Global Real Estate Fund Pays a 9.26% Dividend Yield

By: Ned Piplovic,

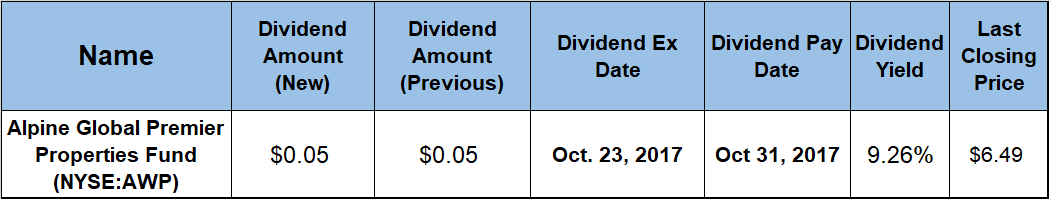

The Alpine Global Premier Properties Fund (NYSE:AWP) from Alpine Woods Capital Investors, LLC currently is offering a 9.26% dividend yield and its share price has gained almost 20% over the past 12 months.

This fund’s combination of strong share price growth, high-yielding dividend distributions and the relatively inexpensive share price of around $6.50 per share could be an affordable way for investors to get exposure to the international real estate market. The fund’s ex-dividend date is coming up on October 23, 2017, and the pay date follows just a week later, on October 31, 2017.

Alpine Global Premier Properties Fund (NYSE:AWP)

Alpine Global Premier Properties Fund is a diversified, closed-end management investment company. As of August 31, 2017, the fund’s $617 million in total assets were allocated across nine sectors, 10 countries and 102 individual holdings. The Fund invests in securities, equity-linked structured notes, equity-linked securities and various other derivative instruments, which could be illiquid. AWP invests in issuers that are principally engaged in the real estate industry or real estate financing that controls real estate assets.

More than 26% of the fund’s assets are invested in securities backed by residential real estate. The Diversified sector has the second-highest asset share with 17.54% and the sector classified Other follows with a 12.13% share. The remaining assets are distributed among the Retail, Financial, Office, Lodging and Industrial sectors with shares ranging between 12% and 4.5%. Only a minor share of 0.26% is allocated into the Mortgage/Finance sector.

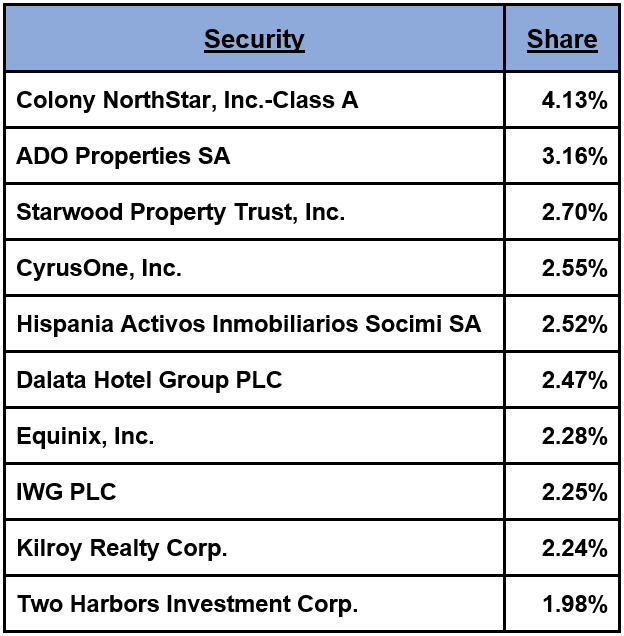

The top 10 individual holdings collectively account for 26.28% share of total assets. Below is the list of the top 10 individual holdings:

The fund’s current monthly dividend of $0.05 converts to a $0.6 annual distribution and a 9.26% yield, which is fractionally lower than its 9.4% average yield over the past five years. Compared to the 3.14% straight average yield for all the equities in the Financial sector, the AWP’s current yield of 9.26% is almost 188% higher and more than triple the 2.93% average for Closed-End Fund: Foreign Industry segment.For the past 12 months, the share price dropped initially 12.8% between late September and November 14, 2016, when it reached its 52-week low, and then reversed course to embark on a nine-month long growth streak. Between November 2016 and August 28, 2017, when the share price reached its new 52-week high of $6.58, the price rose 36%. Since the August peak, the price pulled back slightly and closed on September 27, 2017, at $6.49, which is just 1.4% lower than the August peak and 17% higher than it was one year ago.The combination of the steady dividend income and the substantial asset appreciation delivered a 26.64% total return over the past 12 months. The extended period performance was equally good with a 20.38% total return for the last three years and 30.73% for the previous five years.

The fund’s current monthly dividend of $0.05 converts to a $0.6 annual distribution and a 9.26% yield, which is fractionally lower than its 9.4% average yield over the past five years. Compared to the 3.14% straight average yield for all the equities in the Financial sector, the AWP’s current yield of 9.26% is almost 188% higher and more than triple the 2.93% average for Closed-End Fund: Foreign Industry segment.

For the past 12 months, the share price dropped initially 12.8% between late September and November 14, 2016, when it reached its 52-week low, and then reversed course to embark on a nine-month long growth streak. Between November 2016 and August 28, 2017, when the share price reached its new 52-week high of $6.58, the price rose 36%. Since the August peak, the price pulled back slightly and closed on September 27, 2017, at $6.49, which is just 1.4% lower than the August peak and 17% higher than it was one year ago.

The combination of the steady dividend income and the substantial asset appreciation delivered a 26.64% total return over the past 12 months. The extended period performance was equally good with a 20.38% total return for the last three years and 30.73% for the previous five years.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic