Dividend-Paying Cryptocurrency Investing Opportunities Feature Bank Stocks

By: Paul Dykewicz,

Dividend-paying cryptocurrency investing opportunities feature banks that have begun to accept Bitcoin as digital money in addition to the traditional kind issued by a sovereign nation.

Dividend-paying cryptocurrency investing opportunities are available but require buying stocks of banks and other companies that are among the vanguard of those that have begun to use the most common digital assets, such as Bitcoin, Ethereum, Litecoin, Binance Coin, Ripple and Tezos. Commercial banks that accept bitcoins and other cryptocurrencies offer a way for investors to gain exposure to digital money without directly investing in the alternative assets themselves.

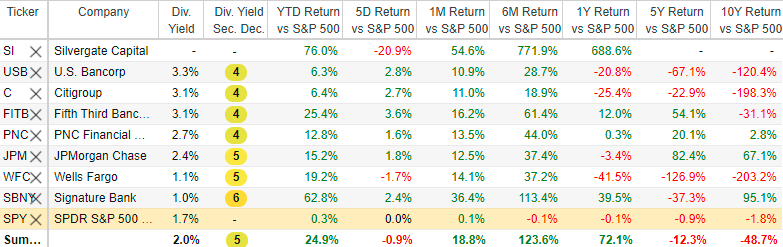

BoA Global Research surveyed banks about their willingness to serve crypto-linked companies and blockchain users and discovered only a limited number are pursing that niche right now. The dividend-paying cryptocurrency investing opportunities among bank stocks include JPMorgan Chase & Co (NYSE:JPM), Citigroup Inc. (NYSE:C), Wells Fargo & Co. (NYSE:WFC), U.S. Bancorp (NYSE:USB), PNC Financial Services Group Inc. (NYSE:PNC), Fifth Third Bancorp (NASDAQ: FITB) and Signature Bank (NASDAQ:SBNY). When their stock prices are reviewed for the past year, none of them outperform non-dividend-paying Silvergate Capital (NYSE:SI), which also is a financial industry trend-setter in accepting cryptocurrencies. The share prices of Citigroup Inc., Wells Fargo & Co. and U.S Bancorp all have underperformed the S&P 500 significantly for the past year, five years and 10 years.

Source: Stock Rover; Click here to sign up for a free, two-week trial for Stock Rover charts and analytics.

Rising Price of Bitcoin Boosts Dividend-paying Cryptocurrency Investing Opportunities

Cryptocurrencies are based on blockchain technology in which the registration and distribution of the alternative money can be tracked through an independent record of digital transactions rather than an institution or a central bank. As countries around the word amass hefty debt and their currencies lose value, the appeal of dividend-paying cryptocurrency investing opportunities as a store of value may grow.

Bitcoin’s recent rise has been stellar, with the cryptocurrency trading at a record high of $58,300 on Sunday, Feb. 21. Even though cryptocurrencies may seem a bit far afield for many investors to consider, blockchain.com wallets quietly have grown to more than 63 million users by year-end 2020, according to Statista.

Seasoned Money Manager Assesses Non-Dividend and Dividend Paying Stocks

“Bitcoin is a financial conundrum in that, on the one hand, it does represent an alternative to traditional hedges against weakening fiat currencies,” said Bryan Perry, who leads a monthly newsletter called Cash Machine that offers high-income investments. “Hence the popular term of digital gold has been applied. Knowing that only 21 million Bitcoins can be mined with over 18.6 million already in circulation creates a natural supply/demand issue that has only been exacerbated by wealthy individuals, corporations and hedge funds buying into Bitcoin. In doing so, their participation lends more credence to the debate as to whether Bitcoin is a rational investment.

“Treasury Secretary Janet Yellen expressed some concern about the volatile nature of Bitcoin’s price action and the financial exposure to illegal activities transacted in bitcoins. Although some companies like PayPal and Square are accepting transactions in bitcoin, it doesn’t mean that it won’t run into regulatory hurdles at some point that have the potential of weighing on Bitcoin’s lofty valuation. At the same time, there is widespread interest in Bitcoin and other digital currencies that may continue to override any fears of government intervention as the adoption rate by businesses spreads — meaning the train has left the station with bitcoins now considered global legal tender.”

Paul Dykewicz interviews Bryan Perry at MoneyShow event in Orlando, Florida.

The “parabolic move” in bitcoin’s price warrants a possible sell-off to its recent breakout level of $40,000 where good technical support seems to exist, Perry opined. Bitcoin’s volatile price settled at $47,190 at 2:30 p.m. EST on Friday, Feb. 26.

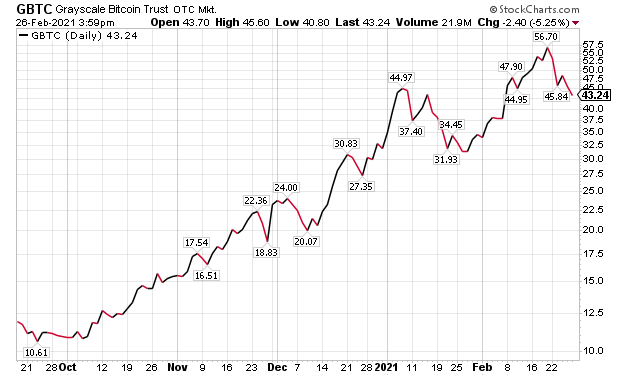

From a trading standpoint, one way to invest in the rise of Bitcoin is through non-dividend-paying Grayscale Bitcoin Trust (OTC:GBTC), which is highly correlated to the price movement of digital currency. Grayscale Bitcoin Trust recently rose 31.1% in the past month, 219.5% in the last six months, 284.5% for the past year and 6,918.1% for the past five years compared to the S&P 500, according to StockRover. But Perry advised that if he is going to own a volatile asset that trades 24 hours a day, 7 days a week, he wants to have 24-hour access to it.

Chart courtesy of www.stockcharts.com

“Therefore, I’m more inclined to own and trade Bitcoin on Coinbase or other dedicated platforms that exclusively serve Bitcoin investors and traders,” Perry said. “In my view, this is a no-brainer.”

Investment Radio Show Host Identifies Cryptocurrency Investing Opportunities

Investors can profit from bitcoin and other cryptocurrencies indirectly by choosing the right bank stocks to buy.

“We have always been more interested in the blockchain technology that makes Bitcoin and other cryptocurrencies possible,” said Hilary Kramer, who hosts the nationally aired “Millionaire Maker” radio program and heads the GameChangers and Value Authority advisory services. “Tokens can rise and fall, emerge and disappear. The systems behind them are changing the world. If you want to hold any crypto token, I won’t try to stop you. Some people say this is a useful hedge against an inflating dollar. Others just like to speculate.

“If you’re looking for a way to get exposure to the place where crypto intersects with the conventional economy, we’ve had extraordinary success with Silvergate Capital Corp. (NYSE:SI), the so-called ‘crypto bank.’ It’s a bank that accepts deposits in digital currency and is now rolling out dollar lending using crypto assets as collateral. While we’re still in early innings, it felt great to get SI in front of my IPO Edge subscribers a little over a year ago at $12.50. You can see for yourself where it’s gone since.”

Paul Dykewicz conducts pre-COVID-19 interview with Hilary Kramer, whose premium advisory services include IPO Edge, 2-Day Trader and Inner Circle.

Cryptocurrency Investing Opportunities Highlighted in Free Online Presentation

Jim Woods, editor of Successful Investing, Intelligence Report and Bullseye Stock Trader, posted a free, online presentation on Feb. 26 about how to profit from cryptocurrencies. He has recommended cryptocurrency investments profitably and discussed in his presentation how to profit from the growing trend. To watch, click here.

Aside from a retreat in the pricing of cryptocurrencies during recent days, Bitcoin generally has been soaring. The Fast Money Alert trading service co-led by Woods and economist Mark Skousen, PhD, watched their recommendation of China’s Canaan Inc. (NASDAQ:CAN) climb faster than just about any investment they had ever seen before.

They recommended that their subscribers sell the stock in two parts that produced a total return of 114.01%. The call options they recommended notched an average gain of 383.37%. Those profits were collected in less than three weeks.

Canaan Inc. provides cryptocurrency “mining rigs” that crypto “miners” need to create a bitcoin. This is important because the creation of a bitcoin or other cryptocurrency requires much computing power to solve complex mathematical puzzles that essentially create the blockchain, Woods said.

While buying Bitcoin and other cryptos directly is the approach taken by certain investors, those people also face risk due to the volatility of the coin prices themselves, as well as the logistical difficulties inherent in owning these currencies.

Columnist and author Paul Dykewicz meets with stock picker Jim Woods before COVID-19.

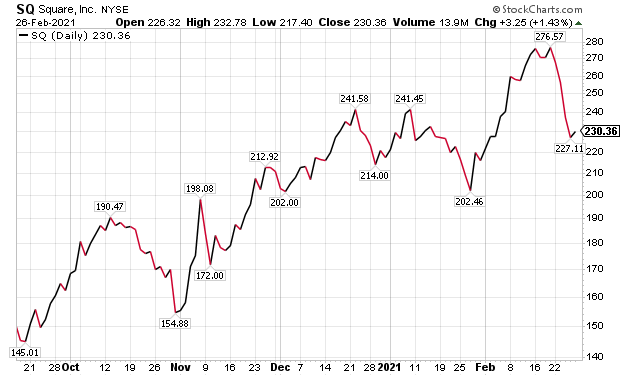

“Yet that doesn’t mean we can’t profit from the stocks that help support and/or are related to this space,” Woods said. For example, Woods has recommended payment processor and non-dividend payer Square, Inc. (NYSE:SQ) profitably.

BoA Identifies Banks that Offer Dividend-paying Cryptocurrency Investing Opportunities

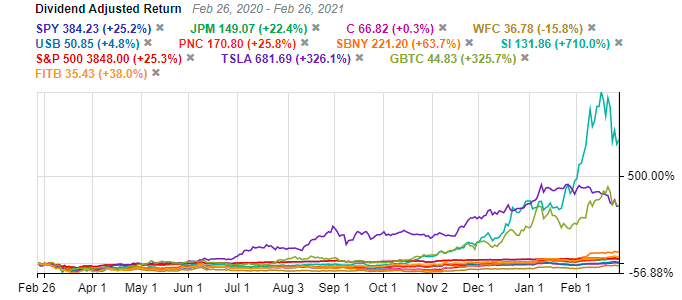

BoA Global Research published a recent research note that found increased investor interest in crypto among banks, especially with Bank of New York Mellon Corp. (NYSE:BK) recently entering the arena. The biggest winner among the financial institutions engaged in cryptocurrencies so far has turned out to be Silvergate Capital Corp. (NYSE:SI), rocketing 710.0% in the past year, beating Tesla’s (NASDAQ:TSLA) 326.1% and GrayScale Bitcoin Trust’s 325.7% gains, respectively. Tesla recently gained big buzz in the market by announcing a $1.5 billion investment in bitcoin, but Silvergate Capital’s share price has zoomed more than twice as much as the electric vehicle manufacturer’s stock in the past year.

Source: Stock Rover. Click here to sign up for a free, two-week trial for Stock Rover charts and analytics.

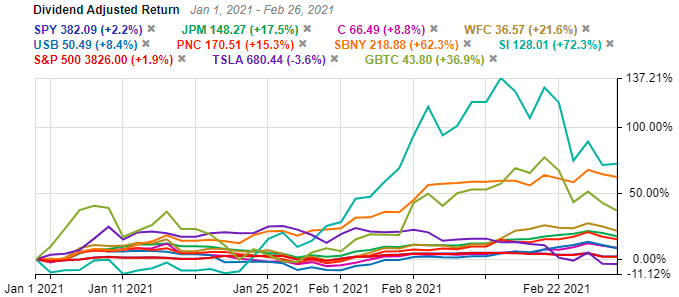

A look at the dividend-adjusted year-to-date performance shows banks have been rising so far this year after a generally weak 2020 for the sector during the COVID-19 crisis. In fact, the two highest dividend-adjusted returns came from Silvergate Capital, soaring 72.3%, and Signature Bank, climbing 62.3%, while Tesla became the only stock to lose money among the other 10 equities in the comparison. The third-place performer became Grayscale Bitcoin Trust (OTC:GBTC), jumping 36.9%.

Source: www.StockRover.com. Click here to subscribe to Stock Rover Research Reports.

Economist Elaborates on Prospects of Dividend-Paying Cryptocurrency Investing Opportunities

Bitcoin is the first and most dominant digital currency that can be used as online payment for goods and services and as an investment asset, said Skousen, a presidential fellow at Chapman University in Orange, California. Since the price is so volatile and can explode upward from time to time, certain investors increasingly use it as an asset allocation in their portfolio, he added.

The use of blockchain technology as a decentralized, transparent data storage system is bound to expand in the future, said Skousen, who also leads the Forecasts & Strategies investment newsletter.

Once blockchain technology is fully developed, it could revolutionize data storage for the trading of stocks, bonds, commodities and real estate, Skousen said. Bitcoin is likely to keep rising in price for several reasons, amid its volatility, Skousen predicted.

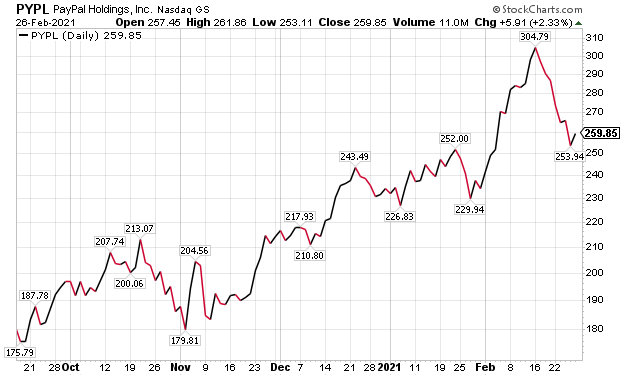

First, institutional retail adoption is growing. Non-dividend-paying Square Inc. (NYSE:SQ) and PayPal Holdings Inc. (NASDAQ:PYPL) now accept bitcoin as a legitimate payment system and other retailers likely will join them soon, he added.

The share prices of both stocks have soared since the market’s multi-week drop that spanned Feb. 20-April 7 last year.

Chart courtesy of www.StockCharts.com

Chart courtesy of www.StockCharts.com

Second, institutional money and asset managers will add Bitcoin to their portfolios. Even if they allocate only 2% of their managed accounts to Bitcoin, it will mean a sharp increase in demand for Bitcoin and other cryptocurrencies, Skousen said.

More than a dozen well-known Wall Street firms, including Ark Invest, SkyBridge Capital, Rothschild Investment Group and Boston Private Wealth, have invested in Bitcoin recently, Skousen continued.

Third, influential investors and money managers, exemplified by commodity trader Paul Tudor Jones, Wall Street legend Bill Miller, entrepreneur Mark Cuban and hedge fund billionaire Stan Druckenmiller, agree that Bitcoin is here to stay. Bitcoin is emerging as an asset class that has appeal as a store of value to both millennials and others, has existed for 13 years and seems to gain more legitimacy as an alternative asset and a brand as time passes.

Bill Miller, founder of Baltimore-based Miller Value Partners, described digital currencies as the “single best-performing asset class” today.

Mark Skousen, PhD, a descendant of Benjamin Franklin, meets with columnist Paul Dykewicz.

Pension Fund Chairman Critiques Dividend-paying Cryptocurrency Investing Opportunities

Bitcoin and other digital currencies have been climbing in price lately primarily due to the easy-monetary policies of the Federal Reserve, said Bob Carlson, chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets. With interest rates near zero and the Fed making its comfort with higher inflation clear, investors are seeking higher investment returns and a store of value, he added.

Bitcoin and other digital currencies are one asset class in which investors are placing money. In fact, the recent surge in Bitcoin is from money moving away from gold, said Carlson, who also leads the Retirement Watch investment newsletter. However, Bitcoin has some attractive features that include portability, accessibility and exchangeability, he added.

Plus, Bitcoin also has become widely recognized and accepted, Carlson said. The cryptocurrency further is limited in supply and its issuance rate halves every few years, he added.

Dividend-paying Cryptocurrency Investing Opportunities Start with Rising Bitcoin

“Some Bitcoin analysts say the price surges for about 18 months after the issuance rate is cut in half, which they think means Bitcoin will rally through late 2021,” Carlson said. “But Bitcoin has a limited history. We can’t say it will be a good diversifier or store hold of wealth over an extended time. We do know Bitcoin and other digital currencies are very volatile in price. There isn’t a lot of volume in their markets. A small number of investors can influence the price.”

That reality has been manifested lately with certain billionaires and celebrities apparently triggering Bitcoin price surges, Carlson said.

Investors also need to keep in mind that Bitcoin does not have the infrastructure of more established investments, Carlson continued. Security is especially important. While Bitcoin itself is very hard for hackers to crack, the same hasn’t been true of the exchanges through which most investors have to trade Bitcoin, he added.

Dividend-paying Cryptocurrency Investing Opportunities Are Mostly Unregulated

Bitcoin currently is mostly unregulated by governments, Carlson said. That is likely to change in the next few years as Bitcoin gains more attention and investors, he added.

“China essentially has prohibited Bitcoin and is trying to move consumers and investors to its digital national currency,” Carlson told me. “In the U.S., it’s more likely that Bitcoin will be regulated like other investments. While that probably is good for Bitcoin in the long term and will make it more acceptable, it could chase early Bitcoin devotees out of the market into something else.

“The best case for digital currencies is that many investors are seeing them as a substitute for gold as a store of wealth and inflation hedge. The market for these currencies is so small that even a small shift of money from gold to Bitcoin would dramatically increase the price.”

Pension fund and Retirement Watch leader Bob Carlson answers questions from Paul Dykewicz prior to COVID-19-related social distancing.

Cryptocurrency Investing Opportunities Are Watched by the IRS

The Internal Revenue Service (IRS) indicates that Bitcoin is taxed like other investments such as stocks. Gains or losses on the sale can be computed. If held for longer than one year, a gain or loss is long-term. If held for one year or less, the gain or loss is short-term.

“That means someone who plans to trade short-term should hold it in an IRA, if they can find an IRA custodian who will hold Bitcoin,” Carlson said. “Longer-term investors can hold in a taxable account.”

Despite COVID-19, Dividend-paying Cryptocurrency Investing Opportunities Grow

After the COVID-19 pandemic claimed more than 100,000 people in America during January 2021 to account for the biggest death total of any month since the virus began to spread in the United States near the start of 2020, the number of fatalities is starting to fall, according to Johns Hopkins University. Plus, approval by the Food and Drug Administration (FDA) of the first COVID-19 vaccines is raising hope, as the highest-priority people receive injections that may restore a semblance of normalcy later in 2021 if the dreaded virus can be contained.

COVID-19 cases have soared to shocking totals with their number reaching 28,464,252 and causing 509,710 deaths in the United States, as a big portion of 113,267,921 cases and 2,513,380 deaths worldwide, as of Feb. 26, Johns Hopkins University reported. America has the dubious distinction as the country with the most cases and deaths.

Dividend-paying cryptocurrency investing opportunities are on the rise along with the price of Bitcoin. Investors may opt to buy the cryptocurrencies directly or gain exposure to them through banks, Tesla or other stocks that should benefit as the price of Bitcoin advances.

Connect with Paul Dykewicz

Connect with Paul Dykewicz