Lamar Advertising Company Pays 4.5% Dividend Yield (LAMR)

By: Ned Piplovic,

The Lamar Advertising Company boosted its annual dividend for the last three consecutive years and currently pays a 4.5% dividend yield, which is more than twice the average dividend yield of the Services sector.

In the last year, the company’s share price experienced some volatility, but still managed double-digit-percentage growth compared to the price at the end of November 2016. The company has been increasing its annual dividend amount at nearly double-digit percentages every year since 2014.

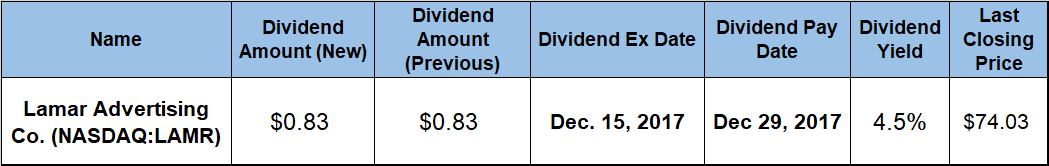

The company’s next ex-dividend date will be on December 15, 2017. The pay date is scheduled just two weeks after the ex-dividend date on December 29, 2017.

Lamar Advertising Company (NASDAQ:LAMR)

Founded in 1902 and headquartered in Baton Rouge, Louisiana, the Lamar Advertising Company is a publicly owned equity real estate investment trust (REIT). The firm’s primary focus is selling advertising space on billboards, buses, shelters, benches and logo plates. With more than 330,000 displays across the United States, Canada and Puerto Rico, the Lamar Advertising Company is one of the largest outdoor advertising companies in the world.

The Lamar Advertising Company made its initial public offering and started trading on the NASDAQ exchange in 1996. In addition to its traditional methods of outdoor advertising methods, Lamar Advertising installed its first digital billboard in 2001 and currently offers its customers the largest network of digital billboards in the United States with over 2,700 displays.

The company’s current $0.83 quarterly dividend distribution is 9.2% above the $0.76 payout from the same period last year. The most recent dividend amount is equivalent to a $3.32 annualized dividend payout and a 4.5% dividend yield. This dividend yield is more than 135% higher than the 1.89% Services sector average dividend yield and more than 50% higher than the 2.97% average dividend yield of Lamar Advertising’s peers in the Advertising Agencies segment within the Services sector.

The company paid its first dividend in 2007 as a one-time payout and did not begin regular dividend distributions until the second quarter of 2014. Since then, the company has increased its annual dividend distribution for the last three consecutive years at an average rate of 9.9% per year.

The company’s share price began its current trailing 12-month period with a 19.2% jump from $66.29 on November 30, 2016, to its 52-week high of $79.05 that it reached by February 21, 2017. However, after the February peak, the share price tumbled more than 25% and reached its 52-week low of $63.14 by September 12, 2017. This low was 4.8% below the November 30, 2016, share price.

Since bottoming out in September, the share price has reversed its course and has been trending up since the trend reversal. The share price closed on November 29, 2017, at $74.03, which is 11.7% higher than it was one year ago and 17.2% higher than the September low.

During the price downtrend between February and September, the share price’s 50-day moving average (MA) started trending lower as well. It crossed below the 200-day MA on August 15, 2017, and continued to drop until it bottomed out on October 11, 2017. One month after the share price reversed course and started rising again, the 50-day MA joined the uptrend. At the Oct. 11 inflection point, the 50-day MA was 7.6% below the 200-day MA. However, the 50-day MA has been rising and is within 0.7% of the 200-day MA as of November 29, 2017.

If the trend continues, the 50-day MA could cross above the 200-day MA next week, which would indicate that the share price should continue rising, barring any unforeseen events. This could be an opportunity to take advantage of the appreciating asset over the short term while waiting for the next dividend distribution.

Based on the past distribution schedule, the company should hike its quarterly dividend amount for the next period and a likely hike of $0.04 or $0.05 per share would be equivalent to a dividend payout increase of 4.8%, or 6%. Next quarter’s ex-dividend date should be in mid-March with a pay date in late March or early April.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic