Monthly Dividend Stocks: Vermilion Energy, Inc. (NYSE:VET)

By: Ned Piplovic,

Vermilion Energy, Inc. (NYSE:VET) is one of many monthly dividend stocks in the energy sector that rewards its shareholders with high dividend yield income distributions.

The company’s share price has lost more than half of its value over the past five years. Even during the last one-year period, the share price continued the downtrend. However, as one of the monthly dividend stocks with a rising revenues and a steady funds from operations inflow, Vermilion Energy’s stock might be undervalued and poised for a trend reversal.

While the share price decline reduced shareholder capital, the lower share price has at least one benefit. The share price drop pushed the forward dividend yield just short of a double-digit level. Therefore, investors whose own detailed analysis indicates that the Vermilion Energy stock might rebound, could take the advantage of the price drop and take a long position in the Vermilion Energy’s stock at discounted rates. Furthermore, while waiting for the share price recovery, investors can collect a dividend that yields nearly 10%, which is high even for monthly dividend stocks.

Vermilion Energy, Inc. (NYSE:VET)

Vermilion Energy, Inc. (NYSE:VET)

Headquartered in Calgary, Canada, and founded in 1994, Vermilion Energy, Inc. is an international energy producer that seeks to create value through the acquisition, exploration, development and optimization of oil-producing properties in North America, Europe and Australia. The company’s business model targets annual organic production growth, as well as delivery of reliable and increasing dividends to investors. Vermilion Energy targets growth in production primarily through the exploitation of light oil and liquids-rich natural gas conventional resource plays in Canada and the United States. Additionally, the company operates exploration and development of high impact natural gas opportunities in the Netherlands and Germany, as well as oil drilling and workover programs in France and Australia. Additionally, Vermilion Energy holds a 20% operated interest in the Corrib gas field in Ireland. The company’s production target for 2019 is 101,000 to 106,000 barrels of oil per day.

Monthly Dividend Stocks: Vermilion Energy Share Price

As already indicated, the main draw of Vermilion Energy is that it is a monthly dividend stock with a high dividend yield. While rising dividend distributions contributed to the yield increase, the main driver is the share price decline over the past several years. In addition to pushing the dividend yield higher, the current share price affords investors who believe that the share price will begin recovering in the near future an opportunity to take a long position at the reduced price level.

Following a downtrend from early 2018, the share price hit its 52-week high of $37.16 just two weeks into the trailing 12-month period. After passing through this peak on July 10, 2018, the share price continued declining for the remainder of the year. Assisted by the downward pressure from the overall market correction in the fourth quarter, the share price declined more than 46% form the July peak and reached its 52-week low of $19.93 on December 24, 2018.

However, after bottoming out in late December 2018, the share price reversed direction and advanced nearly 37% by late-April 2019. Unfortunately, the share price could not sustain this uptrend any longer. By mid-June, the share price gave back all 2019 gains and dropped to just one cent above its December low.

Since hitting this near-low in mid-June, the share price has begun rising again and closed on June 27, 2019, at $21.76. While still nearly 70% down over the pat five years and nearly 40% below its level from one year ago, the share price has gained 8.4% just over the past two weeks. Risk-averse investors looking for long-term buy-and-hold opportunities might shy away from a stock like Vermilion Energy. However, since Vermilion Energy is one of the monthly dividend stocks, some investors could use even a short term share price uptrend to mitigate any capital losses and collect several dividend distributions over the next couple quarters at a yield that is almost 10%.

Monthly Dividend Stocks: Vermilion Energy Dividends

Vermilion Energy’s current dividend performance is diametrically opposed to the company’s share price record over the last few years. The company began dividend distributions in 2003 and managed to avoid dividend cuts even through the Great Recession. Additionally, the company has increased its annual dividend seven times, which includes the last two consecutive years. Since 2017, the company enhanced its total annual dividend payout 7%, which corresponds to a 3.4% average annual growth rate. Even with only seven annual hikes in the past 17 years, the company still increased its annual dividend payout nearly 50% since 2003. This advancement pace still corresponds to a 2.3% average annual growth rate.

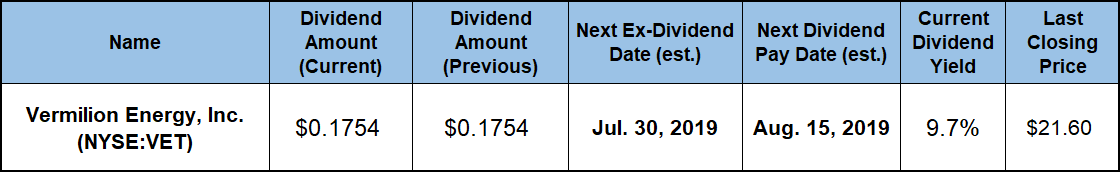

The current $0.1754 (CA$0.23) monthly payout amount is equivalent to a $2.11 (CA$2.76) annualized distribution and a 9.7% forward dividend yield. Furthermore, Vermilion Energy’s current yield is nearly 315% above the 2.35% simple average yield of the entire Basic Materials sector. The current yield also outperformed the 1.71% average yield of the Oil & Gas Drilling & Exploration industry segment by 470%. Vermilion Energy’s current yield is also nearly 50% higher than the 6.54% yield average of the segment’s only dividend-paying companies.

Related Articles

The Complete List of Monthly Dividend Stocks Paying 4%-Plus

Stocks That Pay Monthly Dividends – The Comprehensive List

The Complete List of Monthly Dividend ETFs Paying 3%-Plus Distributions

6 Best Monthly Dividend Stocks to Buy Now

5 Monthly Dividend REITs to Buy Now

7 Monthly Dividend ETFs for your Investment Portfolio

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic