Monthly Dividend Stocks: EPR Properties (NYSE:EPR)

By: Ned Piplovic,

Featured Image Source: EPR Properties Corporate Investor Presentation Q1 2019

EPR Properties (NYSE:EPR) – one of reliable monthly dividend stocks – has been rewarding its shareholders with a combination of rising dividend income distributions and a steady asset appreciation over the past two decades.

The company began dividend distributions in 1997. However, EPR Properties initially distributed its payouts quarterly. The company started paying monthly dividends in 2013. In 2009, EPR Properties cut its quarterly dividend in the aftermath of the financial crisis. This dividend cut also reduced the annual payout the following year as well. However, the company has boosted its annual dividend amount every year since 2011. In addition to a steady dividend growth, the company’s yield continues outperforming industry averages.

Monthly Dividend Stocks: EPR Properties Financial Results

On April 29, 2019, the company announced that its total revenue for the first quarter of 2019 increased 6% from $155 million in the same quarter last year to $164.5 million for the most recent period. Additionally, the net income available to common shareholders was $59.3 million, or $0.79 per diluted common share, for the first quarter of 2019. This figure beat analysts’ expectation of only $0.75 per share by 5.3%.

Funds From Operations (FFO) — which is a non-GAAP financial measure — came in at $93.1 million for the period, or $1.23 per diluted common share, compared to $61.0 million, or $0.82 per diluted share, for the same quarter in 2018. Adjusted FFO of $102.6 million — $1.36 per diluted share — was 8% higher than last year’s $94.0 million, or $1.26 per diluted share.

“We are pleased with the sustained momentum demonstrated by our first quarter results,” stated Company President and CEO Greg Silvers. “We continue to source additional growth opportunities consistent with our focus on experiential activities which play directly into the Company’s differentiated and deep expertise. With the expected payoff of the mortgage associated with the Schlitterbahn water parks, we are well-positioned with additional capital for reinvestment. As we further expand, we will adhere to our core underwriting principles as we seek both accretive initial returns and growth in yield.”

EPR Properties (NYSE:EPR)

Based in Kansas City, Missouri, and established in 1997, EPR Properties is a specialty real estate investment trust (REIT) that owns properties in select market segments which require unique industry knowledge, while offering the potential for stable and attractive returns. Unlike most other REITs that either spread their asset portfolio across a diversified spectrum of industries or invest in a single highly specialized market segment, EPR takes a balanced approach. The company’s current portfolio of nearly $7 billion in assets comprises properties in Entertainment, Recreation and Education. As of 2019, the company owns and leases to more than 250 tenants 395 properties in 43 states and Canada. The entertainment business segment currently generates nearly half of EPR’s net income and includes megaplex theatres, entertainment retail centers and family entertainment centers. Additionally, the Recreation business segment delivers another third of net revenues and comprises golf entertainment complexes, ski areas, attractions and other recreation facilities. Lastly, the Education business segment contributes nearly 20% to the EPR’s net revenue and comprises public charter schools, private schools and early childhood education centers.

Monthly Dividend Stocks: EPR Properties Dividends

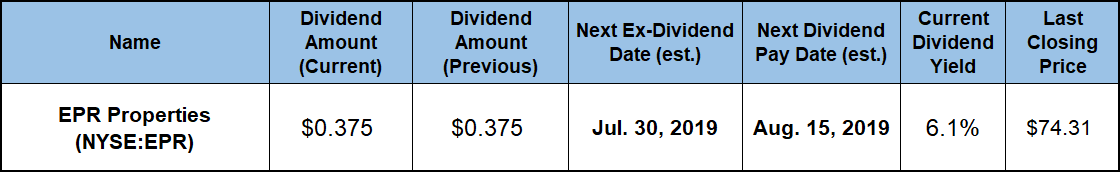

EPR’s current $0.375 monthly dividend payout amount is 4.2% higher than the $0.36 distribution from the same period last year. This new distribution corresponds to a $4.50 annualized payout and a 6.1% forward dividend yield. Despite a share price growth — which reduces the yield — EPR’s current yield is 5.7% higher than the company’s own five-year yield average of 5.73%.

Furthermore, the current 6.1% forward dividend yield is nearly twice the 3.06% average yield of the overall Financial sector. Compared to the 3.29% average yield of the company’s peers in the Real Estate Development industry segment, EPR’s current yield is nearly 85% higher. Additionally, the company’s current yield is also 27% higher than the 4.75% average yield of the segment’s only dividend-paying companies.

Since resuming annual dividend hikes in 2011, the company has enhanced its annual payout amount 73%, which corresponds to an average growth rate of 6.3% per year. Even with two years of declining annual dividend payouts, EPR still managed to enhance its annual dividend payout amount nearly 170% since 1999. This pace of advancement is still equivalent to an average growth rate of 5% per year over the past two decades.

Monthly Dividend Stocks: EPR Properties Share Price

After a significant decline between mid-2016 and early 2018, the share price embarked on a relatively steady uptrend during the trailing 12 months. The only exception was a temporary pullback in late December 2018 caused by an overall market correction. The share price gained nearly 10% over the first five months of the trailing 12-month period. However, the next 30 days after, the share price shed all those gains and fell to its 52-week low of $63.12 on January 2, 2019, which was 3% lower than the share price from the beginning of the trailing one-year period.

However, after reversing direction at the beginning of 2019, the share price rose more than 27% and reached its 52-week high of $80.28 on June 5, 2019. Since peaking in early June 2019, the share price pulled back slightly to close at the end of trading on June 27 at $74.31.

This closing share price marked a 14.2% rise over the trailing 12-month period, and an advancement of nearly 18% since the 52-week low in early January. Additionally, the June 27 closing price was also one-third higher than it was five years ago.

This share price growth combined with rising dividend income distributions to deliver a total return on shareholders’ investment of more than 20% over the last one-year period. The share price correction between mid-2016 and early 2018 held total returns to just 13% over the past three years. However, the five year total return exceeds 70%.

Related Articles

The Complete List of Monthly Dividend Stocks Paying 4%-Plus

Stocks That Pay Monthly Dividends – The Comprehensive List

The Complete List of Monthly Dividend ETFs Paying 3%-Plus Distributions

6 Best Monthly Dividend Stocks to Buy Now

5 Monthly Dividend REITs to Buy Now

7 Monthly Dividend ETFs for your Investment Portfolio

Dividend increases and dividend decreases, monthly dividend stocks, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic