Exxon Mobil Offers 34 Years of Dividend Hikes and 3.7% Yield

By: Ned Piplovic,

The company with the largest market capitalization in the oil exploration and distribution industry has a long record of annual dividend hikes and currently offers a 3.7% dividend yield.

Exxon Mobil has been paying dividends for more than 130 years and has rewarded its shareholders with consecutive annual dividend hikes for more than three decades. The company’s share price is down over the last year but has been trending up lately and has gained almost 10% over the last 60 days.

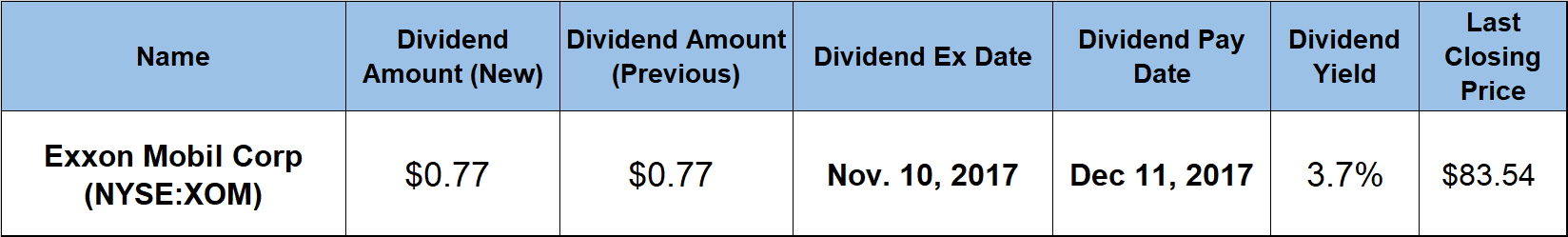

Its ex-dividend is coming up shortly, on November 10, 2017, with the pay date scheduled for December 11, 2017.

Exxon Mobil Corp. (NYSE:XOM)

The two components in the company’s name – Exxon and Mobil – can trace their origins back to Standard Oil, which John D. Rockefeller incorporated in 1870 in Ohio. Cuhttps://www.dividendinvestor.com/dividend-quote-member/?Symbol=EPErrently headquartered in Irving, Texas, the Exxon Mobil Corporation explores for and produces crude oil and natural gas. Exxon Mobil’s current operations are split into the Upstream, Downstream and Chemical segments. The company manufactures petroleum products and commodity petrochemicals, including olefins, aromatics, polyethylene and polypropylene plastics. Additionally, the company transports and sells crude oil, natural gas and petroleum products. The company currently operates about 30,000 wells. Furthermore, the Exxon Mobil Corporation is currently collaborating with Eagle LNG Partners LLC and Crowley Maritime Corporation (OTC:CWLM) on developing Liquid Natural Gas as a marine fuel.

After decades of steady growth, the company’s share price has experienced significant volatility in the last 10 years, which primarily was driven by considerable fluctuations of crude oil prices. Over the last year, the share price trend mostly was downward. The share price rose 11% between October 30, 2016, and December 12, 2016, when the price reached its 52-week high of $92.58. However, after peaking in mid-December, the share price reversed course and fell almost 22% on its way to the 52-week low of $76.10 by August 30, 2017. However, since the August low, the share price has been trending up and has regained half its losses since December 2016 to close at $83.54 on October 30, 2017. This closing price is still 9.8% short of the December 2016 peak, but it is also 9.8% above the August bottom and marginally higher – $ 0.24 or 0.3% – than the share price from one year ago.

The 50-day Moving Average (MA) has been below the 200-day (MA) since October 2016 and declining since mid-November 2016. However, the recent share price uptick has caused the 50-day MA to reverse course and start rising as of September 25, 2017. The current 50-day MA of $80.42 is a mere 1.2% below the current 200-day MA of $81.41. The rising 50-day MA could cross above the 200-day MA, which is still declining, in a bearish manner in a matter of days, which would be an indication that the share price could continue to rise in the short term.

While the share price has struggled lately, Exxon Mobil’s dividend has not wavered for decades and has rewarded its shareholders’ patience with 34 consecutive years of dividend hikes. The current quarterly distribution of $0.77 is 2.7% higher than the quarterly dividend from the same period one year ago.

The annualized dividend distribution of $3.08 yields 3.7%, which is 15.2% higher than Exxon Mobil’s own average yield over the past five years. Additionally, the current 3.7% yield is 11% higher than the average yield of all the companies in the Integrated Oil and Gas industry segment and 57% higher than Exxon Mobil’s peers in the Basic Materials sector.

Over the past two decades of consecutive dividend hikes, the company grew its annual dividend payout at an average rate of 6.8% per year, resulting in a 275% annual dividend amount enhancement since 1997.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic