The Clorox Company Offers Four Decades of Rising Dividends, 20% One-Year Asset Appreciation (CLX)

By: Ned Piplovic,

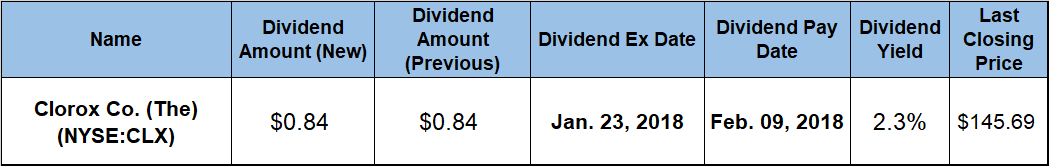

The Clorox Company (NYSE:CLX) continues rewarding its shareholders with rising dividends after more than four decades and currently offers a 2.3% dividend yield.

Additionally, the company managed to complement its long-term rising dividends with asset appreciation that saw the company’s share price nearly double over the past five years and rise almost 20% over the past 12 months.

With a January 23, 2018, ex-dividend date and a February 9, 2018 pay date, interested investors have time to investigate Clorox’s financial performance and outlook before taking a long position in this company’s stock.

The Clorox Company (NYSE:CLX)

Founded in 1913 and headquartered in Oakland, California, The Clorox Company manufactures and markets consumer and professional products. The company operates through four segments: Cleaning, Household, Lifestyle and International. In its product lineup, the company offers laundry additives, home care products, stain fighters and color boosters under the Clorox, Formula 409, Liquid-Plumr, Pine-Sol, S.O.S. and Tilex brands, as well as Green Works branded naturally-derived products. CLX manufactures and distributes professional cleaning and disinfecting products under the Clorox, Dispatch, Aplicare, HealthLink and Clorox Healthcare brands as well.

Additionally, the company makes charcoal products under the Kingsford and Match Light brands, as well as bags, wraps, and containers under the Glad brand. Cat litter products under the Fresh Step, Scoop Away and Ever Clean brands are also part of the company’s product portfolio. Additionally, the company owns Hidden Valley, KC Masterpiece, Kingsford and Soy Vay brands used for distribution of dressing and sauces, the Brite water-filtration systems and filters brand and the Burt’s Bees brand of natural personal care products.

The company’s current $0.84 quarterly dividend is 5% higher than the $0.80 dividend payout from the same quarter last year. The current quarterly distribution is equivalent to a 2.3% dividend yield and a $3.36 annual dividend distribution. This current dividend yield is 48% higher than the 1.56% straight average yield of the entire consumer goods sector and 124% higher than the 1.03% average yield of all the companies in the cleaning products segment.

The company started paying dividends 49 years ago in 1968 and the current streak of consecutive rising dividends goes back to 1976. Just over the past two decades, CLX boosted its annual dividend at an average growth rate of 8.3% per year. Because of the 8.3% growth rate, Clorox enhanced its annual dividend payout almost five-fold over the past 20 years.

The long-term rising dividend history earned the Clorox Company a spot on the exclusive list of 51 companies that are designated Dividend Aristocrats. In addition to a record of raising annual dividends for at least 25 consecutive years, Dividend Aristocrats must be part of the S&P 500 Index and must have a market capitalization of more than $3 billion.

The company’s share price descended about 3% from $122.70 on January 5, 2017, to its 52-week low of $118.75 on January 11, 2017. After bottoming out in mid-January 2017, the share price rose 14.4% to $138.66 by mid-March. Over the subsequent six months, the share price traded mostly sideways and then fell almost 9% between mid-September and the end of October.

However, the share price jumped more than 19% between November 1, 2017, and December 26, 2017, when at the share price reached its 52-week high of $149.69. Since the December 2017 peak, the share price has pulled back 2.7% and closed on January 4, 2018, at $145.69, which is 18.7% above the share price from January 5, 2016, 22.7% higher than the 52-week low from January 2017, 16.7% higher than the November 2016 52-week low and 93% higher than it was five years earlier.

Related Articles:

5 Best Dividend Aristocrats to Buy Now

The Dividend Aristocrats Investing Strategy and Stocks List

The Best Dividend Aristocrats ETFs

Why Invest in the Dividend Aristocrats?

The S&P 500 Dividend Aristocrats — Everything You Need to Know

What are the Dividend Aristocrats?

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic