Pfizer Boosts Annual Dividend Eight Consecutive Years (PFE)

By: Ned Piplovic,

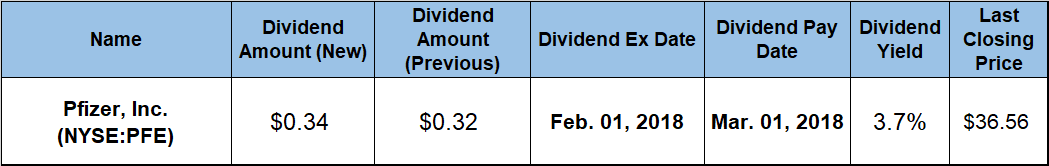

Pfizer, Inc. (NYSE:PFE) has rewarded its shareholders with eight consecutive years of dividend hikes at a growth rate of more than 8% per year and currently offers a 3.7% yield.

In addition to the short-term dividend growth streak, the company managed to boost its annual dividend at an average rate of almost 9% per year for the past two decades. In support of the above-average yield, the company grew its share price more than 12% over the last 12 months for a total return on shareholder investment of nearly 14%.

The company’s next ex-dividend date is set for February 1, 2018, and the pay date follows exactly four weeks later, on March 1, 2018.

Pfizer, Inc. (NYSE:PFE)

Founded in 1849 and headquartered in New York City, Pfizer Inc. discovers, develops, manufactures and sells health care products worldwide. The company operates through two segments — Pfizer Innovative Health (IH) and Pfizer Essential Health (EH). The Innovative Health segment focuses on the development and commercialization of medicines, vaccines, and consumer health care products for application in internal medicine, vaccines, oncology, inflammation, immunology and rare diseases. Additionally, this segment provides products for consumer health care, such as dietary supplements and pain management, as well as gastrointestinal, respiratory and personal care. This segment markets its products under several well-known brands, including Prevnar 13, Eliquis, Lyrica, Viagra, Advil and Centrum. The Essential Health segment offers products that will lose or have lost marketing patent protection, branded generic products, sterile injectable products, and infusion systems. It provides products under the Lipitor, Premarin family, Norvasc, Lyrica, Celebrex and Pristiq brand names.

The company’s current $0.34 quarterly dividend payout is 6.3% higher than the $0.32 distribution from the same period last year. The current $1.36 annualized dividend payout amount yields 3.7%, which is almost 10% above the company’s own 3.4% average yield over the past five years and notably higher than the average yield of Pfizer’s industry peers. Pfizer’s current 3.7% yield is 89% higher than the 1.97% average yield of all the companies in the Drug Manufacturers segment and more than six times higher than the meager 0.6% average yield of the entire Healthcare sector.

The company started distributing dividends to its shareholders in 1901. Over the past two decades, the company has hiked its annual dividend distribution amount 18 times. Pfizer cut its annual dividend nearly 44% over a two-year period between 2009 and 2010. After that most recent dividend cut, the company resumed boosting its annual distributions and has enhanced its annual payout for the past eight consecutive years. The company’s dividend recovered completely from the 44% cut in 2009 and 2010 and Pfizer distributed the same $1.28 annual dividend in 2017 as it did in 2008 prior to that most recent dividend cut. The total annualized dividend for 2018 is 6.3% above last year’s total distribution and the 2008 payout.

Over the past eight consecutive years, the company enhanced its annual dividend at an average growth rate of 8.3% and nearly doubled its total annual payout since 2010. Even with the 44% dividend cut in 2009 and 2010, Pfizer’s annual payout amount grew at an average annual growth rate of 8.5% per year and expanded almost 440% over the past two decades.

The share price began its trailing 12-month period with a 4.4% drop towards its 52-week low of $31.15, which it reached on January 24, 2017. After the January low, the share price jumped more than 11% by mid-March. However, that uptrend reversed immediately, the share price lost 8.3% by early June and closed on June 8, 2017, at $31.75, which was less than 2% above the 52-week low from January 2017.

After the June trough, the share price rose with considerably less volatility and reached its new 52-week high of $37.20 on December 15, 2017. After the December peak, the share price pulled back 1.7% and closed on January 11, 2018, at $36.56, which was 12.1% than it was one year earlier and 17.4% higher than the 52-week low from January 2017.

Dividend increases and decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic