Motorola Solutions’ Quarterly Dividend Advances 10.5% Higher (MSI)

By: Ned Piplovic,

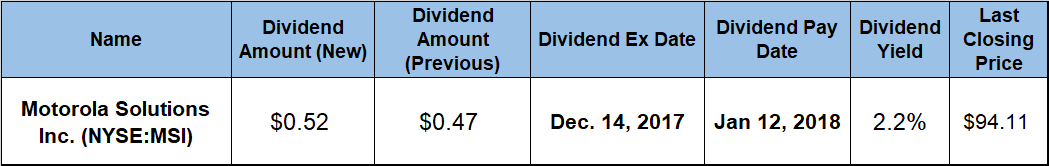

Motorola Solutions not only is offering its shareholders a 2.2% dividend yield, but it recently hiked its current quarterly dividend payout by 10.6%.

The company now has raised its average annual dividend by double-digit percentages during each of the last five years. Besides Motorola’s strong annual dividend payout growth, MSI’s current yield exceeded the company’s own five-year average yield by more than 16%.

Additionally, the company rewarded its shareholders with asset appreciation of nearly 20% over the past 12 months. The company’s next ex-dividend date is December 14, 2017, and its pay date is scheduled for early next year on January 12, 2018.

Motorola Solutions Inc. (NYSE:MSI)

Motorola Solutions, Inc. provides communication infrastructure, devices, accessories, software and services worldwide. The company operates through two segments, Products and Services. The Products segment offers a portfolio of infrastructure, devices, accessories and software for government, public safety and first-responder agencies, municipalities and commercial customers. This segment’s products include two-way portable radios, vehicle-mounted radios and accessories, such as microphones, batteries, earpieces, headsets, carry cases and cables. Additionally, the company offers radio network core and central processing software, base stations, consoles and repeaters, as well as software applications. The Services segment provides integration services, such as implementation, optimization and integration of networks, devices, software and applications. MSI also offers managed and support services, such as repair, technical support and hardware maintenance services, as well as network monitoring, software maintenance and cyber security services.

Motorola Solutions Inc. is commonly considered to be the direct successor of Motorola Inc, whose origins go back to the 1928 foundation of the Galvin Manufacturing Corporation in Schaumburg, Illinois, where Motorola Solutions also keeps its headquarters. After suffering large losses between 2007 and 2009, Motorola Inc. spun off its mobile business into Motorola Mobility and renamed the remaining operations as Motorola Solutions in January 2011. In 2012, Google, Inc. – now a subsidiary of Alphabet Inc. (NASDAQ:GOOG) – acquired Motorola Mobility and sold it to Lenovo (SEHK:992) in 2014.

Motorola Solutions hiked its quarterly dividend 10.6% from $0.47 in the previous quarter to the current $0.52 quarterly payout. The current quarterly distribution converts to a $2.08 annualized payout amount and a 2.2% yield. This hike is just the most recent in a series of annual dividend hikes that Motorola Solutions managed every year since the 2011 breakup of Motorola Inc. Over the past six years, the company boosted its total dividend amount at an average annual rate of 15.4% per year for a total annual dividend growth of 136% since 2011.

The current 2.2% yield is 16.3% higher than the company’s own 1.9% average yield over the last five years. Additionally, Motorola Solutions’ current yield is 12.8% above the 1.96% average yield in the Communication Equipment segment and 81.2% higher than the 1.22% average yield of the entire Technology sector.

The share price started its trailing 12-month period with a 2.3% drop from $79.19 on November 29, 2016, to its 52-week low of $77.34 on February 7, 2017. After bottoming out in early February, the share price rose 19% over the following six months and reached $92.21 before its next trend reversal. This time, the share price fell 10% to $83.02 by September 26, 2017.

However, since reversing direction again in late September, the share price rose 14% to reach its 52-week high of $94.53 on November 27, 2017, and traded in the same range for the following few days. The share price closed on November 30, 2017, at $94.11, which is 18.8% higher than it was one year ago and 21.7% higher than the 52-week low from February 7, 2017.

The Motorola Solutions’ shareholders received total returns of 19% over the past 12 months. Over the most recent three and five-year periods, the total returns for Motorola shareholders reached 51.5% and 87%, respectively.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic