Foot Locker Annual Dividend and Share Price Continue Rising (FL)

By: Ned Piplovic,

While the Foot Locker (NYSE:FL) may have been suffering losses because of e-commerce competition like most its peers in the retail sector, but continuously rising dividend distributions and a recent share price uptrend could make this stock a good for investors seeking some short-term capital gains and steady income flow.

Despite the company’s seventh consecutive year of raising dividends, the yield dropped more than 35% over the past quarter. But that yield drop was simply caused by a rise in share price. Additionally, the company’s dividend payout ratio is low, and the company can keep raising its dividend distribution to keep up with the rising share price.

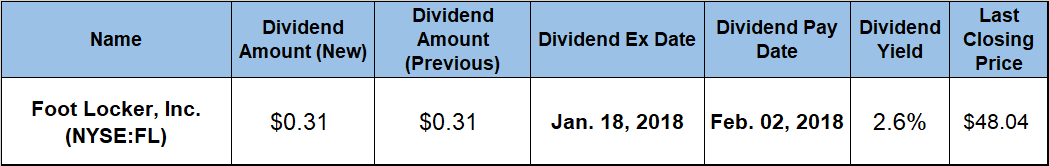

The company’s next ex-dividend date will occur on January 18, 2018, and the pay date is scheduled for the following month, on February 2, 2018.

Foot Locker, Inc. (NYSE:FL)

Founded in 1879 and headquartered in New York, New York, Foot Locker, Inc. operates as an athletic shoes and apparel retailer. The company operates in two segments, Athletic Stores and Direct-to-Customers. The Athletic Stores segment retails athletic footwear, apparel, accessories and equipment through various store formats, including Foot Locker, Kids Foot Locker, Lady Foot Locker, Champs Sports, Footaction and Runners Point. As of November 2017, this segment operated 3,363 stores in 23 countries in North America, Europe, Australia and New Zealand. The Direct-to-Customers segment sells athletic footwear, apparel, equipment and team-licensed merchandise for high school and other athletes through catalogs and more than a dozen brand websites.

The company’s current $0.31 quarterly dividend distribution is 12.7% higher than the $0.275 payout from the same period previous year. This current distribution converts to a $1.24 annualized payout and a 2.6% yield. The 2.6% yield is 9.4% above the 2.36% average yield of all the companies in the Apparel Stores segment and nearly 40% higher than the 1.85% average yield of the entire Services sector. Even with the rising share price lowering the yield, Foot Lockers current 2.6% yield is still 43.4% higher than the company’s own 1.8% average yield over the past five years.

The company started paying dividends in 1990 and has not cut its annual distribution amount in the past 14 years. Over those 14 years, the annual dividend amount rose at an average rate of 18.2% per year and has increased more than 10-fold since 2003. Just over the last eight years of consecutive dividend hikes, the annual payout amount rose at an average rate of 9.5% per year and more than doubled since 2010.

The share price has not always been kind to existing shareholders, as it fell more than 30% in 2017. Between early January 2017 and May 10, 2017, the share price rose nearly 8% to reach its 52-week high of $77.35. However, after peaking on May 10, 2017, the share price experienced two significant drops of more than 20% over two separate 10-day periods and fell to its 52-week low of $29.24 on November 7, 2017. That was a 62% drop between the price high in May 2017 and the November low.

After bottoming out in early November, the share price embarked on an uptrend and continues to rise. In less than 60 days, the share price recovered 40% of its loss and the share price 50-day moving average (MA) has been rising since November 16, 2017. If the current share price uptrend endures, the 50-day MA could cross above the 200-day MA in the next 30 to 60 days, which would indicate that the current share price uptrend could continue at least a few more quarters after that.

Foot Locker’s current dividend payout ratio is a very low 30%, which means that the company can easily continue to hike its dividends at the current pace to support the rising share prices. The combination of a continuously rising dividend and steady asset appreciation could easily turn the current 30%-plus total loss over the past 12 months into a double-digit total return for 2018.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic