Gain Increased Dividends and 7%-Plus Yields with These 5 Investments

By: Ned Piplovic,

Dividend-loving investors drive share prices higher as the ex-dividend dates approach to ensure they capture those payouts.

To avoid overpaying for the dividends, here are a few investments that you can buy ahead of dividend announcements to increase your return with minimal risk. A key reason to buy these stocks is that all of the picks have a long history of high yields and rising dividend payouts.

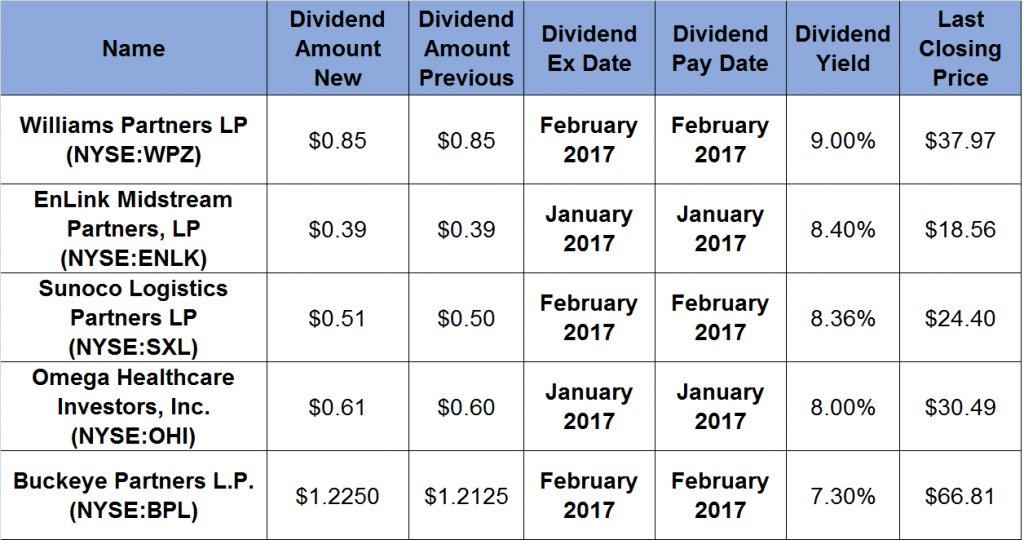

All five companies have dividend yields of at least 7 percent. Additionally, three of the five suggestions have a long history of increasing dividends and the other two have tripled their share price in 2016. Four of the companies are in the energy infrastructure industry and one company is a real estate investment trust (REIT) that serves the long-term health care industry.

Williams Partners LP (NYSE:WPZ)

Williams Partners is an energy infrastructure company. Through several business segments, Williams Partners engages in natural gas processing and fractionation, owns interstate natural gas and oil pipelines, and operates a refining facility on the Gulf Coast.

Its annual dividend for 2016 is the same as last year — $3.40. However, the dividend increased significantly for five consecutive years prior to that. Its dividend increased more than 1,500% between 2010 and 2015. Its quarterly payout is currently $0.85, which translates to a trailing 12-month dividend yield of 9%. Even with the considerable dividend increase over the past five years, the current dividend yield is 34% higher than the 6.7% five-year average.

Good asset appreciation accompanies the high dividend yield. The share price closed on December 27, 2016, only slightly lower — 6% — than the 52-week high on September 8, 2016. However, that is still 200% higher than the February low of $12.69.

EnLink Midstream Partners, LP (NYSE:ENLK)

EnLink Midstream Partners provides midstream energy services. The company provides gathering, transmission, processing and marketing services to producers of natural gas and crude oil.

Its quarterly dividend of $0.39 translates to a $1.56 annual payout with an 8.4% yield. The annual dividend for 2016 is 2% higher than it was last year. This continues the increasing dividend strategy that ENLK has been following since 2010. After raising dividend payouts more than 150% between 2003 and 2008, the company cut its dividend drastically in 2009 and 2010 to $0.25. However, the dividend has been growing every year since and has increased more than six-fold.

Additionally, EnLink Midstream Partners’ stock price almost tripled since the 52-week low of $6.32 on February 18, 2016. Its current share price is down 7% compared to its September 2016 high. However, it remains 194% above the February low.

Sunoco Logistics Partners LP (NYSE:SXL)

Sunoco Logistics Partners provides transportation, as well as storage to natural gas and crude oil markets.

Its annual dividend for 2016 is 15% higher than it was last year. The dividend has been increasing for the past 14 consecutive years. During that time, the dividend failed to record a double-digit percentage year-over-year increase only once. Its total annual dividend is distributed quarterly. The most recent installment of $0.51 was paid on November 14, 2016.

Its share price hit a 52-week low of $15.43 on January 20, 2016. The price then doubled between the January low and the 52-week high on August 18, 2016. However, the price lost about 30% since then and closed on December 27, 2016, at $24.40. While the price increase is not as big as the first two examples, it is still almost 60% higher than the price in January 2016.

Omega Healthcare Investors, Inc. (NYSE:OHI)

Omega Healthcare Investors is a real estate investment trust (REIT) that finances sale and leaseback, construction and renovation of long-term health care facilities.

OHI has been paying dividends for the past 24 years. Its dividend payout has increased for the last 13 consecutive years. Current annual dividends of $2.44 yields 8%. That yield level is 23% higher than the five-year dividend yield average of 6.5%.

Its current share price is almost in the middle between the 52-week low of $26.96 and the 52-week high of $38.09. After increasing 40% between the February low and the September high, the share price lost 20% and closed on December 27, 2016 at $30.49.

Buckeye Partners L.P. (NYSE:BPL)

Buckeye Partners, L.P owns and operates liquid petroleum products pipeline systems in the United States. The company also operates marine terminals and merchant services.

Buckeye’s current quarterly dividend of $1.225 equals a $4.90 annual payout and a 7.3% dividend yield. That level of yield, while impressive on its own, is the lowest in this group. However, BPL could be a long-term investment opportunity. The company has been paying dividends since 1990 and increasing the dividend payout every year for two decades.

Additionally, Buckeye’s share price grew consistently since BPL became publicly-traded in 1986, with only two significant decreases of more than 25% in 2009 and 2012. However, both times the share price rebounded and reached new highs that were 25% higher than the ones prior to price corrections.

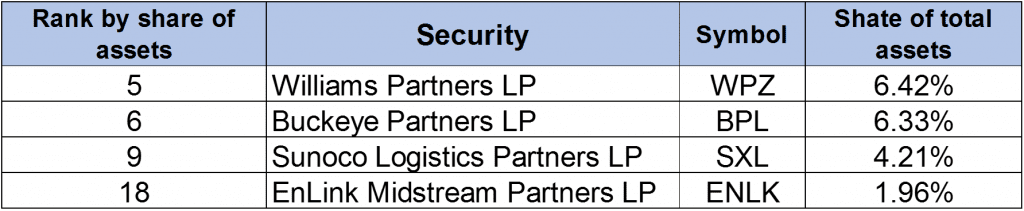

If you do not wish to invest in individual stocks, you could gain exposure to the four energy infrastructure stocks by investing in the Alerian MLP ETF (NYSE:AMLP). This ETF has almost a fifth of its $9.4 billion in total assets allocated in these four stocks. The average trading volume of AMLP is about 8 million shares per day and its expense ratio is 0.85%.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily.

To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to e-mail alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic