ECOL), a provider of environmental services, agreed to participate as an observer to the Romeo Power and Heritage fleet electrification program. Key performance metrics of the program will be shared with US Ecology to help its management assess electrification solutions for its fleet of 1,100 trucks.

Chart courtesy of www.stockcharts.com

The launch of Heritage’s fleet electrification program with Romeo Power marks an “important step” to offer the safest, most reliable, efficient and greenest solution, said Jeff Laborsky, Heritage’s president and chief executive officer.

New NYSE Listing Features Non-Dividend-Paying Automobile Supplier Stocks to Purchase

Romeo Power completed a business combination on Dec. 29 with non-dividend-paying RMG Acquisition Corp. (NYSE: RMG), a special purpose acquisition company (SPAC). The deal, approved by RMG stockholders in a Dec. 28 special meeting, led to the listing of Romeo Power’s shares of common stock on the NYSE under the ticker symbol “RMO.” Related warrants trade on the NYSE under the ticker symbol “RMO.WT.”

The transaction gave Romeo Power a $900 million enterprise value and raised additional equity funding of approximately $394 million, prior to expenses. Approximately 99.8% of RMG shareholders voted for the combination and no RMG shareholders redeemed their shares. The additional funds are expected to support Romeo Power’s continued growth, innovation, infrastructure and research and development (R&D).

“At this inflection point where regulation is driving electrification across the commercial vehicle industry and adjacent sectors, Romeo Power’s energy technology is ready to meet the demand,” said Lionel Selwood, Jr., chief executive officer of Romeo Power.

“We spent significant time and evaluated hundreds of companies before selecting Romeo Power for this transaction,” said Robert Mancini, RMG’s chief executive officer. “Romeo Power’s innovative technology and strong partnerships solidify its position as a market leader, and we look forward to working with them.”

With more than $545 million in contracted revenues across a diverse and growing customer base, Romeo Power is designing and producing battery management systems, modules and packs at its 113,000 square-foot, automated manufacturing facility in Los Angeles.

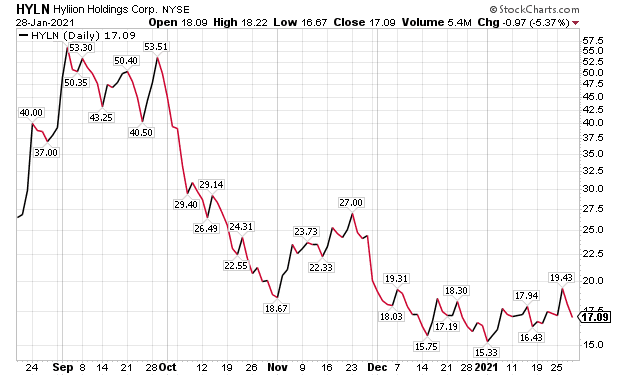

Dividend-paying Automobile Supplier Stocks to Purchase Include Hyliion Holdings

Hyliion Holdings Corp., a provider of electrified powertrain solutions for Class 8 commercial vehicles, took its current name on Oct. 1 after completing a strategic combination between Hyliion Inc. and Tortoise Acquisition Corp. The deal yielded approximately $520 million in net proceeds to fund Hyliion’s growth plans and the pursuit of its long-term goals.

Hyliion lost money when it reported its third-quarter 2020 results but it also installed eight hybrid electric units in that quarter for four fleet-based customers. Hyliion futher pledged with FEV North America Inc. to speed up commercialization of the Hypertruck ERX for the Class 8 truck market, while forming new partnerships to pursue an increased share of a $800 million market.

Chart courtesy of www.stockcharts.com

“With ample resources from our strategic combination, Hyliion is well-capitalized and primed to disrupt the powertrain market,” said Thomas Healy, Hyliion Holdings’ chief executive officer, in a press release.

Hyliion is focused on achieving long-term, sustainable growth, while capturing the market opportunity of electrifying class 8 vehicles. Its management continues to pursue the company’s business objectives and growth amid the COVID-19 pandemic.

Non-Dividend-paying Automobile Supplier Stocks to Purchase Include Beam Global

There also are companies that provide infrastructure and components for EVs, such as San Diego-based Beam Global (ASDAQ: BEEM), a provider of innovative sustainable technology for EV charging, outdoor media and energy security, Carlson said. The shares of another supplier, QuantumScape Corp. (NYS:QS), plunged roughly 41% on Jan. 4 after fallout from a Seeking Alpha article that claimed its solid-state batteries are “completely unacceptable” for real-world electric vehicles.

QuantumScape’s $34.49 per share drop led to it closing at $49.96 on Jan. 4, giving shareholders paper losses of billions of dollars in market capitalization. Class action lawsuits have been filed against QuantumScape and some of its executives in the U.S. District Court for the Northern District of California, following the company’s share price plunge.

Chart courtesy of www.stockcharts.com

Seasoned Stock Trader Eyes Dividend-paying Automobile Supplier Stocks to Purchase

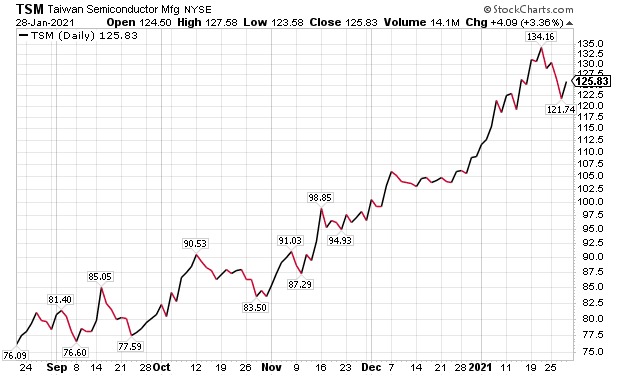

The most effective way to invest in the EV sector is to purchase shares in companies that supply components and key technologies to the auto makers in the competition for market share, said Bryan Perry, a seasoned trader of both stocks and options.

A good example of this is Taiwan Semiconductor Manufacturing Company, Ltd. (NYSE: TSM), the world’s largest foundry for manufacturing semiconductor chips for many of the biggest companies, including Apple (NASDAQ: AAPL), Broadcom (NASDAQ: AVGO), Nvidia (NASDAQ: NVDA) and Advanced Micro Devices (NASDAQ: AMD). Taiwan Semiconductor also offers a 1.77% dividend yield.

Chart courtesy of www.stockcharts.com

Taiwan Semiconductor, of Hsinchu, Taiwan, is seeking to tap into the fast growth of four major markets: smartphones, high-performance computing, automotive electronics and the Internet of Things. Automotive innovation requires electronic components to drive 80% of the change, according to Taiwan Semiconductor.

Taiwan Semiconductor Caters to Dividend-paying Automobile Supplier Stocks to Purchase

Applications in intelligence, connectivity, sensing and control are evolving and Taiwan Semiconductor seeks to meet the growing complexity of safer, greener and smarter vehicle design. Taiwan Semiconductor stands to benefit as new applications require additional semiconductor components to equip increasingly advanced vehicles.

Apple, a Cupertino, California-based technology company known for its iCloud technology, products such as iPhone, iPad, Mac, Apple Watch and Apple TV, as well as its five software platforms — iOS, iPadOS, macOS, watchOS and tvOS, is producing strong sales for its new line of 5G-enabled iPhone 12 smartphones. The company reportedly is planning to partner with electric vehicle manufacturers by using a similar business model to the way its iPhones are sold by telecommunications providers. Apple offers pays a 0.61% dividend yield.

San Jose, California-based Broadcom, a supplier of semiconductor and infrastructure software solutions, also has carved out a niche in addressing a wide range of needs in vehicle connectivity and networking, optical isolation and sensing, wireless communications and light-emitting diode (LED) lighting. With extensive product experience in automotive applications, Broadcom’s automotive solutions enable OEMs to bring innovative electronics to next-generation vehicles and enhance the driving experience and safety for consumers. Broadcom currently offers a 3.19% dividend yield.

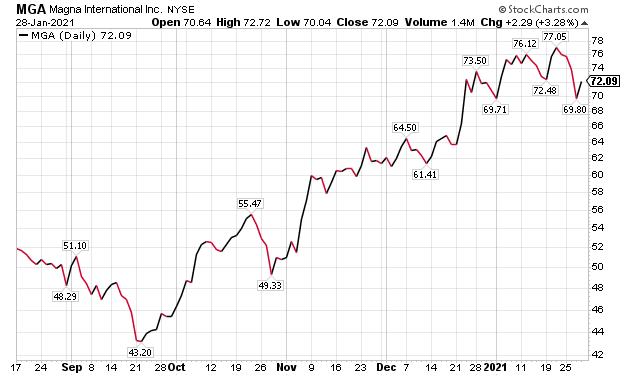

Magna International Is Among the Dividend-paying Automobile Supplier Stocks to Purchase

Magna International Inc. (NYSE: MGA), offering a current dividend yield of 2.29%, supplies the EV industry in a role that is similar to an arms dealer meeting the needs of combatants in a conflict, Perry continued. Magna International is a contract manufacturer and global supplier of parts to the automotive industry and is rapidly expanding its outsourcing model to include some of the 11 fledgling EV start-ups and major OEMs in the space, he added.

For example, the company’s 2021 revenues are forecast to surge by 18% to $38.1 billion with earnings expected to soar by 108% to $6.37 per share, Perry said. With Magna International trading near $73, the stock is priced at only 12 times earnings and is “a steal” by today’s lofty price-to-earnings ratios for market leaders, he added.

“If EV’s are all the rage for the next several years, then owning MGA has the potential to be a tremendous portfolio holding,” Perry said.

Chart courtesy of www.stockcharts.com

Dividend-paying Automobile Supplier Stocks to Purchase Draft Behind Market-leading Electric Vehicle OEMs Like Tesla and GM

Perry recommended selling naked put options in giant EV competitor GM recently in his Quick Income Trader service and he advised locking in profits on Jan. 19 after they zoomed 55.88% in less than a week. That strategy avoided the need to hold a short position in the underlying shares of GM to let his subscribers instead go long in the stock to profit further from its ongoing ascent. As a result, his recommendation of GM’s stock is up by double-digit percentages in the same time frame.

Paul Dykewicz interviews Bryan Perry, who heads the Cash Machine investment newsletter, as well as the Premium Income, Hi-Tech Trader, Quick Income Trader and Breakout Profits Alert advisory services.

Kramer Considers Dividend-paying Automobile Supplier Stocks to Purchase This Year

“There are too many companies around the world hoping to be the next Tesla and their efforts to capture even trivial market share will ultimately leave investors poorer,” said Hilary Kramer, who hosts the nationally aired “Millionaire Maker” radio program and heads the GameChangers and Value Authority advisory services.

Instead of buying a car manufacturer, Kramer suggested focusing on the often-overlooked stocks within the transportation ecosystem that keep vehicles moving.

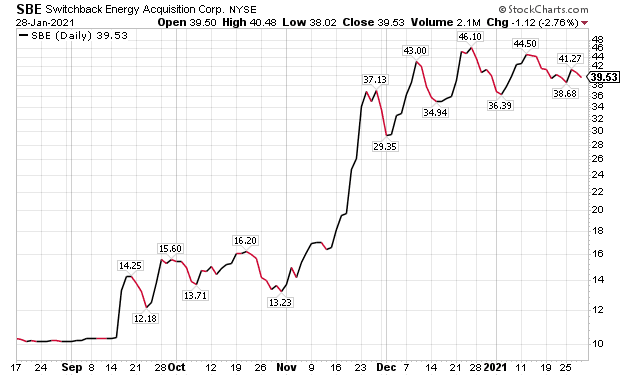

“Do not buy the gas station stocks like Getty Realty (NYSE:GTY), which owns the stations themselves, or CrossAmerica Partners (NASDAQ:CAPL), which distributes the fuel,” Kramer counseled. “They held up surprisingly well in the pandemic but are unlikely to shift into racing gear here. Look at charging stations instead to capture the growth of the EV market, no matter who makes the cars in question: Switchback Energy Acquisition Corp. (NYSE:SBE) or Blink Charging Co. (NASDAQ:BLNK) when you can get them on a significant dip. They’ve run up a lot, but not as much as Tesla itself.”

Chart courtesy of www.stockcharts.com

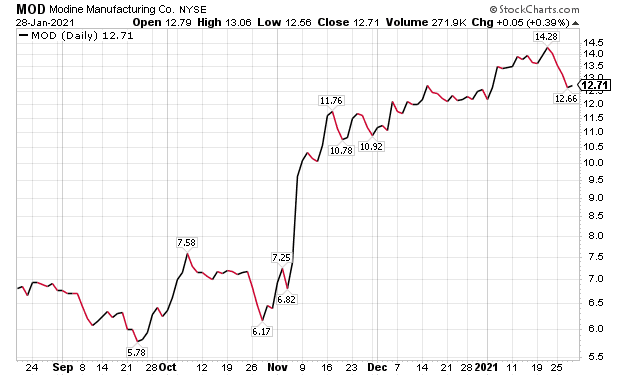

Non-Dividend-paying Automobile Supplier Stocks to Purchase Include Modine Manufacturing

Investors also should consider the original equipment manufacturers (OEMs) that provide the parts for Tesla and other EV builders, Kramer said. Buying the stocks of EV battery makers that use lithium is an “overdone story” these days, she added.

Kramer recalled doing well by investing in lithium stocks five or six years ago, but now the supply lines are settled, she said.

“Modine Manufacturing Co. (NYSE:MOD) is widely believed to make the refrigeration systems that keep all that lithium from exploding,” Kramer continued. “Start there.”

Chart courtesy of www.stockcharts.com

Columnist and author Paul Dykewicz interviews money manager Hilary Kramer, whose premium advisory services include IPO Edge, 2-Day Trader, Turbo Trader, High Octane Trader and Inner Circle.

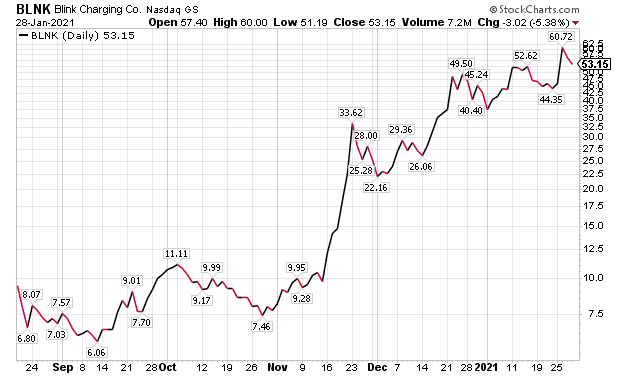

Woods Likes Blink Charging as One of the Non-Dividend-paying Automobile Supplier Stocks to Purchase

“One sector of the market likely to get a lot of stimulus and favorable treatment with Democrats in charge is green energy, and specifically electric vehicles (EVs),” said Jim Woods, co-editor of Fast Money Alert. “And one of the fastest-moving stocks in the EV space is Blink Charging Co. (NASDAQ:BLNK),”

Blink provides technology for EV charging stations, including the hardware and even the cloud-based software. According to recent company data, Blink has a growing registered member base of more than 180,000 and has deployed more than 23,000 EV charging stations throughout the United States, Europe and the Middle East.

“Blink generates revenue by charging EV drivers to power their cars, by selling EV charging hardware, by providing network connectivity, by processing payments for its property partners and from advertising,” said Woods, who recommends the stock in his Fast Money Alert trading service.

“BLNK has surged an incredible 2,200% over the past year, and some 350% over the past three months,” said Woods, who heads the Bullseye Stock Trader advisory service and writes the monthly investment newsletters Successful Investing and Intelligence Report. “Yet, in my opinion, this one is just getting started, as the EV wave is still just in its early stages.”

Chart courtesy of www.stockcharts.com

Dividend-paying Automobile Supplier Stocks to Purchase This Year Amid COVID-19

The COVID-19 pandemic afffects investors and consumers alike as many people work from home rather than drive to offices as they did befoe the still-raging public health crisis. COVID-19 cases have climbed to tear-inducing numbers and keep rising as a second surge continues.

The number of cases hit 25,789,000 and led to a distressing 433,622 deaths in the United States, accounting for a large share of 101,636,470 cases and 2,194,790 deaths worldwide, as of Jan. 29, according to Johns Hopkins University. America has the dubious distinction of suffering the most cases and deaths of any country.

The dividend-paying automobile supplier stocks to purchase this year include lesser-known companies that the major OEMs need to help them build new electric vehicles, as well as keep partnering with auto companies that produce internal-combustion engine cars for the many people who still want them. Investors would be wise to consider buying shares in the dividend-paying automobile supplier stocks that are participating in the EV market’s growth, without incurring the risk of paying the high prices to buy shares of front-running Tesla and other stocks with sky-scraping valuations.

Connect with Paul Dykewicz

Connect with Paul Dykewicz