Diversified Machinery Maker Grows Dividends at 25% Annually for 12 Years

By: Ned Piplovic,

A diversified machinery manufacturer grew its annual dividends distributions at an annual rate of 25% for the last 12 years, offering a current yield of 2.5% and rewarding its shareholders with double-digit percentage share price growth in the last year.

The combination of 30%-plus asset appreciation and dividends income produced a 43% total return in the last 12 months. Additionally, the company’s yield exceeds the average yields of its competitors in the industry by more than 100%.

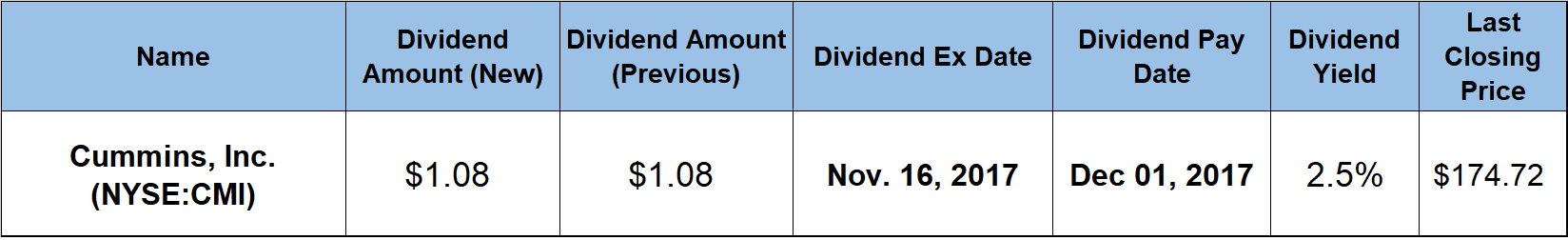

The company’s next ex-dividend date will be on November 16, 2017, and the pay date occurs just two weeks later, on December 1, 2017.

Cummins, Inc. (NYSE:CMI)

Headquartered in Columbus, Indiana, Cummins Inc. and its subsidiaries design, manufacture, distribute and service diesel and natural gas engines, as well as spare parts and engine-related component products. The company operates through the Components, Engine, Power Systems and Distribution segments.

The Components segment offers emission solutions for stationary and mobile applications. These solutions include catalytic emissions reduction systems, turbochargers for diesel engines, air and fuel filters, lube and hydraulic filters, coolants, fuel additives and fuel systems for heavy-duty on-highway diesel engine applications. This segment comprises of four individual businesses – Cummins Electronics and Fuel System, Cummins Filtration, Cummins Turbo Technologies and Cummins Emission Solutions.

The Engine segment manufactures and markets a range of diesel and natural gas- powered engines under the Cummins and other customer brand names. These engines are intended for use in trucks, buses and recreational vehicles, as well as light-duty automotive, construction, mining, marine, rail, oil and gas, defense and agricultural markets. Additionally, the Engine segment provides new parts and services, as well as remanufactured parts and remanufactured engines. The Power Systems segment offers components for primary and backup full power generation solutions, including controls, paralleling systems, transfer switches and air conditioning generator/alternator products under the Stamford, AVK and Markon brands.

The Distribution segment distributes parts, engines and power generation products. Also, this segment provides service solutions, such as maintenance contracts, engineering services and integrated products.

The company was originally founded as The Cummins Engine Company in 1919 with the sole focus on developing and manufacturing diesel engines. However, with the expansion into other business areas, the company changed its name to Cummins Inc. in 2001.

The current quarterly dividends payout of $1.08 converts to a $4.32 annualized dividends payout and yields 2.5%, which is 3% above the company’s own 2.4% average yield for the past five years. Additionally, the company’s current yield is 115% higher than the simple average yield of the Industrial Goods sector and 143% higher than the average yield of its peers in the Diversified Machinery segment.

The company has been paying dividends for nearly seven decades and has hiked its annual distribution for the last 12 consecutive years. Over these dozen years, the annual dividends payout grew at an average rate of 25% per year and resulted in a 14-fold rise of the annual distribution amount since 2005.

To complement the company’s reliable and rising dividends income, the share price has been climbing with minimal volatility since the beginning of 2016. After dropping 47% between its previous all-time high of almost $160 in June 2014, the share price reversed direction and has been trending upward since the beginning of 2016. Since then, the largest price drop of 9.8% occurred over a 30-day period from mid-July to mid-August 2017.

After passing through its 52-week low of $121.72 on November 3, 2016, the share price continued rising. On June 12, 2017 the share price broke above its all-time high from June 2014 and continued towards its new all-time of $174.72, which it reached at the end of trading on October 17, 2017. The new all-time high is 37.5% higher than it was 12 months ago. The combination of share price growth and rising dividends distributions provided shareholders with a 43% total return over the last year and a 108% return over the trailing five-year period.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic