Medifast Boosts Quarterly Dividend 50% (MED)

By: Ned Piplovic,

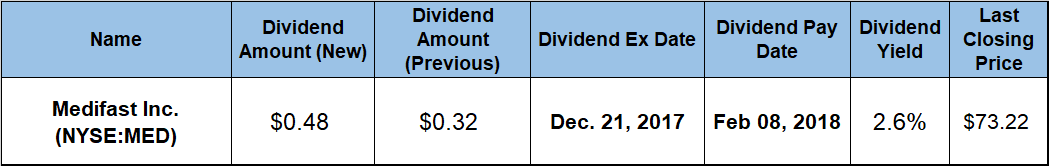

Medifast Inc. has a dividend payout history of only two years, but the company followed up last year’s 28% annual dividend payout hike with a 50% annual dividend boost this year and the dividend currently yields 2.6%.

While the company’s current yield is 24% lower than it was in the first quarter of 2017, it is still a good yield considering that the company’s share price rose more than 80% over the past 12 months, which drove the yield lower even with the significant dividend payout growth. The company’s next ex-dividend date is coming up shortly on December 21, 2017. However, the next pay date is not scheduled for another seven weeks and will occur on February 8, 2018.

Motorola Solutions Inc. (NYSE:MSI)

Founded in 1980 and headquartered in Baltimore, Maryland, Medifast Inc. is a manufacturer and distributor of healthy living and wellness products and programs. The company produces, distributes and sells diet food, weight loss and other health-related products, primarily through its own website, medical professionals and franchised weight loss clinics. In 2016, the company launched OPTAVIA, an exclusive brand and product line. Medifast distributes this product line through a network of more than 14,000 independent distributors – who internally are called “Coaches.” The OPTAVIA line of products generated 84% of company’s net sales. The company’s e-commerce segment – Medifast Direct – contributes another 11% of net sales and the Medifast Business Partners segment, which consists of 35 wellness centers and two reseller locations, brings in the remaining 5% of net sales.

The company’s share price had an uneventful first half of the current trailing 12-month period. Starting from its 52-week low of $40.27 on December 14, 2016, the share price rose 17% with a few temporary dips and reached $43.17 by May 8, 2017. However, that growth was short-lived, as the share price reversed course, gave up all the gains and dropped down by July 13, 2017 to $40.32, which was just 0.1% above the December 2016 low. After hitting near-bottom levels in mid-July 2017, the share price embarked on a strong uptrend and rose more than 80% to reach its new 52-week high on December 11, 2017. The new $73.22 price peak is 82% higher than its 52-week low from one year ago and almost 140% higher than it was five years ago.

The share price dropped in July 2017 and drove the 50-day moving average (MA) below the 200-day MA for almost a month between mid-July and mid-August. However, the 50-day MA crossed back above the 200-day MA in a bullish manner on August 15, 2017. As of December 11, 2017, the 50-day MA is nearly 28% higher than the 200-day MA and continues to rise, which is an indication that, despite the 80% gain in the last 12 months, the share price could continue to rise in the next couple of quarters.

The company enhanced its quarterly dividend 50% to $0.48 for 2018 versus the last quarterly dividend for 2017 of $0.32, which was paid on November 9. 2017. The current $0.48 quarterly dividend converts to a $1.92 annual payout per share and yields 2.6%. This yield is 18% higher than the 2.22% average yield of Medifast’s peers in the Specialty and Other Retailers segment, as well as nearly 40% higher than the average yield of the entire Services sector.

As indicated already, the company has been paying dividends only for the past two years. However, over that period, Medifast Inc. has boosted its annual dividend payout by an exceptionally high average growth rate of 38.6% per year and nearly doubled its annual distribution amount in just two years.

Extraordinary dividend hikes, combined with extraordinary asset appreciation, led to extraordinary total return for shareholders. Over the last 12 months, Medifast’s shareholders enjoyed an 84% total return and a 148% total return over the last three years.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic