Five Industrial Stocks for Dividend Investors to Buy in Tapping Technology Trends

By: Paul Dykewicz,

Five industrial stocks for dividend investors to buy tap technology trends and give exposure to artificial intelligence (AI), cloud computing, software and automation advances.

The five industrial stocks for dividend investors to buy also are aided by technology advances that should allow quickened growth and enhanced capability for the companies to respond to marketplace changes, compared to their competitors. Such technologically advanced industrial companies are gaining praise from BofA Global Research.

Those five industrial stocks for dividend investors to buy not only are using artificial intelligence and other technologies to enhance their business operations, but so are investment analysts. People who are slow to adopt the technology may be slipping behind their competitors without realizing it.

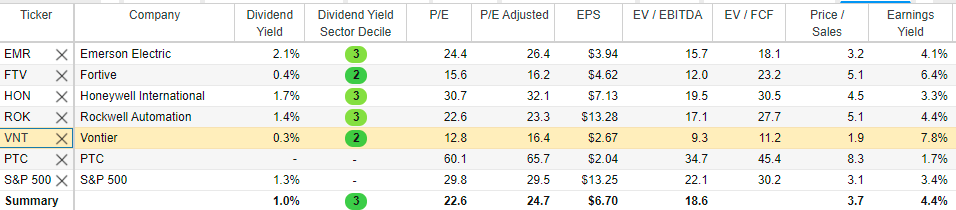

Source: Stock Rover. Click here to sign up for a free two-week trial.

Five Industrial Stocks for Dividend Investors to Buy Show the Value of Using Artificial Intelligence

“Trying to invest in the markets today without artificial intelligence is like going into a gunfight with a knife,” said Bryan Perry, who writes the high-yield-focused Cash Machine investment newsletter and the Premium Income, Quick Income Trader, Breakout Profits Alert and Hi-Tech Trader services. “There is considerably more information than what can be analyzed by a person. Aside from traditional fundamental research where emotions can wrongly influence decision making, it is very helpful to have an agnostic model that crunches data while canceling the market noise.”

Perry uses artificial intelligence (AI) to aid him in making recommendation to subscribers of his of Hi-Tech Trader service. With each new recommendation, he uses a score generated by AI technology to give his readers a quantitative measure to reveal whether the new pick is ranked 99, 98, 97, 96 or 95, for example, on a scale up to 100.

Paul Dykewicz interviews Bryan Perry, who uses artificial intelligence in Hi-Tech Trader.

Five Industrial Stocks for Dividend Investors to Buy Receive Praise from BofA

The five industrial stocks for dividend investors to buy are outperforming their peers by using artificial intelligence, cloud computing, software and automation, BofA wrote in a research note. Management teams of each of the five industrial stocks for dividend investors to buy gave presentations at BofA’s Industrial Software & Automation Summit, Sept. 21-23.

The summit reinforced that industrial software and automation are driving growth and sources of investment, BofA wrote in a Sept. 24 research note. This view is consistent with BofA’s view of improving capital expenditure growth by “reshoring and automation.”

BofA added that automation is a sector tailwind, particularly for buy-rated companies such as Emerson (NYSE: EMR). The investment firm estimates Emerson has approximately $2.4 billion in software revenue, including $1.1 billion of embedded software.

Automation and Software Spur Growth for one of the Five Industrial Stocks for Dividend Investors to Buy

Emerson Electric Co. (NYSE: EMR) offers automation and control software through its DeltaV control applications, operations management software with its Plantweb product and vertical-specific software from its Bio-G in Life Sciences business, BofA wrote. Approximately 35% of EMR’s software is revenue collected on a subscription basis, with a three- or four-year transition for the remaining portfolio, according to Mark Bulanda, executive president of Emerson Automation Solutions.

Emerson’s Digital Transformation business unit includes hardware, software and services in the areas of sensing, predictive maintenance and analytics. Emerson is adding sales resources focused on information technology and C-level executives to complement its existing relationships.

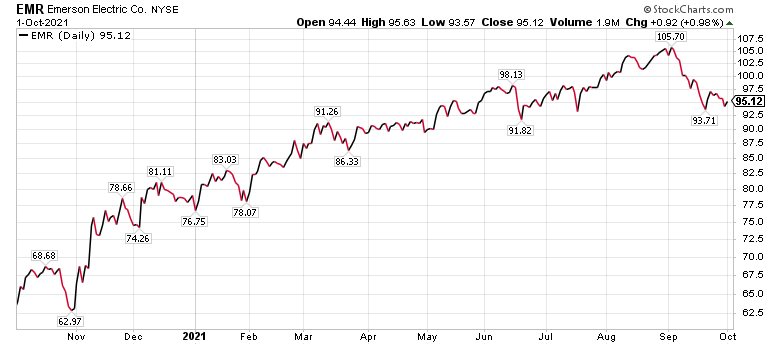

Chart courtesy of www.StockCharts.com

Stuart Harris, Emerson’s group president of Digital Transformation, told the BofA event attendees that he is seeing more customers go from piloting new technology to widespread deployments. The company’s digital transformation includes its Plantweb operations management platform that he said is at the heart of Emerson’s Digital Transformation offerings.

The Plantweb Optics capability lets Emerson differentiate by combining principles models (i.e., how an asset should work) with data-driven analysis that involves machine learning and artificial intelligence. While there are low code options for Plantweb, wider adoption could be ahead for pre-built templates for pumps, compressors, generators, heat exchangers, fans and blowers.

In a deal that closed in October 2020, Emerson paid $1.6 billion to acquire Open Systems International to add grid management software for utilities. An increased mix of renewable energy is driving increased adoption of grid management software. Since only about 35% of utilities have advanced distribution management systems (ADMS), the niche offers Emerson a good growth opportunity.

Five Industrial Stocks for Dividend Investors to Buy Led by Emerson

“Emerson Electric is a good stock to own for a number of reasons,” said Bob Carlson, chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets.

The company’s operations are diversified across industrial and infrastructure sectors of the economy, said Carlson, who also leads the Retirement Watch investment newsletter. Emerson will benefit from economic growth and increased capital spending, he continued.

“It also provides key equipment and services for water systems, and a portion of the infrastructure bill Congress is working on provides money to improve municipal water systems,” Carlson said. “In addition, the company is a steady dividend payer. The yield is 2.09%, and EMR has increased its dividend annually for more than 50 years.”

Five Industrial Stocks for Dividend Investors to Buy Gain Attention from Pension Fund Chairman

Emerson has been at the leading edge in using technology, even though its business largely is engaged with valves, pressure systems, pumps and other traditionally low-technology products, Carlson continued. However, the company also sells technology that is attractive to companies that are trying to increase their factory automation and supply chain resiliency. Those are two trends that are likely to stay strong for a while, he added.

Pension fund and Retirement Watch chief Bob Carlson answers questions from columnist Paul Dykewicz.

Honeywell Earns a Spot in the Five Industrial Stocks for Dividend Investors to Buy

Charlotte, North Carolina-based Honeywell International Inc. (NASAQ: HON), a provider of aerospace, building technologies, performance materials and technologies, along with safety and productivity solutions, also is recommended by BofA. The investment firm’s $270 price objective for Honeywell is based on 20x 2022E enterprise value (EV) / earnings before interest taxes depreciation and amortization (EBITDA).

BofA’s target multiple for Honeywell is at a premium to its peers by trading at 18x EV/EBITDA on 2021 estimates. The investment firm wrote that such a premium is warranted given a more defensive portfolio that provides Honeywell with resilient margins and above-average earnings per share (EPS) growth.

Potential risks to the BofA price objective on Honeywell are acquisitions, specifically if the industrial company overpays for deals in the pursuit of diversifying and expanding into new, faster-growing, technology-driven adjacent markets, as well as unforeseen future sales slowdowns due to economic pressures. Another possible threat is execution issues due to the company’s ongoing simplification efforts.

“Honeywell shares a lot of the positive traits of EMR,” Carlson said. “Each company has a long history of knowing what it does well and executing extremely well.”

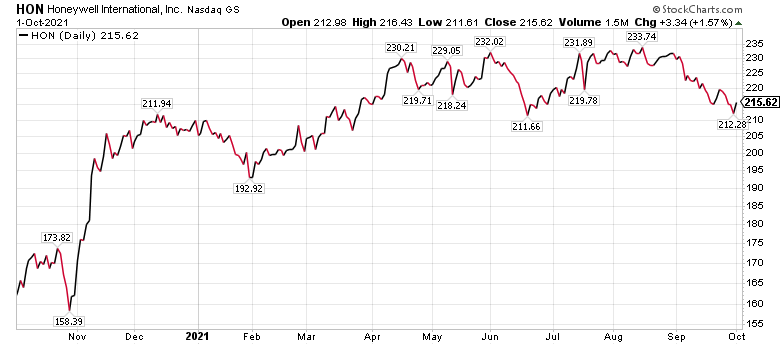

Chart courtesy of www.StockCharts.com

Rockwell Ranks Among Five Industrial Stocks for Dividend Investors to Buy

Rockwell Automation Inc. (NYSE: ROK), a Milwaukee, Wisconsin-based provider of industrial automation and information technology, features brands such as Allen-Bradley and Factory Talk software. It employs more than 23,000 people, serves customers in 100-plus countries and is another of the six industrial stocks recommended by BofA.

The company’s management offered a presentation at the summit that identified its framework as growing its core automation business and its Information Solutions & Connected Services at a double-digit-percentage rate, while pursuing acquisitions focused on software. Rockwell also is oriented to the life sciences and pharmaceutical industries, which have been bringing operations back to the United States as the COVID-19 crisis is fought with vaccinations and other preventive measures.

Plus, Rockwell’s FactoryTalk offers a suite of cloud-based offerings to support advanced industrial applications. Rockwell built out the suite with its recent acquisitions of Plex and Fiix.

The purchase of Plex provides cross-selling opportunities for Rockwell. Not only can Rockwell cross-sell Plex to existing customers, but a new pipeline of customers can be obtained synergistically, BofA wrote. Both Rockwell and Plex have leading market positions in North America, BofA added.

“One of management’s priorities is to grow market share in Asia and Europe,” according to BofA. “Management is also focused on training and enabling its software channel partners.”

Rockwell’s partners include hyperscalers such as Microsoft (NASDAQ: MSFT) and software providers such as PTC Inc. (NASDAQ: PTC). Software growth is a priority for management.

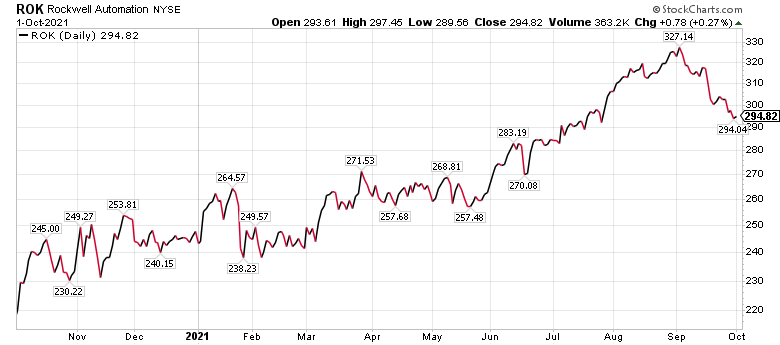

Chart courtesy of www.StockCharts.com

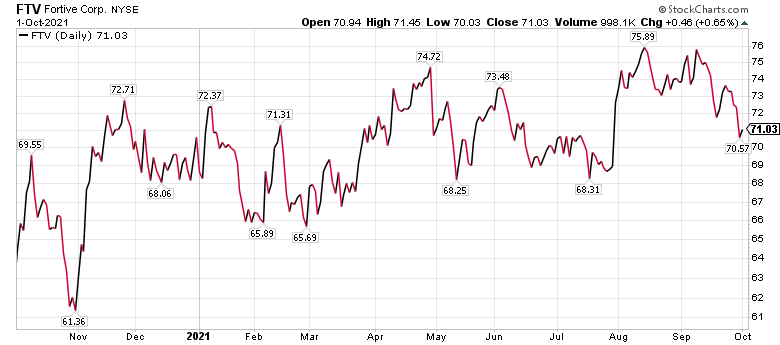

Fortive Finds Spot Among Five Industrial Stocks for Dividend Investors to Buy

Everett, Washington-based Fortive Corporation (NYSE: FTV), a diversified industrial technology conglomerate that was spun off from Danaher in July 2016, gained a recommendation from BoA as a provider of technologies for connected workflow solutions across a range of markets. Fortive’s strategic segments of Intelligent Operating Solutions, Precision Technologies and Advanced Healthcare Solutions include brands with leading positions in their markets.

Fortive is leveraging its industry & customer knowledge for selective acquisitions, and then applying Fortive Business System tools to enhance growth and margins. The company’s businesses design, develop, service, manufacture and market professional and engineered products, software and services. Fortive employs more than 17,000 research and development, manufacturing, sales, distribution, service and administrative team members in 50-plus countries.

Fortive Concludes Purchase of ServiceChannel to Spur Sales

Plus, Fortive reported on Sept. 1 that it completed its previously announced acquisition of ServiceChannel Holdings Inc. to become an operating company within its own Intelligent Operating Solutions (IOS) segment. ServiceChannel, with more than 500 enterprise customers in 70-plus countries, is a global provider of SaaS-based multi-site facilities maintenance service solutions.

“The transaction adds another differentiated, high-growth SaaS asset with an attractive runway to drive increasing profitability and free cash flow, and generate strong returns over the next five years,” said James Lico, Fortive’s president and chief executive officer. “As we look ahead, we have significant capacity and opportunity for additional capital allocation which will continue to strengthen the portfolio and drive double-digit earnings and free cash flow growth over the long-term.”

Fortive’s second-quarter results, ended July 2, produced a 26.7% jump in revenues from continuing operations to reach $1.3 billion, compared to the same quarter a year ago. For Q2 2021, adjusted net earnings from continuing operations were $238.8 million. Diluted net earnings per share from continuing operations for the second quarter, ended July 2, were $0.48.

Chart courtesy of www.StockCharts.com

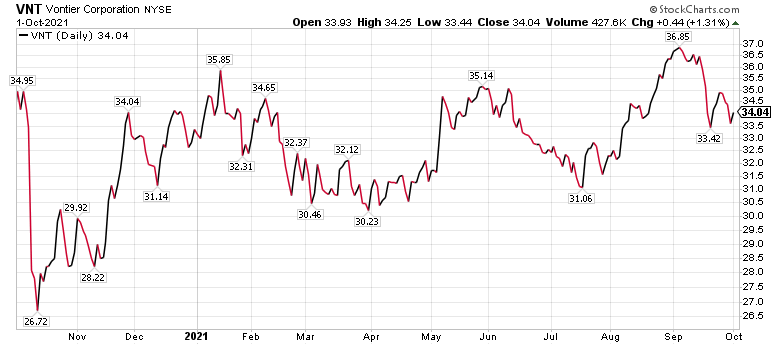

Vontier Vaults onto List of Five Industrial Stocks for Dividend Investors to Buy

Raleigh, North Carolina-based Vontier Corp. (NYSE: VNT) is providing its customer base with software offerings that, among other things, aid gas stations by supplying electric vehicle (EV) charging networks. Vontier is a manufacturer that owns the brands Gilbarco Veeder-Root, Matco Tools and Teletrac Navman, plus subsidiaries Hennessy Industries, Gasboy and Global Traffic Technologies.

BofA gave Vontier a $46 price objective on 11x the investment firm’s 2022 estimated EBITDA. That price target is a discount to the peer average of 18x on 2021 estimates, reflecting slower near-term earnings trajectory, BofA wrote.

But Vontier is not without risks. Those potential threats may not end up doing any harm but they include faster-than-expected drops in U.S.-related revenue, acquisition timing, selection and integration problems, along with greater adoption of electric vehicles hurting demand for retail fueling infrastructure.

Chart courtesy of www.StockCharts.com

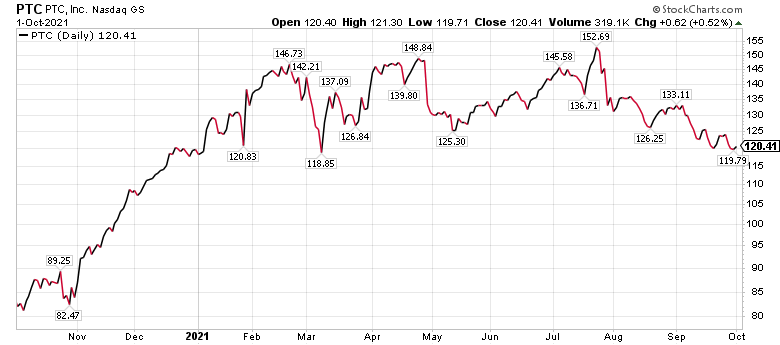

Non-Dividend-paying Software Company PTC Does Not Qualify for the Five Industrial Stocks for Dividend Investors to Buy But Offers an Alternative

PTC Inc. is a Boston-based computer software and services company founded in 1985. The global technology giant has 6,000-plus employees who work in 30 countries, with 1,150 technology partners and generate more than $1 billion in annual revenue.

The recovery in demand for the internet of Things (IoT) is occurring largely as PTC management expected and has been incorporated into BofA’s fiscal year 2021 guidance. Temporary plant shutdowns and site access limitations have pushed back the recovery trajectory by “a few weeks” but PTC management expressed “zero reason” to alter long-run IoT revenue targets.

PTC is investing in turnkey IoT solutions, with four distinct offerings: real-time production performance monitoring, connected work cell, asset monitoring and utilization, as well as digital performance management (DPM). Among those, DPM is the latest offering, which launched just weeks ago to analyze the end-to-end manufacturing processes from raw inputs to final outputs. The company’s management voiced a goal of providing a turnkey solution that will shorten sales cycles and implementation times, while speeding up adoption by clients.

BofA has given PTC a buy recommendation and a price objective of $160, based on 28x 2022 estimated EV / EBITDA. The valuation is a discount to industrial software peers at around 29x on 2021 estimates, but BofA wrote it is warranted due to below-average EBITDA margin.

Downside risks to the price target could come from significant competition, declines in discrete manufacturing activity, IoT and augmented reality, among other threats, BofA cautioned.

Chart courtesy of www.StockCharts.com

Bullish News for Five Industrial Stocks for Dividend Investors to Buy Comes from Record Growth Output

A little-known yet bullish development came to light on Sept. 30 when the U.S. Department of Commerce’s Bureau Economic Analysis reported that gross output (GO), which accounts for all economic activity, rose an annualized 5.5% in the second quarter of 2021. Gross Output reached a record $40 trillion so far in 2021, based on the latest government economic data analyzed by Mark Skousen, an economist who heads the Forecasts & Strategies investment newsletter, as well as the Fast Money Alert, Five Star Trader, Home Run Trader and TNT Trader advisory services.

Gross output is described as the top line in national income accounting by Steve Forbes, who characterized gross domestic product (GDP), an economic measure of final production that does not include intermediate stages, as the economy’s bottom line. Both measures are useful in understanding where the economy is headed and they are best used together to provide a superior snapshot of economic performance than they do separately. The latest economic data showed that gross output continued to expand in second-quarter 2021 faster than GDP, as has occurred for the past nine months.

Business-to-business (B2B) spending also is growing faster than consumer spending, offering another good sign for the U.S. economy, Skousen wrote. The latest data is especially welcome, after some economists expressed concern about a long economic downturn and weak marginal growth, based on second-quarter 2020 results. However, it appears that last year’s second-quarter downturn was just a short-term response to the 2020 economic slowdown caused largely by government restrictions and business shutdowns due to the COVID-19 pandemic.

Mark Skousen, head of Forecasts & Strategies and a descendant of Ben Franklin, meets with Paul Dykewicz.

COVID-19 Does Not Stop Growth of Five Industrial Stocks for Dividend Investors to Buy

Cloud providers, or “hyperscalers,” such as Amazon (NASDAQ: AMZN) through its AWS and Microsoft with its Azure service, are penetrating the industrial market. Despite the size of scale and investment dollars, hyperscalers still lack deep domain expertise, BofA wrote.

Hyperscalers may turn into partners of industrial automation providers that offer “rich domain expertise,” rather than become their competitors, BofA opined. Even though most providers partner with a single hyperscaler on a preferred basis, many software offerings are Cloud-agnostic, the investment firm added.

What is clear to BofA is the migration of data from on-premise to Cloud and Edge is accelerating post-COVID. Nonetheless, the Delta variant of COVID-19 has proven to be a highly transmissible threat that is gaining close attention from health experts.

The Centers for Disease Control and Prevention (CDC) is blaming the variant for recent spikes in case numbers and deaths, despite increases in the number of people who have been vaccinated against COVID-19. As of Oct. 1, 214,597,690 people, or 64.6% of the U.S. population, have received at least one dose of a COVID-19 vaccine. The fully vaccinated total 184,2852,416 people, or 55.7%, of the U.S. population, according to the CDC.

COVID-19 cases worldwide, as of Oct. 1, total 234,132,346 and led to 4,789,367 deaths, according to Johns Hopkins University. U.S. COVID-19 cases hit 43,548,632 and caused 699,647 deaths. America has the dreaded distinction as the country with the most COVID-19 cases and deaths.

The five industrial stocks for dividend investors to buy offer ways to profit and collect payouts from companies using advanced technology not just to survive, but ideally to thrive.

Connect with Paul Dykewicz

Connect with Paul Dykewicz