Pinnacle West Capital Corporation Pays Rising Dividend That Yields 3.4% (PNW)

By: Ned Piplovic,

The Pinnacle West Capital Corporation (NYSE:PNW) — an Arizona-based utility company — is rewarding its shareholders with rising dividends that yield 3.4%, which is more than 40% higher compared to the straight average yield across the entire utilities sector.

The company managed to avoid cutting its annual dividend amount in more than two decades and has a current streak eight-year streak of consecutive annual dividend distribution hikes. Despite a slight share price pull back at the end of the current trailing 12-month period, the company managed a double-digit percentage total return on investment over the past year.

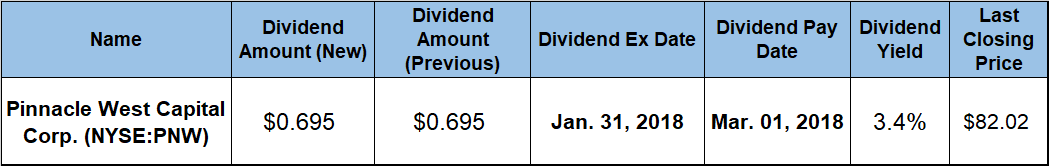

The Pinnacle West Capital Corporation will pay its next dividend distribution on March 1, 2018 to all its shareholders of record before the company’s next ex-dividend date, which is set for January 31, 2018.

Pinnacle West Capital Corporation (NYSE:PNW)

Founded in 1920 and headquarters in Phoenix, Arizona, the Pinnacle West Capital Corporation provides retail and wholesale electric services primarily in the state of Arizona through its two subsidiaries — Arizona Public Service Company and Bright Canyon Energy. The company owns or leases more than 6,250 megawatts of regulated generation capacity. PNW uses coal, nuclear, gas, oil and solar resources to generates electric power, which it then transmits and distributes to its residential and commercial customers in the region. As of November 2017, the company served approximately 1.2 million customers in 11 out Arizona’s 15 counties and expects to add 700,000 new customers by 2030. The Pinnacle West Capital Corporation is Arizona’s largest and longest-serving electric company.

The company’s current quarterly dividend distribution of $0.695 is 6.1% higher than the $0.655 payout from the same quarter of last year. This current quarterly payout of $0.695 converts to a $2.78 annual payout and a 3.4% forward dividend yield. Pinnacle West Capital Corporation’s current 3.4% yield outperforms the 2.36% average yield of the entire Utilities sector by more than 43% and it is almost 47% higher than the 2.31% average yield of the company’s peers in the Electric Utilities market segment.

The company started paying dividends in 1993 and has raised its annual dividend payout amount 80% of the time. The current streak of consecutive annual dividend boosts stands at eight years and PNW has not cut its annual dividend payout in more than two decades. The company failed to hike its annual distribution and paid a flat $2.10 annual amount each year between 2008 and 2011.

However, after resuming dividend hikes in 2012, the company enhanced its annual payout every year at an average growth rate of 3.6% over the past eight consecutive years. Even with four years of flat dividend distribution between 2008 and 2011, the company managed to achieve a 4.2% average dividend growth rate over the last two decades, which is 17% higher the 3.6% growth rate for the current consecutive boosts streak.

The share price lost approximately 1% between January 10, 2017 and its 52-week low of $76.44 on January 30, 2017. After that slight drop, the price reversed trend and over the following 10 months ascended more than 20% — with just two temporary drops of more than 5% each — to reach its new all-time high of $91.81 of by November 30, 2017. Since the November peak, the share price pulled back 10.7% and closed on January 9, 2018 at $82.02, which was 6.3% higher than its was one year earlier, 7.3% higher than the 52-week low from the end of January 2017 and 56% above its price from five years earlier.

The company rewarded its shareholders with a 10% total return over the past 12 months. Additionally, over the longer periods of the past three years and five years, the company managed shareholder total returns of 30% and 85%, respectively.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic