Great Plains Energy Offers Rising Dividend, 3.4% Current Yield (GXP)

By: Ned Piplovic,

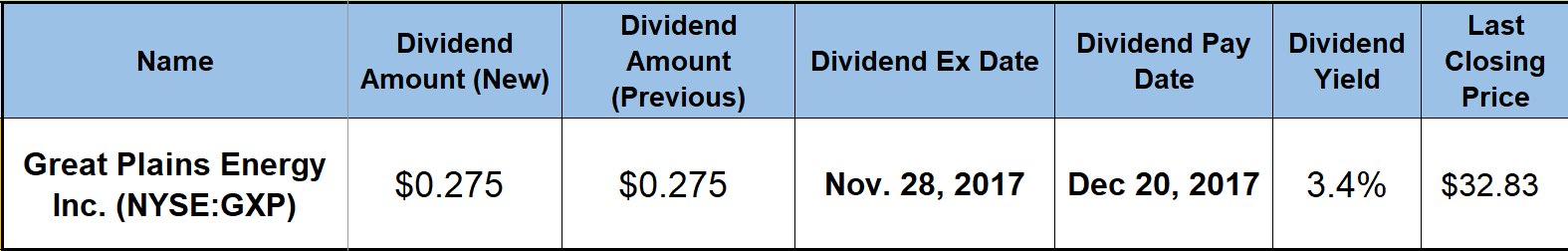

The Great Plains Energy company currently offers its shareholders a 3.4% dividend to continue its current seven-year rising dividend streak.

In addition to the rising dividend, the company’s share price rose by a double-digit percentage over the past 12 months. The combined total return of asset appreciation and dividend income exceeded 20% in the same 12-month period.

The ex-dividend date is coming up on November 28, 2017 and the pay date is scheduled three weeks after later for December 20, 2017.

Great Plains Energy Inc. (NYSE:GXP)

Founded in 1919 and headquartered in Kansas City, Missouri, Great Plains Energy Incorporated, generates, transmits, distributes and sells electricity. Additionally, the company provides regulated steam services in St. Joseph, Missouri. The company’s total generating capacity of approximately 6.500 megawatts (MW) comprises generation facilities powered by coal, nuclear, natural gas, oil, wind, solar and hydroelectric sources. Through its operating subsidiaries, Kansas City Power & Light Company (KCP&L) and Greater Missouri Operations Company (GMO), the company provides energy to about 750,000 residences, 100,000 commercial firms and 2,500 industrials, as well as municipalities and other electric utilities.

The company’s current $0.275 quarterly dividend is 4.76% higher than the $0.2625 quarterly payout from the same period last year. The current annualized $1.10 dividend amount yields 3.4%. This 3.4% yield is 45% above the 2.31% average yield of the Utilities sector and 43% above the average yield of all the companies in the Electric Utilities segment.

The company started paying dividends in 1919, just two years after its founding. More recently, the company has paid a flat $1.60 annual dividend for a decade between 1999 and 2008. Amid the financial crisis, Great Plains Energy cut its annual payout in half and paid $0.83 per share for two years. After 2010, the company embarked on the current seven-year rising dividend streak. Over the past seven years, the annual dividend payout grew at an average rate of 4.1% per year. As a result, the annual dividend distribution amount rose by a third since 2011.

The share price began the trailing 12 months with a 6% drop in November 2016 and reached its 52-week low $26.20 on December 1, 2016. However, since bottoming out at the beginning of December, the share price has been trending up with minimal volatility. Since the December bottom, the share price rose more than 25% and reached its new $32.85 52-week high on October 30, 2017. The share price has been trading near the 52-week peak level over the last two days. Compared to share price from one year ago, the current price level as almost 18% higher and just 5.2% below the all-time high price from April 2004. Just over the last 30 days, the share price rose 6%.

Great Plains Energy announced in May 2016 that it entered into a merger agreement with Westar Energy (NYSE:WR).The merger process is currently undergoing and the current timeline anticipates that the formal merger process and relevant government approvals will conclude at some point in the first quarter of 2018. With a combined 1.6 million customers and a market capitalization of nearly $21 billion this merger will create the second largest Midwest utility in terms of customer count and market capitalization.

In its July 2017 presentation to shareholders, the company estimated that the immediate financial impact to shareholders would be a 15% dividend hike for 2018, a 6% to 8% rising dividend payout every year through 2021 and a 60% to 70% target payout ratio. The additional funds to support the rising dividend should come from estimated cumulative operational savings of approximately 15% through 2021. The current estimate is that just in partial fiscal year 2018 the combined operations could realize between $35 million and $45 million in operational efficiencies. Great Plains Energy’s management team estimates that these efficiencies will increase each year and reach $140 million to $170 million in 2021.

Some of these announcements are already built into the current share price, However, if the merger goes through as planned and operational efficiencies are realized, the share price could continue to rise, which is also supported by the current 50-day moving average (MA). The 50-day MA continues to rise and has been higher than the 200-day MA since March 2017.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic