Grocery Chain with 10 Years of Rising Dividends Pays 2.4% Yield

By: Ned Piplovic,

A national grocery store chain has been paying rising dividends for a decade and currently is offering a 2.4% dividend yield.

While the company’s share price trend generally has been down since its all-time high in December 2015, the Kroger Company (NYSE:KR) has continued paying rising dividends every year for the past decade to complement its current 2.4% dividend yield.

The supermarket space is traditionally a low margin sector. Many competitors in that sector have been struggling with reduced market share to online retailers. Other than the effects of the “retail ice age” on the traditional supermarket chains, the sector’s big news recently has been the acquisition of Whole Foods Market by Amazon (NASDAQ:AMZN) and Walmart’s (NYSE:WMT) purchase of Jet.com.

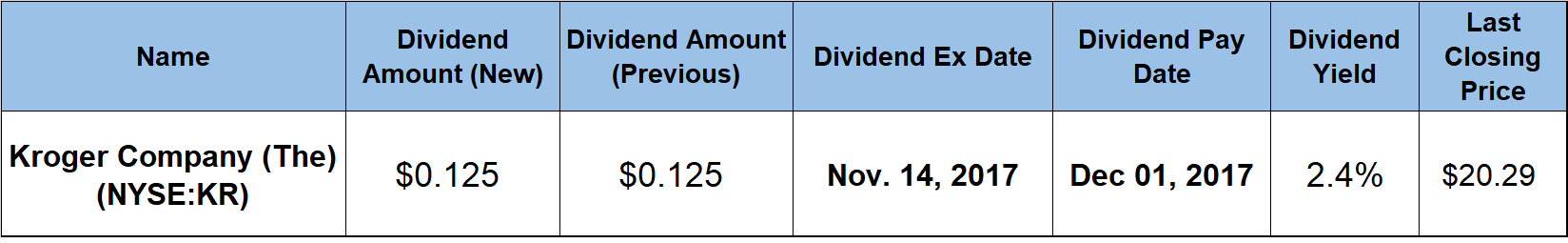

However, investors willing to speculate a little could find few grocery chains like Kroger, which generates a steadily rising dividend income and might turn out to be a discounted buying opportunity at its current, reduced share price. Kroger is scheduled to pay its next quarterly dividend on December 1, 2017, to all its shareholders as of the November 14, 2017, ex-dividend date.

Kroger Company (The) (NYSE:KR)

Founded in 1883 and headquartered in Cincinnati. the Kroger Company operates as a retailer in the United States with retail food and drug stores, multi-department stores, jewelry stores and convenience stores. As of September 8, 2017, the company operated almost 2,800 grocery retail stores in 35 states under nearly two dozen banners, 783 convenience stores under six banners in 19 states and 307 fine jewelry stores under names Fred Meyer Jewelers and Littman Jewelers. Additionally, the Kroger company operated 38 food production or manufacturing facilities producing high quality private-label products, 1,472 supermarket fuel centers and 2,258 pharmacies in Kroger’s combination food and drug stores.

The share price lost 35% over the last 12 months. While the share rose initially 15% between October 10, 2016, and its 52-week high on December 15, 2016, the trend has been downward since the December high with two significant 15%-plus drops.

The first drop of 16% over 10 trading days occurred the last week of February and the first week of March. However, the second drop of 26% over just two trading days occurred in late June when Amazon’s acquisition of Whole Foods Market was announced just one day after Kroger reported reduced earnings guidance.

After continuing its decline, the share price reached its 52-week low of $19.96 on October 2, 2017. Since that low, the share price rose 1.7% and closed at $20.29 on October 9, 2017.

As one of the few remaining national grocery stores, Kroger has managed to create a lucrative niche by taking advantage of its infrastructure and manufacture of its own products. Compared to Albertson’s – its only grocery store competition with similar nationwide reach – Kroger has a higher store count and higher current revenues. In fact, the only company in the grocery segment that has a higher market share than Kroger’s is Walmart.

One way for Kroger to turn around its business and compete with Walmart and Amazon is to expand its own online grocery ordering service – ClickList – to all its stores. Currently, the service is available in less than 23% of the company’s stores.

However, the company’s strong suit is its decade-long record of rising dividends. The current quarterly dividend of $0.125 is equivalent to a $0.50 annual payout and yields 2.6%. This current yield is 64.3% higher than the company’s average yield over the last five years. Additionally, the company’s current yield outperformed the average yield of the companies in the Services sector by 28.4% and the average of the Grocery Stores segment by 58%.

Since starting to pay a dividend in 2006, Kroger has paid rising dividends every year. Over the last 11 years, the annual dividend payout grew at an average rate of 13% per year. The result of that growth rate for more than a decade is a total annual dividend payout that is almost four times higher than it was in 2006.

The current dividend payout ratio is only 29%. Such a low payout ratio indicates that Kroger will be able to continue paying rising dividends in the short term even if it misses its earnings or must trim estimates again.

However, if the company manages a quarter of two of positive results, modest asset appreciation could accompany the steadily rising dividends and quarterly income payments, which would make the current share price drop an opportunity to buy the company’s shares at a discount.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic