Gabelli Utility Trust Offers 8.4% Dividend Yield (GUT)

By: Ned Piplovic,

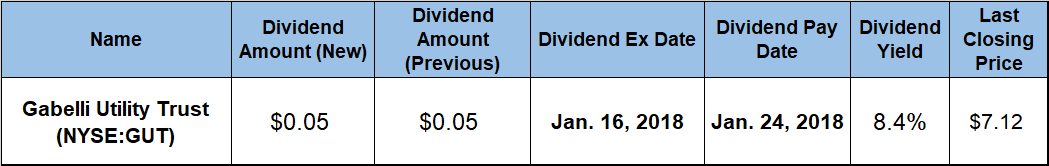

The Gabelli Utility Trust (NYSE:GUT) is currently offering an 8.4% dividend yield and has had a total return of more than 20% over the past 12 months.

While the trust reduced its annual dividend slightly for 2011 — only the second dividend cut since its inception in 1999 — it has paid a consistent annual distribution over the past seven years. In addition to a healthy dividend yield, the fund rewarded its investors with a double-digit percentage share-price growth over the previous 12 months.

The fund will distribute its next monthly dividend payment on January 24, 2018, to all its shareholders of record prior to the January 16, 2018, ex-dividend date.

Gabelli Utility Trust (NYSE:GUT)

The Gabelli Utility Trust is a diversified, closed-end management investment company whose primary objectives are long-term growth of capital and income. The fund invests in companies that provide products, services or equipment for the generation or distribution of electricity, gas and water. Additionally, the fund invests in telecommunications services or infrastructure operations companies. As of September 30, 2017, the fund held almost $340 Million in total assets. Common stocks comprise nearly 84% of the fund’s total assets. Within this group of common stocks, more than 80% of assets are in Energy and Utilities stocks and approximately 20% are in other industries. The 16% of assets that are not held in common stock are comprised of 99% U.S. Government Obligations and the remaining assets are in Corporate Bonds, Warrants and Convertible Corporate Stocks. Out of the top five holdings, four are electric utilities — Westar Energy Inc at 4.53%, Eversource Energy at 2.99%, El Paso Electric Co at 2.57% and WEC Energy Group Inc 2.57% — and ONEOK, Inc., at a 2.74% share of assets, is the sole natural gas utility in the top five holdings by asset share group.

Since cutting its dividend distribution 16.7% in the first quarter of 2011, the fund has been paying a stable $0.05 monthly dividend. This current payout is equivalent to a $0.60 annualized amount and an 8.4% yield. Despite lacking dividend hikes, the current yield still outperforms the average sector and segment yields. Compared to the current 7.4% average yield of all closed-end equity funds, GUT’s current yield is 14% higher. The advantage is even higher when compared to the entire sector, where Gabelli Utility Trust’s 8.4 % yield is 111% above the 4% average yield of the entire financial sector.

The fund’s share price experienced a 27% drop during 2015, but has risen consistently throughout 2016 and 2017 and has recovered all 2015 losses. The share price started the trailing 12-month period on January 3, 2017, from its 52-week low of $6.33 and rose 13.6% with minimal volatility to reach its 52-week high of $7.19 by October 11, 2017.

After peaking in mid-October, the share price pulled back 3.3% by December 21, 2017, but reversed trend and jumped to close on January 2, 2018 at $7.12, which was just 1% below the 52-week-high share price from October 2017. Additionally, the closing price as of January 2, 2018 is 12.2% above its 52-week low price from one year earlier and just 5% higher than it was five years earlier.

Because of the significant share price drop in 2015, the REIT’s three-year total return is only 21.3%. However, the share price escalation over the past year rewarded shareholders with a 24% total return in just 12 months. The five-year total return, which includes the 27% share price drop in 2015, is a healthy 68.6%.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic