Extra Space Storage Boosts Dividend Eight Consecutive Years (EXR)

By: Ned Piplovic,

Extra Space Storage boosted its annual dividend payout for the past eight years at an average growth rate of 30% per year and currently pays a 3.7% yield.

The company’s current yield is also considerably higher than the company’s five-year yield average. Additionally, the company complemented its attractive dividend income with asset appreciation in excess of 20% over the past year.

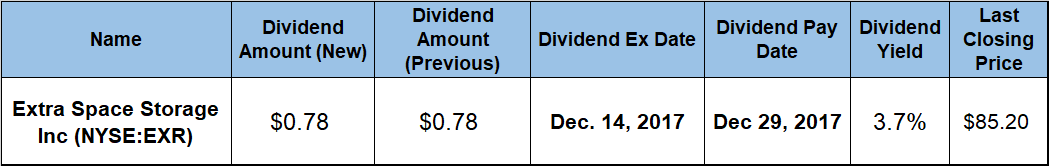

The company will pay its next dividend on December 27, 2017, to all its shareholders of record prior to the ex-dividend date, which is approximately two weeks prior to the pay date on December 14, 2017.

Extra Space Storage Inc. (NYSE:EXR)

Based in Salt Lake City, Utah, Extra Space Storage, Inc. operates as a real estate investment trust (REIT). The trust acquires, develops and manages self-storage facilities. While founded in 1977, Extra Space Storage has been traded publicly as a REIT on the New York Stock Exchange since 2004. As of September 30, 2017, Extra Space Storage owned approximately 1,400 facilities, comprising approximately 910,000 storage units and more than 100 million square feet of rentable space in 38 states, Washington, D.C., and Puerto Rico. In addition to its own facilities, the company manages approximately 75 additional facilities, which are owned by franchisees or third parties. In terms of number of locations and available rentable space, Extra Space Storage is currently the second-largest operator of self-storage facilities in the United States. Extra Space Storage’s positive financial performance – especially in 2015 – lead to the company meeting all the necessary requirements to be selected for inclusion in the S&P 500 Index in 2016.

The trust’s current quarterly dividend distribution of $0.78 converts to a $3.12 annual payout and a 3.7% yield. This current yield is in line with industry average yields of all the companies in the Financials sectors and the Industrial REITs segment. Additionally, the current yield is 14.4% above the company’s own 3.2% average yield over the past five years.

Since its public offering in 2004, the REIT has hiked its annual dividend every year, except two years. The company paid the same annual dividend in 2006 as the prior year and dropped its annual distribution amount 62% amid the financial crisis in 2009. However, since 2009 the company resumed raising its annual dividend every year. Over this eight-year period, the REIT grew its annual payout at an average rate of 30.1% per year, which resulted in an eight-fold annual dividend amount increase since 2009.

The company’s share price started its trailing 12 months from its 52-week low of $70.18 on December 1, 2016, and rose almost 13% by January 6, 2017. After that quick rise, the share price dropped and went through three up-and-down cycles where the share lost or gained more than 10% of its value by mid-May 2017. Subsequently, the volatility subsided, and a clear uptrend emerged for the remainder of the year. After falling to $75.79 on May 16, 2017, the share price reversed its trend and ascended 15.7% to reach its new 52-week high of $87.66 on November 21, 2017. After the November peak, the share price pulled back a little and closed on December 1, 2017, at $85.20, which is only 2.8% below the recent 52-week high, 21.4% above the 52-week low of $70.18 from the beginning of December 2016 and 142% above the share price from five years ago.

The shareholders enjoyed the double benefit of a rising dividend income and considerable asset appreciation over the past few years. While the total return over the last 12 months came in at 27%, the total return over the last three and five years was 59% and 176%, respectively.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic