2 REITs Boost Dividends 5%-Plus and Offer 4%-Plus Yields

By: Ned Piplovic,

Two real estate investment trusts (REITs) have rewarded their stockholders with another boost to their annual dividends and 4%-plus dividend yields.

These two REITs have boosted their annual dividend payouts around 5% every year for several years. The current dividend hikes continue that trend with annual increases of around 5.5%.

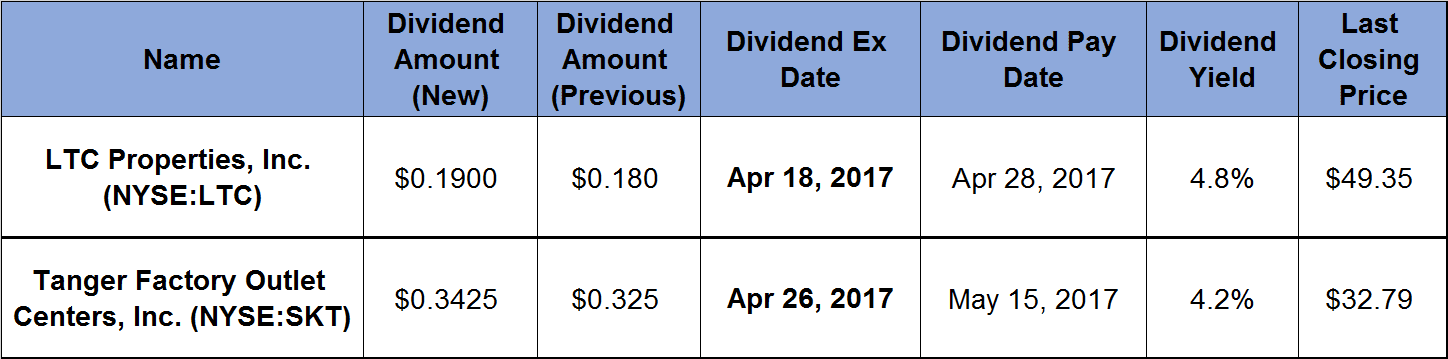

One of the REIT’s ex-dividend dates is April 18, while the other is later in the month on April 26.

LTC Properties, Inc. (NYSE:LTC)

LTC Properties, Inc. operates as a health care real estate investment trust (REIT) in the United States. It invests in senior housing and long-term health care properties. Its portfolio consists of 89 skilled nursing properties, 102 assisted living properties, 14 other senior housing properties, two schools and a parcel of land under development.

The current monthly dividend bump of 5.6% increases the track record of boosting the annual dividends to seven consecutive years. The new monthly distribution amount of $0.19 is equivalent to a $2.28 annual payout and a 4.6% yield. Over the past seven years, LTC Properties has been raising its annual dividend payout by an average 5.6%.

The REIT’s share price rose 16% between April and the beginning of September 2016, when it reached its 52-week high of $54.20. The share price dropped more than 25% and hit its 52-week low in early November. Between November 2016 and mid-March 2017, the stock traded generally between $45 and $47. Since mid-March, the share price has been on a steady uptrend and rose 9.25% by April 11, 2017.

While the current price is about 9% below the September price peak, that is 14% higher than the November bottom and almost 6% above the share price from April 2016.

Tanger Factory Outlet Centers, Inc. (NYSE:SKT)

Tanger Factory Outlet Centers, Inc. is a real estate investment trust. The firm focuses on developing, acquiring, owning, operating and managing outlet shopping centers. Tanger Factory Outlet Centers owns and operated 44 outlet centers in 22 U.S. states and Canada.

The company boosted its current dividends by 5.4%. The new quarterly payout converts to a $1.37 annual payout and a 4.2% dividend yield. Since 1997, the REIT boosted its regular dividend at an average 4.7% annual rate every year. Over the past five years, the average dividend growth rate was even higher at 10.4%.

Regrettably, the share price has not performed as well as the dividend income distribution. The share price rose 15% between April and mid-July 2016. However, the price dropped 36% by the beginning of March 2017. Since March 9, 2017, the share price rose almost 6%. However, that is still 11% below April 2016 levels and 22% lower than the July 2016 price peak.

Many major retailers are reducing their store count and a considerable number of retail malls are struggling because of increased competition from online shopping. However, while the retail sector might be struggling overall, outlet shopping could be the one bright spot.

In the outlet segment, Tanger Factory Outlet Centers could be the one speculative pick for high returns. It has no anchor stores and no exposure to the retailers in trouble, such as Macy’s or Kohl’s.

Steven Tanger, Tanger Factory Outlet Centers president & CEO, appeared on CNBC earlier this month and discussed his outlook on the retail market. Mr. Tanger said that as many full-price retail stores are closing, “it helps the outlets, because there is less dilution of the consumer spending at retail and more focus on value.”

Additionally, Tanger stated that his company’s business model is more resilient to retail market volatility and that in its 36-year existence, Tanger Factory Outlet Centers has never ended a year below 95% occupancy.

While this stock is a speculative pick, the CEO’s prediction that Tanger Factory Outlet Centers will take advantage of the current retail marked consolidation might materialize. In that case, the current share price drop could turn out to be an opportunity to buy SKT shares at discount while collecting a dividend income with a 4.2% yield.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox. In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic