Xenia Hotels & Resorts Offers Dividend Boosts, 4.9% Yield (XHR)

By: Ned Piplovic,

Only in its third year of operation as an independent entity, Xenia Hotels & Resorts, Inc. (NYSE:XHR) has rewarded investors with rising dividends every year so far and it currently offers above-average yields of approximately 5%.

In addition to the above-average dividend yields, the company has grown its annual dividend amount at double-digit-percentage rates every year. Xenia Hotels & Resorts also has grown its share price more the 15% in the last 12 months.

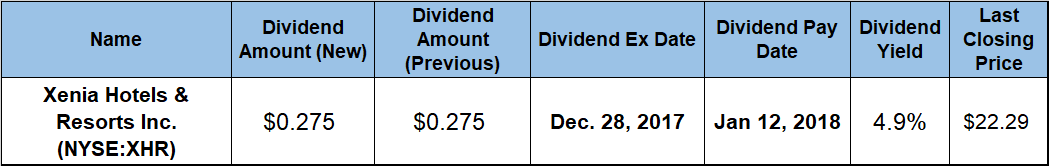

The company’s next ex-dividend date is on December 28, 2017, with the pay date following approximately two weeks later, on January 12, 2018.

Xenia Hotels & Resorts Inc. (NYSE:XHR)

Xenia Hotels & Resorts, Inc. operates as a self-advised and self-administered real estate investment trust (REIT). The company was created in February 2015 as a spin-off from the InvenTrust Properties Corporation. Xenia Hotels & Resorts owns a diversified portfolio of lodging properties operated by well-known industry brands such as Marriott, Hyatt, Kimpton, Aston, Fairmont, Hilton and Loews, as well as other leading independent management companies. The company’s primary strategy is to invest in premium, full-service lifestyle and urban upscale hotels in Top 25 Markets and key leisure destinations. As of October 2017, the company owned 39 hotels with nearly 12,000 rooms across 18 states and the District of Columbia. Currently, the company’s headquarters are in Orlando, Florida.

The company’s current quarterly dividend distribution of $0.275 is equivalent to a $1.10 total annual dividend payout and a current dividend yield of 4.93%. XHR’s current 4.93% dividend yield is almost 12% higher than the 4.41% average dividend yield of all the companies in the Hotel-Motel REIT segment and it is 31% higher than the 3.77% average dividend yield of the entire financials sector.

While the company has a record of only three years of operation, it has increased significantly its total annual dividend amount every year. The company has hiked its total annual distribution at an average growth rate of 13.5% per year since the REIT started paying rising dividends in early 2015. Even with just a brief history of rising dividends, the company managed to boost its total annual dividend distribution amount by 46% in less than three years.

The REIT’s share price started its current trailing 12-month period with a 14.4% slide from $19.24 on December 15, 2016, down to its 52-week low of $16.47, which it reached by March 9, 2017. However, after languishing not far above the 52-week levels for most of March 2017, the share price embarked on a relatively steep uptrend.

Since the end of March 2017, the share price rose more than 35% to reach its 52-week high price of $22.29 at closing on December 15, 2017. That closing price is just 2% shy of the company’s all-time high share price of $22.75, which it reached in March 2015 – only a few weeks after the company was spun off from its former parent company.

Additionally, the closing price on December 15, 2017, was almost 16% higher than it was one year earlier on December 15, 2016. Because the share price had to recover from a 35% share price drop between May 2015 and January 2016 before making any gains, the current share price is only 8% higher that the REIT’s initial share price of $20.70 on February 3, 2015.

However, in the last 12 months, the share price and the dividend income have combined to reward the company’s shareholders with a 23% total return. After becoming an independent business entity in February 2015, the company achieved total return of more than 70% in less than three years.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic