Energy Company Offers 70% Dividend Yield

By: Ned Piplovic,

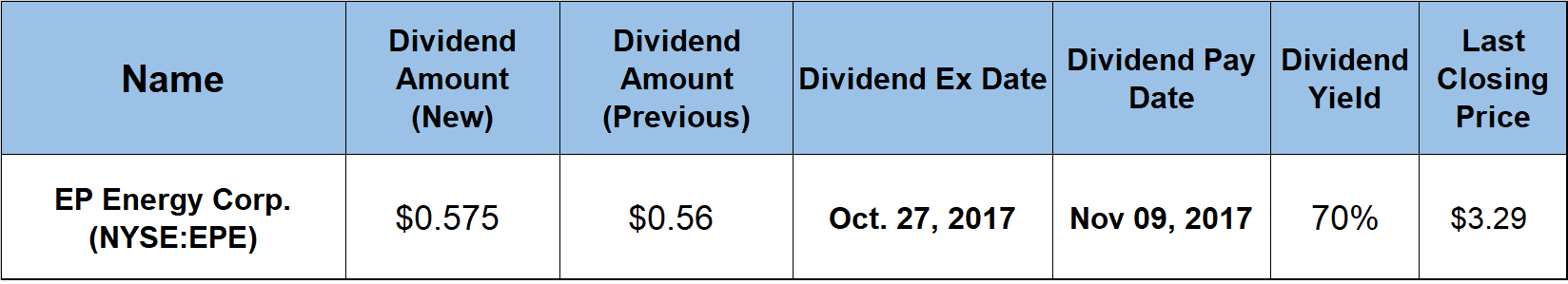

The EP Energy Corporation’s (NYSE:EPE) current quarterly dividend payout of $0.575 converts to a remarkable 70% forward dividend yield.

Dividend yields can be very deceptive. Extremely high dividend yields, especially when accompanied by dividend payout ratios above 100%, are certainly warning signs that a company’s share price might be at risk of falling.

Often, a company’s dividend yield and its share price will have an inverse relationship. Consequently, the yield’s rise is a direct result of a declining share price, which is almost exactly what happened to the EPE share price. I say almost, because the company continues to boost its dividend and the share price showed some gains over the past 60 days.

This stock in the oil and gas segment might not be a long-term play for risk averse investors. However, investors using dividend capture strategies looking for a quick dividend income payout and some potential asset appreciation in the short term might be interested in the EP Energy Corporation.

A November 9, 2017, pay date follows the October 27, 2017, ex-dividend date by less than two weeks.

EP Energy Corp. (NYSE:EPE)

Founded in 2013 and headquartered in Houston, EP Energy Corporation is an independent exploration and production company that engages in exploration acquisition, development and production of oil, natural gas and natural gas liquids in the United States. The company has interests in three primary exploration areas – the Eagle Ford Shale located in South Texas, the Wolfcamp Shale located in the Permian Basin in West Texas and the Altamont Field located in the Uinta Basin in Northeastern Utah. As of December 31, 2016, the company had more than 430 million barrels of proven reserves of oil equivalent and an average net daily production in excess of 87,500 barrel of oil equivalent. The company does not engage in distribution but primarily sells its oil and natural gas production to third parties.

The company’s share price rose 63% between its October 4, 2016, closing price of $4.16 and its 52-week high closing price of $6.77 on January 6, 2017. After peaking at the beginning of January, the share price fell 59% by the time it closed at $2.78 on August 28, 2017, which is the lowest closing price over the past 52 weeks. That low was 33% below the closing price from 12 months ago.

These figures certainly do not inspire confidence in the long-term performance of the EPE stock. However, there are few bright spots that, with the aid of the extraordinary yield, could generate substantial short-term payoff.

Here are some of the positive indicators. Since bottoming out in late August, the share price improved more than 18% and closed at $3.29 on October 3, 2017. In addition to the double-digit percentage share price growth over the past 60 days, the share price also has crossed above the 50-day moving average (MA) and remained above the 50-day MA more than a week for the first time since April 2017.

While the share price upsurge might not happen, the main driver for considering a position in this company is to take advantage of the exceptionally high dividend income, even if it is for a short time. The company hiked its quarterly payout 2.7% from $0.56 in the previous period to the current $0.575. This current amount, converts to a $2.30 annual payout and an extraordinary 70% forward dividend yield, based on the $3.29 closing share price on October 3, 2017. The current yield is much higher than the company’s average yield of 5.4% over the last five years.

In addition to hiking its annual dividend for more than five consecutive years, EPE managed to boost the dividend payout for 21 consecutive quarters. Over that period, the quarterly dividend payout rose at an average rate of 9.1% per quarter and 35.7% per year.

A rising dividend yield because of a falling share price does not justify investment in a stock. However, a potentially small share price growth could tip the scale just enough for daring investors to take advantage of the exceptional yield and collect some short-term dividend income before the end of the year.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic