Higher Interest Rates Drive Preferred Stocks Lower

By: Tim McPartland,

As the 10-year treasury yield spiked higher on Wednesday, Oct. 3, to the 3.16% area, holders of many preferred stocks and baby bonds have felt substantial pain.

During the last few years, we have written many times about the need to stay in shorter maturity “term” preferreds, which have a mandatory redemption date, and baby bonds that offer maturities of less than 10 years during times of rising interest rates. Of course, it is likely that we were a bit early in our caution, but this week shows why income investors need to stay with short maturities as capital losses on “perpetual” preferreds have been substantial, as high as 6%.

When an investor holds a “term” preferred stock or a baby bond with a maturity of less than 10 years, it is quite normal to have to accept a yield that is ½-1% lower than a similar “perpetual” preferred might offer. The perpetual security, which has no maturity date, carries with it substantial “interest rate risk” as buyers demand higher yields on securities that have very long maturity dates as interest rates move higher.

With a “term” preferred or baby bond with short maturity dates, there is a time that the investor knows he will receive a $25 principal for his holdings, while the “perpetual” issues may essentially remain outstanding forever with no known time for return of the $25 liquidation value.

We have observed over the years that the preferred stocks of the highest quality, which would include those from Closed End Funds (CEFs), many banking companies and also highly rated real estate investment trusts (REITs), such as giant self-storage company Public Storage (NYSE:PSA), suffer the most as interest rates move higher. The reason for this is simple. These companies have issued very low coupon preferred stocks in recent years. As interest rates rise, investors demand higher yields. This demand for higher yields means the share price must fall for the yield to rise.

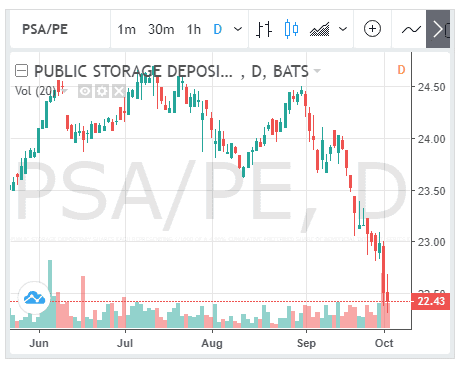

A great example of how a low coupon, high quality, perpetual preferred reacts to higher interest is the Public Storage Series E (NYSE:PSA-E) perpetual preferred stock. This issue, like all issues from Public Storage, is strongly investment grade. In addition, it was issued in 2016 when interest rates were extremely low, and it carries a rock-bottom coupon of 4.90%.

You can see that during much of the last six months, the issue traded between $23.50 and $24.50. However, as interest rates began to rise in the last number of weeks, the share price began to fall hard. Through Wednesday, the loss since the most recent peak on 8/31/2018 is $2.03/share — a relatively massive 8.3%!!

Many investors are simply happy to hold low coupon preferreds to gain the safety of holding quality. Other investors simply stay away from these types of issues when they believe interest rates will be moving higher. In our case, we simply stay in shorter maturity “term” preferreds and baby bonds. We present a good example of how to avoid huge capital losses during a time of rising interest rates in our Short/Medium Duration Income Portfolio. This portfolio contains issues that mature in the relatively near future and has garnered a nice 6.5% return each year since 2014.

Investors who are simply looking for the safety of investment-grade issues with little concern for their current net asset value should search for bargains in the investment-grade issues which are now about ½% higher in current yield. We maintain a listing of investment-grade issues which can be found here. We would expect that there may be more pain ahead in the sector and “bargains” may get better. Investors would be well off to “leg in” to a position, meaning buy a part position now and add to it later at potentially better prices.

Investors who have held these high quality, low coupon preferreds are likely best off at this point in time to simply ride out the storm. Prices will stabilize and even move higher in the future. You will be collecting safe dividends while you wait.

Our best lesson for these times of falling preferred stock and baby bond prices is simply to not panic. Bad decisions will be made when knee-jerk moves are made. Review your goals and needs and make decisions over the course of days — not minutes.

Connect with Tim McPartland

Connect with Tim McPartland