Dividend-Paying Electric Vehicle Manufacturing Stocks Face Threat from Tesla and Newcomers

By: Paul Dykewicz,

Dividend-paying electric vehicle manufacturing stocks face a threat from new entrants led by Tesla (NASDAQ:TSLA) that include developers of a one-seat, three-wheel commuter car, delivery trucks and light duty trucks for commercial fleets.

The dividend-paying electric vehicle manufacturing stocks for investors to consider now have fledgling rivals seeking to serve market niches by offering unique capabilities that established automobile companies may not target as keenly. However, the competitive road ahead for dividend-paying electric vehicle manufacturing stocks and their entrepreneurial electric vehicle (EV) rivals will require attaining scale, meeting price points customers will pay, availability of interstate charging stations and obtaining cost-effective and powerful battery technology to substitute for fuel stations.

Electrameccanica Vehicles Corp. (NASDAQ:SOLO), of Vancouver, British Columbia, plans to offer a one-seater, three-wheel EV that will be priced at $18,500. It is meant to be a commuter vehicle, since 80 mph will be its top speed and it will have a limited travel range of 100 miles per charge.

Three Traditional Dividend-Paying Electric Vehicle Manufacturing Stocks Will Be Fueled by Electrifying $142 Billion Investment

Traditional automobile manufacturers are pumping tens of billions of dollars into EV development individually. Detroit’s General Motors (NYSE:GM) announced plans to spend $27 billion on all-electric and autonomous vehicles, as well end production of internal-combustion engine (ICE) vehicles and only offer zero-emission models by 2035. GM also plans to offer 30 new EVs globally by 2025. General Motors suspended its dividend in 2020 amid the raging COVID-19 crisis but is considering restoring it in the months ahead.

Ford Motor Co. (NYSE:F), of nearby Dearborn, Michigan, is committing more than $22 billion into its electric vehicle program through 2025, with an additional $7 billion going to driverless-vehicle tchnology, the company announced Feb. 4. The global pandemic caused Ford to suspend its dividend but it is among the traditional auto makers that typically resume the payout as the cyclical industry recovers from weakness.

European automobile manufacturing powerhouse Volkswagen Group (OTCMKTS:VWAGY) disclosed plan in November 2020 to raise spending on technologies for electric and self driving cars by boosting its financial commitment to $86 billion, or half the company’s budget through 2025, while increasing production of EVs in its home market of Germany. It marks a $15 billion jump from the $71 billion, or 40% of its budget, it announced the prior year. Vokswagen currently offers investors a 3.15% dividend yield.

Perry Picks SOLO to Find a Place to Survive Among Dividend-Paying Electric Vehicle Manufacturing Stocks

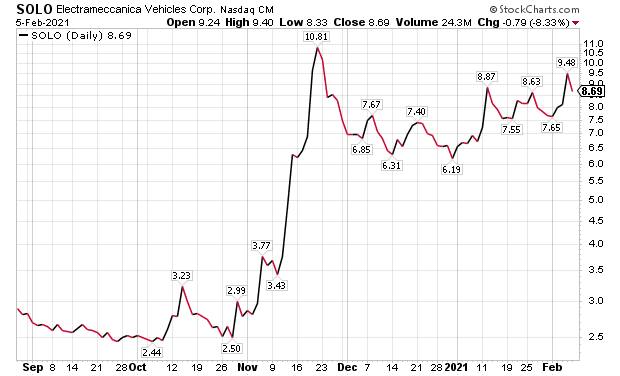

Bryan Perry, who recommended SOLO in his Hi-Tech Trader service on Jan. 15, watched the stock rise 5.81% through the close of trading on Feb. 2. Based on pure EV sector momentum, he has a target on the stock’s share price of $12, projecting a 58.52% gain from his buy price.

Chart courtesy of www.stockcharts.com

Perry, who also heads the Cash Machine investment newsletter, as well as the Premium Income and Breakout Profits Alert advisory services, wrote that sales for the manufacturer’s three-wheel SOLO electric vehicle are “starting to take off.” Much the way Tesla gained pre-orders online for its vehicles online, SOLO is doing likewise at the following web link: https://electrameccanica.com/product/solo-reservation/.

ElectraMeccanica Vehicles announced on Jan. 15 that it is expanding its retail network to three new West Coast locations in March to boost the total number to 13 across 10 major markets. The newest direct-to-consumer retail locations will be in Corte Madera, California, Orange County, California, and Tucson, Arizona.

Electric Vehicle Manufacturing Stocks to Consider Include Canadian Startup

Built for a single occupant, the SOLO vehicle will provide a unique driving experience for environmentally conscious consumers. The EV’s safety measures feature front and rear crumple zones, side-impact protection, roll bar, torque-limiting control, power steering, power brakes, air conditioning and a Bluetooth entertainment system.

Forbes magazine included the vehicle among its rankings of the “coolest new cars” for 2020 from manufacturers such as Aston Martin, Cadillac and Tesla. However, Perry cautioned that the early-stage EV company is a speculative investment.

ElectraMeccanica Vehicles became a target of public scorn on Nov. 15. Citron Research, a short seller, claimed the stock was “laughably” overvalued and would fall back to $2 a share. Citron is the same short seller that recently caused users of a Reddit forum, called r/wallstreetbets, or r/WSB, to battle it by bidding up the share price of GameStop (NYSE:GME), a retailer of video games and entertainment with 500-plus stores and e-commerce properties across 10 countries.

Dividend-Paying Electric Vehicle Manufacturing Stocks and Rivals Gain Radio Host Kramer’s Attention

Hilary Kramer, who hosts the nationally aired “Millionaire Maker” radio program and heads the GameChangers and Value Authority advisory services, said she is not “extremely bullish” about any of the junior EV manufacturers as long as Tesla remains the $800 billion elephant in the room. The reality is that there really is “no easy outcome,” since Tesla CEO Elon Musk seems to have become the world’s most visible EV leader and the industry’s newly public stocks in that category likely will rise to unsustainable valuations, leaving shareholders vulnerable for long-term disappointment, she said.

“SOLO is a bit of an outlier because it isn’t trying to crowd into the gas-powered family car segment,” Kramer said. “Its recreational vehicles don’t directly compete with Tesla sedans. They’re really more like closed-cabin scooters and there’s room for both companies to succeed.”

Columnist and author Paul Dykewicz interviews money manager Hilary Kramer, whose premium advisory services include IPO Edge, 2-Day Trader, Turbo Trader, High Octane Trader and Inner Circle.

Fisker Looks to Compete With Dividend-Paying Electric Vehicle Manufacturing Stocks

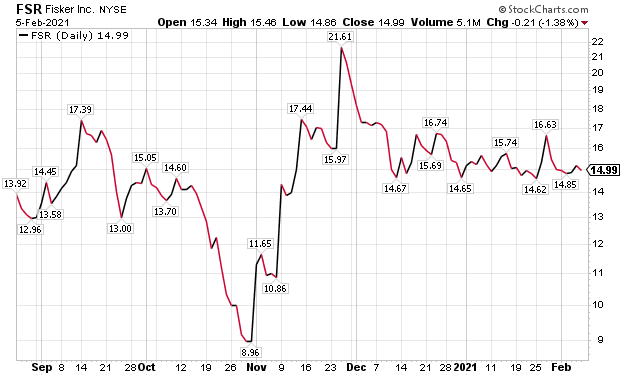

If forced to choose a sedan manufacturer, Kramer said she would pick Fisker Inc. (NYSE:FSR), which is still a niche brand but has designer cachet, assembly contracts in place and a 10,000-car waiting list.

“That’s nearly $400 million in revenue in the pipeline and the first production models roll out this summer,” Kramer said. “It might never conquer the world, but at $15 a share, it doesn’t really need to defeat Elon Musk to make investors happy. All it really needs to do is convince a conventional car company like GM to buy it out.”

As for Tesla, the market has priced the stock beyond achieving “world domination,” Kramer said. In a good year, 86 million consumer cars get sold around the world, she continued.

Chart courtesy of www.stockcharts.com

Speculative Fervor of Investors May Affect Dividend-Paying Electric Vehicle Manufacturing Stocks

“Even if Elon Musk takes over that entire category, it’s going to take him about a decade and I don’t see the stock doing much better than tripling over that timeline,” Kramer said. “That’s basically my long-term target on the S&P 500, so unless Tesla becomes a lot more than cars, you’re unlikely to beat old-fashioned vanilla index funds from here. A whole lot of success is already baked into the stock at this level. On the other hand, a whole lot can still go wrong.”

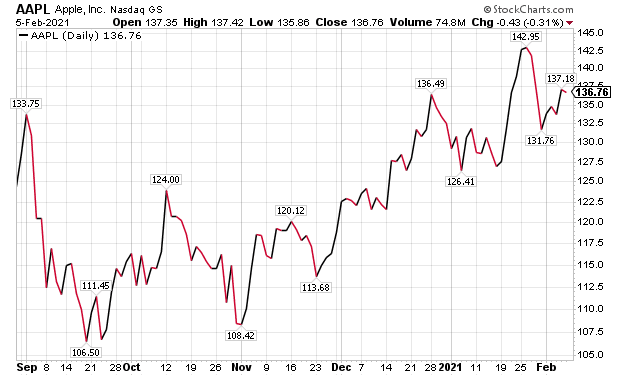

For example, Apple Inc. (NASDAQ:AAPL) intends to put a car on the market in the next few years, Kramer said. Win or lose, that’s going to complicate the competitive landscape, she added.

Asian news reports indicate that Apple plans to invest $3.6 billion in South Korea’s Kia Motors Corp. to collaborate with the car builder to develop electric vehicles. Apple also offers investors a current dividend yield of 0.60%.

Chart courts of www.stockcharts.com

Dividend-Paying Electric Vehicle Manufacturing Stocks Face Competition from New Truck Makers

In 2018, the U.S. transportation system moved a daily average of about 51.0 million tons of freight valued at more than $51.8 billion. Plus, estimated tonnage is projected to rise about 1.2% per year between 2018 and 2045, according to the Bureau of Transportation at the U.S. Department of Transportation.

The largest percentage of goods, by weight and value, move relatively short distances of less than 250 miles, the Bureau of Transportation reported. Roughly 67.1% of the weight and 51.8% of the value of goods moved less than 250 miles between origin and destination in 2018. In contrast, about 7.5% of the weight and 16.8% of the value of goods moved 1,000 miles or more, according to the bureau.

Indeed, electrification requires infrastructure development, and it can be difficult for fleet owners to justify the time commitment needed to obtain it. While development time frames can vary, most industry professionals know they may need up to two years to establish the required electric vehicle infrastructure, according to Mortenson, which is engaged in engineering, procurement and construction of renewable energy and other electric infrastructure.

Investments in zero and near-zero emission vehicles for public and private fleets are growing, and fleet owners are balancing the costs and benefits of converting their conventional combustion fleets to clean technology, Mortenson found. To understand the dynamics facing fleet and transit owners in their clean transportation journey, Mortenson surveyed 200-plus professionals at the 2019 Advanced Clean Transportation Expo. Survey participants consisted of clean transportation leaders, as well as public and private-sector fleet owners, policymakers, public infrastructure developers and the suppliers.

Workhorse Plots Future Amid Dividend-Paying Electric Vehicle Manufacturing Stocks

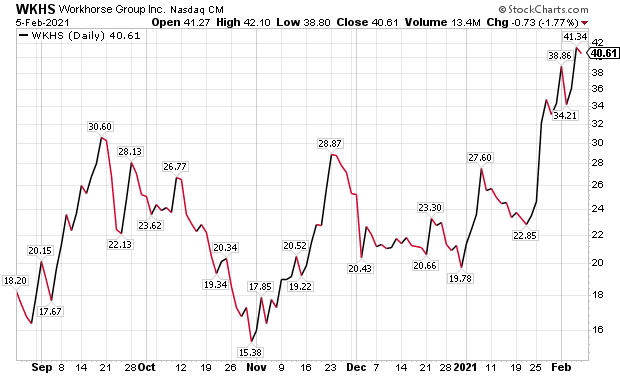

Workhorse (NASDAQ: WKHS), of Cincinnati, Ohio, is focused on manufacturing electrically powered delivery and utility vehicles. It is angling to win a U.S. Postal Service contract worth up to $6.3 billion to provide delivery trucks.

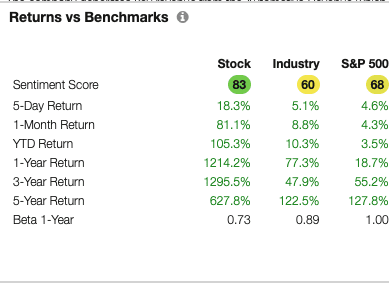

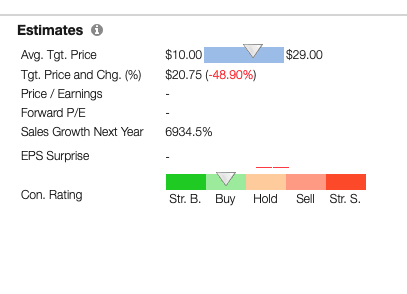

Source: Stock Rover. Click here to sign up for a free two-week trial.

A hefty contract came to Workhorse when Pride Group Enterprises, a privately held Canadian and U.S.-based company in transportation equipment retail, wholesale, rental, leasing and logistics, ordered 6,320 C-Series all-electric delivery vehicles. The deal reportedly approached $500 million.

Investors will want to be careful with Workforce, since the stock missed its second- and third-quarter bottom-line guidance by wide amounts. Workhorse is expected by analysts to lose money this year, despite signing a technology pact with Hitachi America and Hitachi Capital America Corp. in 2020.

Chart courtesy of www.stockcharts.com

Lordstown Motors Looks for Niche Among Dividend-Paying Electric Vehicle Manufacturing Stocks

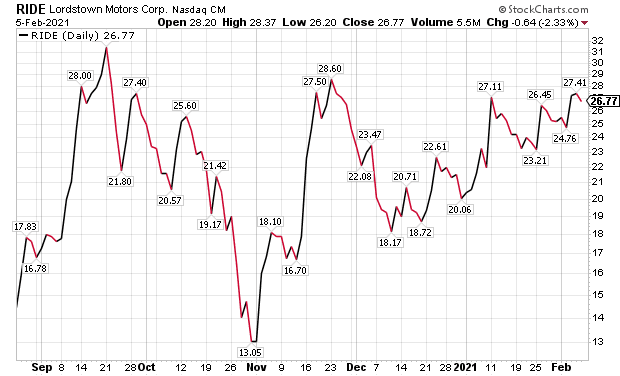

Lordstown Motors, which completed its initial public offering (IPO) on October 29, 2020, now trades on the NASDAQ under the ticker symbol RIDE.

“Electrification of the automotive industry is at an inflection point, and this transaction helps us play our part in this transformation,” said Steve Burns, founder and chief executive officer of Lordstown Motors. “At Lordstown, we have built a differentiated company, and we look forward to combining our EV startup culture with the infrastructure and assets we already have in place in order to successfully achieve our production milestones.”

Chart courtesy of www.stockcharts.com

Lordstown Motors, which unveiled the prototype of its flagship Endurance pickup truck in June 2020, remains on pace to commence commercial production in the second half of 2021 at its plant in Lordstown, Ohio. The Endurance’s use of an in-wheel hub motor design is expected to deliver superior performance, efficiency and safety, while providing a significant reduction in cost of ownership for commercial fleet owners.

“We have a near production-ready plant and approximately $675 million in proceeds from this transaction, which is more than enough funding to get us through initial production,” Burns said.

The successful execution of this merger included a private investment in public equity (PIPE) financing that occurs when an institutional or other type of accredited investor buys stock directly from a public company below market price. In this instance, General Motors and several long-term institutional investors backed the PIPE. Lordstown Motors plans to offer the first electric pickup truck for commercial fleets.

Pension Fund Head Assesses Dividend-Paying Electric Vehicle Manufacturing Stocks Amid Commerical Customers

Rather than buy stocks of consumer EV companies, consider focusing on commercial EVs instead of consumer EVs, said Bob Carlson, chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets.

“The consumer EVs are heavily promoted and potentially overpriced, while the commercial EVs have received less attention,” continued Carlson, who also heads the Retirement Watch investment newsletter.

Romeo Power, Inc. (NYSE: RMO), and Hyliion Holdings Corp. (NYSE: HYLN) are two niche electric vehicle manufacturing stocks to consider for potential investment that I featured in a recent column.

Los Angeles-based Romeo Power Inc., an energy-technology company that designs, engineers and produces energy-dense, commercially available lithium-ion battery packs, is a stock that Carlson said he is watching. Founded in 2016, Romeo Power’s mission is to electrify the industrial transportation sector by focusing on supplying lithium EV batteries to the medium-duty, short haul and heavy-duty, long haul trucking markets.

Pension fund and Retirement Watch head Bob Carlson answers questions from Paul Dykewicz prior to COVID-19-related social distancing.

Dividend-Paying Electric Vehicle Manufacturing Stocks Seek to Survive and Thrive

Hyliion Holdings Corp., a provider of electrified powertrain solutions for Class 8 commercial vehicles, took its current name on Oct. 1 upon completion of a strategic combination between Hyliion Inc. and Tortoise Acquisition Corp. The deal yielded approximately $520 million in net proceeds to fund Hyliion’s growth plans and its long-term objectives.

Hyliion reported a loss in third-quarter 2020 but installed eight hybrid electric units in that period for four fleet-based customers. Hyliion also agreed with FEV North America Inc. to speed up commercialization of the Hypertruck ERX for the Class 8 truck market, while forming new partnerships to seek an increased share of an $800 million market.

Carlson also is recommending companies that provide the infrastructure and components for EVs instead of those assembling them into final products. Two to consider are San-Diego-based Beam Global (NASDAQ: BEEM), and QuantumScape (NYS:QS), of San Jose, California.

Beam is a provider of innovative sustainable technology for EV charging, outdoor media and energy security. QuantumScape Corp. (NYS:QS), a developer of solid-state lithium-metal batteries for electric vehicles, plunged roughly 41% on Jan. 4 after fallout from a Seeking Alpha article that claimed its solid-state batteries are “completely unacceptable” for electric vehicles.

The stock’s $34.49 per share drop caused it to close at $49.96 on Jan. 4, dumping paper losses on shareholders of billions of dollars in market capitalization. Class action lawsuits have been filed against QuantumScape, and key executives, in the U.S. District Court for the Northern District of California following the plunge in the company’s share price.

Dividend-Paying Electric Vehicle Manufacturing Stocks Endure COVID-19 Crisis

The COVID-19 pandemic killed more than 100,000 people in America in January 2021 to account for the largest death toll of any month since the deadly virus reached the country more than a year ago, according to Johns Hopkins University. But approval by the Food and Drug Administration (FDA) of the first COVID-19 vaccines is giving encouragement as the highest-priority people receive injections and raise hope that a return to a semblance of normalcy could come later this year if the deadly virus can be contained.

COVID-19 cases have climbed to heart-breaking totals and continue rising as a second surge of infections slams society in general across the Earth. The number of cases reached 26,779,193 and led to a distressing 458,791 deaths in the United States, as a huge part of 105,243,379 cases and 2,294,186 deaths worldwide, as of Feb. 5, according to Johns Hopkins University. America has the dreaded distinction as the country with the most cases and deaths.

Dividend-paying electric vehicle manufacturing stocks to consider offer alternative choices to EV startups such as Tesla and those seeking to following in its path to serve market niches. Despite traditional valuation metrics not supporting some of the non-dividend-paying and certain dividend-paying electric vehicle manufacturing stocks at their current share prices, investors have many choices for taking stakes in companies that are part of a seismic shift away from internal-combustion engine dependence to a clean-energy future.

Connect with Paul Dykewicz

Connect with Paul Dykewicz