Sonic Corporation Hikes Annual Dividend Four Consecutive Years (SONC)

By: Ned Piplovic,

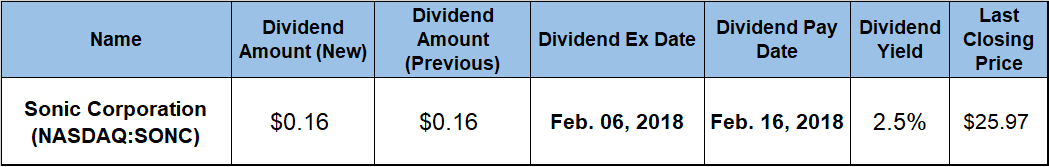

The Sonic Corporation (NASDAQ:SONC) offers its shareholders a 2.5% yield and four consecutive years of annual dividend hikes at a double-digit-percentage growth rate.

In addition to enhancing its annual dividend at a steady pace over the past few years, the company’s share price is trending higher for the trailing 12-month period and recovering quickly from its 52-week low, reached in September 2017.

The company will distribute its next dividend on February 16, 2018, to all its shareholders of record before the ex-dividend date, which is set for February 6, 2018, just 10 days prior to the company’s dividend pay date.

Sonic CorporationSolutions Inc. (NASDAQ:SONC)

Founded in 1953 and headquartered in Oklahoma City, Oklahoma, the Sonic Corporation operates and franchises a chain of quick-service drive-in restaurants in the United States. As of August 31, 2017, the company operated almost 3,600 Sonic Drive-Ins in 45 states. The company owned and operated 228 of its own locations and franchisees owned and operated the remaining locations. In addition to store operation and franchising, the company owns and leases or subleases 188 properties to franchisees and other external parties.

The company’s current $0.16 quarterly dividend amount is 14.3% higher than it was in the first quarter of 2017. The annualized $0.64 dividend distribution for 2018 yields 2.5%. Compared to the 1.67% average yield of all the companies in the Restaurants segment, Sonic’s 2.5% dividend yield is almost 48% higher. Excluding companies in the Restaurants segment that do not pay dividend increases the average yield to 2.27%. However, Sonic’s 2.5% yield is still 8.65% higher than the 2.27% average yield of all the dividend-paying peers in the Restaurants industry. Additionally, the company’s current yield is 34% higher than the 1.84% average yield of the entire Services sector.

The company started paying dividends in the last quarter of 2014 and has boosted its annual payout every year. Including the annualized total annual dividend for 2018, the company grew its annual dividend payout at an average rate of 15.5% per year. Because of this high growth rate, Sonic’s current annualized dividend amount for 2018 is 78% higher than the initial annualized dividend in 2014.

The company’s share price experienced a few significant trend reversals over the past 12 months. At the onset of the current trailing 12-month period, the share price fell 14.4% between January 17, 2017, and the middle of March 2017. After that drop, the share price reversed trend and shot up 37.2% to reach the current 52-week high of $29.78 by June 1, 2017.

However, the share price traded in peak territory for fewer than two weeks before tumbling down more than 25% and reaching its 52-week low of $22.27 on September 7, 2017 — a little more than 90 days after its peak. After bottoming out at the beginning of September, the share price changed direction again and rose 27.5% to regain more than 80% of its loses and close at $28.39 by December 27, 2017.

The Sonic Corporation released mixed financial results for the first quarter of fiscal 2018 – which ended on November 30, 2017 – on January 8, 2018. For the first quarter, the company missed revenue estimates, but exceeded analysts’ earnings estimates by 20%.

Since the end of 2017, the share price has lost more than 9%, and it closed on January 16, 2018, at $25.97. However, even at that level, the share price was approximately 2.5% higher than it was 12 months earlier and 16.6% higher than its 52-week low from early September 2017.

Sonic’s outlook for fiscal 2018 is positive. The company expects a 5% to 10% year-over-year growth of adjusted earnings per share for fiscal 2018, without considering any positive impact of the U.S. tax reform. If Sonic meet these expectations for the fiscal year, the current price dip could be the last opportunity to buy the company’s shares at a discount and collect a rising 2.5% dividend distribution while waiting for the assets to appreciate on positive financial performance.

Dividend increases and decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic