Dividend-Paying Digital Currency Stocks to Buy

By: Paul Dykewicz,

Dividend-paying digital currency stocks to buy could benefit from big changes for many financial institutions, central banks and countries.

Interest in investing in digital currencies is growing way beyond Bitcoin and other cryptocurrencies. Europe and China are racing ahead as global frontrunners in exploring the launch of Central Bank Digital Currencies (CBDCs).

While electronic payments tradionally depend on commercial banks, adoption of CBDCs could reduce the past role of financial institutions. CBDCs may become an anti-cryptocurrency alternative as central banks seek to ensure payments move through a convenient, regulated, transparent, cheap and easy-to-use process.

European Central Bank Affects Dividend-paying Digital Currency Stocks to Buy

Geopolitics and years of the European Union falling behind the United States in technological advancement may have spurred the European Central Bank (ECB) to move more quickly than the Fed and most other major central banks in introducing a CBDC. While a full-fledged CDBC is years away, even in the eurozone, implications for banks and payment networks are critical to understand as the ECB indicates that change is likely coming and may begin with a trial of CBDCs by mid-2021, according to a recent podcast by BoA Global Research.

“Central banks worry about losing their monopoly of money,” said Philip Middleton, a specialty finance equity research analyst at BoA Global Research. “They worry about private sector stable coins. Diem… formerly known as Libra, is the obvious example here. And they’re worried that other economies could use a digital currency, and this becomes broadly used. The Bahamas already has a digital currency, the Sand Dollar, but I suspect the ECB is more concerned about China, which has already completed a CBDC trial and is supposedly quite a long way along this process.”

Only banks can take deposits, said Alastair Ryan, BoA’s head of European banks equity research. With the technology advances of the past five, 10 and 15 years, everybody’s deposits are still with one of the banks, but a digital currency could potentially change that, he added.

Commercial Applications Fuel Dividend-paying Digital Currency Stocks to Buy

“There’s about €10 trillion of deposits in Europe,” said Ryan. “Back before the financial crisis, the ECB had a balance sheet of €1 trillion, but with all the interventions of the last few years, it was close to €4 trillion just over a year ago. Now, it’s close to €7 trillion. The ECB’s got used to dealing with very large numbers and been very central to an awful lot of what’s going on in the economy in a way that just wasn’t the case 10 years ago. If they take everybody’s salary and end up with that, with them in a digital euro, that’s about a trillion euros.”

Central bank digital currency potentially could become disruptive both banks and the payments networks, said TJ Thornton, head of product marketing and predictive analytics at BoA Global Research. The ECB will launch a trial of CBDCs sooner or later, he predicted.

However, CBDCs most likely are years away, even in Europe, so the biggest ramifications are for “fringe currency speculators,” said Hilary Kramer, who hosts the nationally aired “Millionaire Maker” radio program and leads the GameChangers and Value Authority advisory services.

“I’d consider focusing on opportunities with commercial applications closer to the here and now,” Kramer said. “Look at the way payment flows are shifting toward captive electronic networks.”

Paul Dykewicz conducts a pre-COVID-19 interview with Hilary Kramer, whose premium advisory services include IPO Edge, 2-Day Trader, Turbo Trader and Inner Circle.

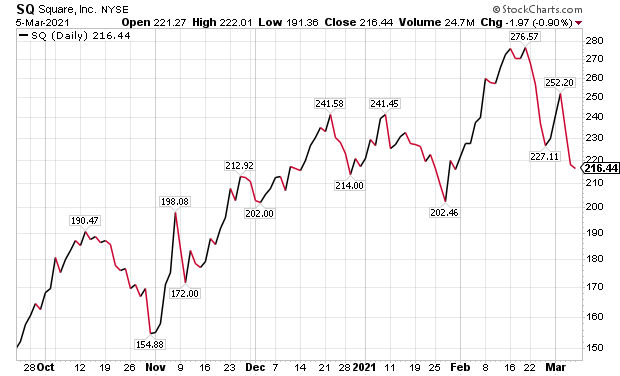

Square and PayPal Headline Non-dividend-paying Digital Currency Stocks to Buy

Kramer cited two stocks that could capitalize on the trend. One is Square Inc. (NASDAQ:SQ), an online payment company that now has regulatory approval to operate as a bank to “squeeze every micro-cent” out of $112 billion in transactions that its system processed last year, Kramer added.

“The company already has 3 million active customers buying and selling with Bitcoin,” Kramer said.

Chart courtesy of www.stockcharts.com

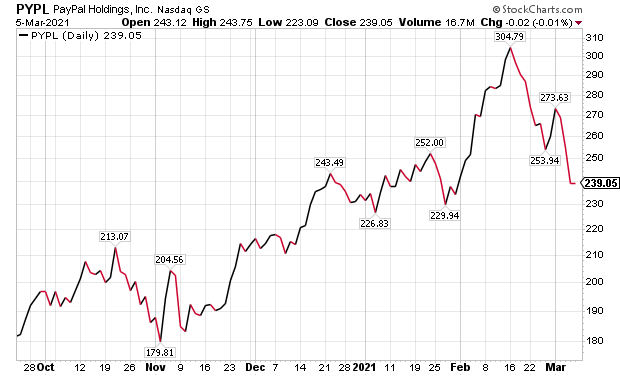

A second stock that should gain a boost is PayPal Holdings Inc. (NASDAQ:PYPL), another online transaction provider that now supports Bitcoin, Kramer said. Square and PayPal both collect money on cryptocurrency transactions.

Chart courtesy of www.stockcharts.com

“Lock that in and then raise your gaze toward prospects farther out on the timeline,” said Kramer, who added she is more interested in the blockchain technology that makes bitcoin and other cryptocurrencies possible. The systems supporting them could change the world, she added.

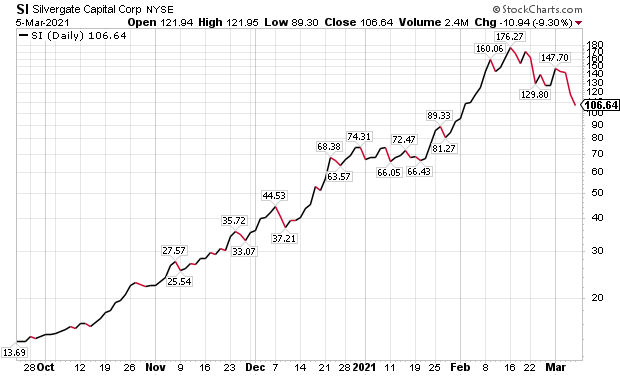

Dividend-paying Digital Currency Stocks to Buy Include Silvergate Capital and Its 755% One-Year Return

For investors seeking to profit from cryptocurrency intersecting with the conventional economy, Kramer mentioned her successful recommendation of Silvergate Capital Corp. (NYSE:SI), a so-called “crypto bank” that accepts deposits in digital currency and is now lending dollars using crypto assets as collateral.

Chart courtesy of www.stockcharts.com

“It felt great to get SI in front of my IPO Edge subscribers a little over a year ago at $12.50,” Kramer said. “You can see for yourself where it’s gone since.”

Silvergate Capital closed trading at $106.64 on Friday, March 5, down 25.5% from $143.32 on Tuesday, March 2, just three days earlier. However, the stock currently offers a divdiend yield of 3.84% and has achieved a 754.72% increase since April 2020.

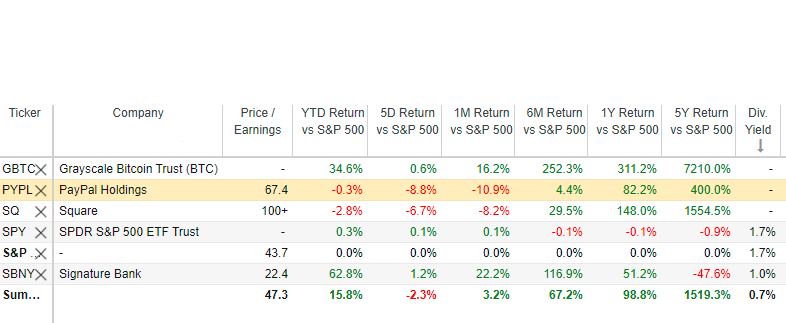

Source: Stock Rover. Click here to sign up for a free, two-week trial for Stock Rover charts and analytics.

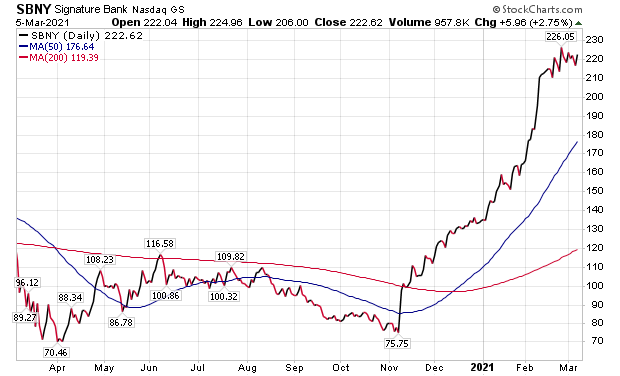

Another digital-paying digital currency stock to buy is Signature Bank (NASDAQ:SBNY). The company handles transactions in Bitcoin and is up 96.0% in the past year. The stock also pays a current dividend yield of 1.02%.

Chart courtesy of www.stockcharts.com

Trading Service Leader Assesses Investment Climate for Dividend-paying Digital Currency Stocks to Buy

“I don’t think investors should be concerned by the adoption of CBDCs in Europe,” said Jim Woods, editor of Successful Investing, Intelligence Report and Bullseye Stock Trader, as well as co-editor of Fast Money Alert, who recently posted a free, online presentation about how to profit from cryptocurrencies. “The adoption of a digital currency by the ECB, Bank of England, and frankly also in the United States, is something I see as inevitable.”

Woods spoke well of cryptocurrencies as an alternative to government control of fiat money. But rather than investing in only Bitcoin or individual cryptocurrencies, he said companies in the blockchain space, as well as the “picks-and-shovels” plays in stocks related to cryptocurrencies, are the better way to go.

Columnist and Author Paul Dykewicz Meets with Stock Picker Jim Woods before COVID-19.

Woods counseled that unlike in 2017, when individual investors drove the rise and fall of Bitcoin and the other cryptocurrencies, the new wave has three key forces behind it:

- A massive influx of large-scale investors and institutions

- Investors seeking a hedge against inflation

- Growing acceptance by retailers, grocery stores and other businesses

Dividend-paying Digital Currency Stocks to Buy Feature Financial Institutions

Financial institutions collectively are committing big money. They include JPMorgan creating a JPM Coin to settle payments between clients that will transform the payments business, Woods predicted.

In addition, the New York Stock Exchange’s parent company, International Exchange, has hopped on the movement by launching a Bitcoin firm and futures contracts, Woods continued.

The Chicago Mercantile Exchange, known for trading agricultural products, currencies, metals and stock indexes, has formed four trading platforms for bitcoin futures and options on futures, Woods added.

Fidelity Investments, a giant mutual fund company, launched Fidelity Digital Assets for institutional companies to buy, hold and trade cryptocurrencies.

Overall, cryptocurrencies allow for borderless payments, lower fees and faster, more secure transactions.

Report Indicates Promise of Dividend-paying Digital Currency Stocks to Buy

National currencies may break from their current physical form and become digitized. Cointelegraph reported:

- 36% of 800 institutional investors already owned crypto assets as of February 2020.

- 90% of institutional holders of crypto assets expect to invest even more in bitcoin this coming year.

Bitcoin and the other cryptocurrencies offer bankers, institutions and investors decentralized finance, also called DEFI. Digital currencies can change the dynamics of money, since no nation or central bank controls the assets.

Dividend-paying Digital Currency Stocks to Buy May Serve as a Counter Balance to China’s Actions

Investors need to watch China more than Europe as digital currencies begin to be offered by central banks, said Bob Carlson, chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets. China effectively has banned Bitcoin and other private digital currencies, he added.

“Instead, it developed a digital form of its own currency and is testing it in several cities,” Carlson said. “China also recently reached an agreement with several other countries to test using the digital Chinese currency as a means of transfer and payment. China is well ahead of other governments in establishing a digital currency and aims to use it to replace the dollar as the world’s reserve currency.

“Investors also need to be more focused on the blockchain that underlies Bitcoin and its imitators more than on the currencies themselves. Advocates of blockchain technology believe that over time it will be able to replace credit cards, banks and much of the current financial system. It remains to be seen if that will happen or how long it will take, but investors need to monitor it. Major financial services and technology companies established small blockchain departments but are prepared to pour additional resources into them if breakthroughs are achieved.”

Pension fund and Retirement Watch leader Bob Carlson answers questions from Paul Dykewicz prior to COVID-19-related social distancing.

COVID-19 Crisis Does Not Deter Dividend-paying Digital Currency Stocks to Buy

COVID-19 killed more than 100,000 people in America during January 2021 to account for the highest death total of any month since the virus began spreading in the United States, but the ferocity eased in February as vaccine rollout gained momentum, according to Johns Hopkins University. The Food and Drug Administration (FDA) recently approved a third COVID-19 vaccine to boost hope that a semblance of normalcy may return later in 2021 if the virus can be curtailed.

COVID-19 cases have hit heart-breaking totals with their number soaring to 28,886,897 and causing 522,610 deaths in the United States, as a large chunk of 116,025,351 cases and 2,578,805 deaths worldwide, as of March 5, Johns Hopkins University reported. America has the dubious distinction as the country with the most cases and deaths.

Investing in digital currencies is gaining worldwide interest, especially with the price of Bitcoin reaching $48, 578 at press time. Plus, investors may have a widened number of ways to buy digital currencies after the expected eventutal launch of CBDCs from Europe, China and elsewhere.

Connect with Paul Dykewicz

Connect with Paul Dykewicz