Four Dividend Stocks to Buy as Inflation Shields

By: Paul Dykewicz,

Four dividend stocks to buy as inflation shields amid price hikes include companies that collectively provide diversification with the opportunity for income and potential capital appreciation.

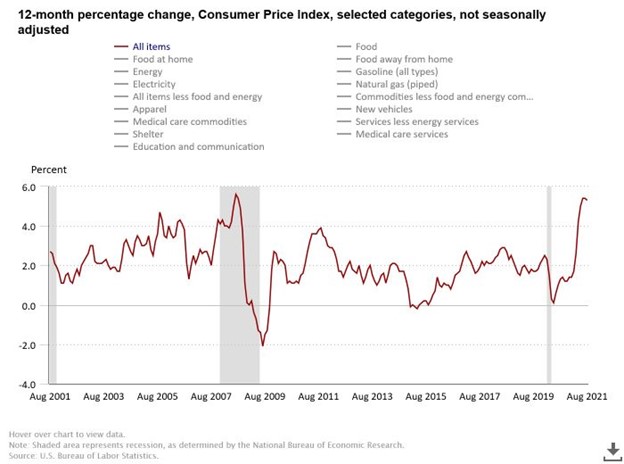

The four dividend stocks to buy as inflation shields could be especially worthwhile after Fed Chairman Jerome Powell testified on Sept. 30 before the House Committee on Financial Services that the U.S. central bank has “no control” over supply-chain “bottlenecks” that led to a 3.6% jump in “core prices,” excluding volatile food and energy, for the 12-months ended July 2021. The Wall Street saying, “Don’t fight the Fed,“ indicates the best way forward may be to decide the time is right to use inflation shields to profit while many companies face supply-chain struggles.

Indeed, the Consumer Price Index (CPI) for All Urban Consumers jumped 5.3% for the 12 months ended August 2021, compared to a 5.4% rise for the 12-month period ended in July 2021. The index for all items, other than food and energy, rose 4.0 percent over the last 12 months ended in August, also just under the 12-month period at the close of July. The energy index soared 25.0% in the past 12 months ended in August 2021, while the food index climbed 3.7%, with both rising from the 12-month period ended in July 2021.

Four Dividend Stocks to Buy as Inflation Shields Feature REITs

Instead of relying on one inflation hedge, investors can consider several ways to shield their portfolios from higher-than-usual price hikes. Investments that traditionally help to fend off the fallout of inflation include producers of consumer goods that people always need include real estate investment trusts (REITs) and business development companies (BDCs). Choosing the right ones at the best times is a key challenge.

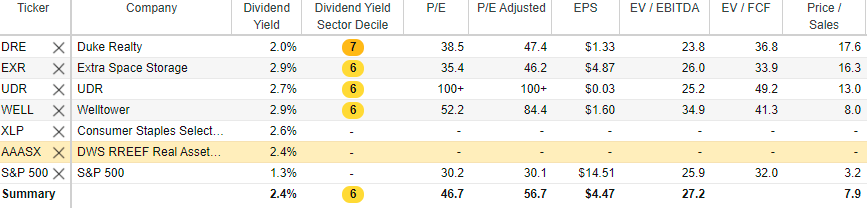

Source: Stock Rover. Click here to sign up for a free two-week trial.

Pension Fund Head Cautions None of the Four Dividend Stocks to Buy as Inflation Shields Will Work All the Time

“It’s important to have a diversified basket of inflation hedges,” said Bob Carlson, chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets. “No inflation hedge has been shown to work well in every inflationary period. You only have to look at the last year for evidence.”

Gold peaked in August 2020 and has had negative returns since then, said Carlson, who also heads the Retirement Watch investment newsletter. “But there have been positive returns in diversified commodities, real estate investment trusts (REITs) and Treasury Inflation-Protected Securities (TIPS). Those are the four main inflation hedges. An investor concerned about inflation should own them all.

Certain stocks and market segments tend to do well in inflationary periods, but these should only be part of a broad inflation hedge portfolio, Carlson continued. A solution for many investors could be a fund that invests in all the inflation shields, he suggested.

A Diversified Fund Could Be Coupled With the Four Dividend Stocks to Buy as Inflation Shields

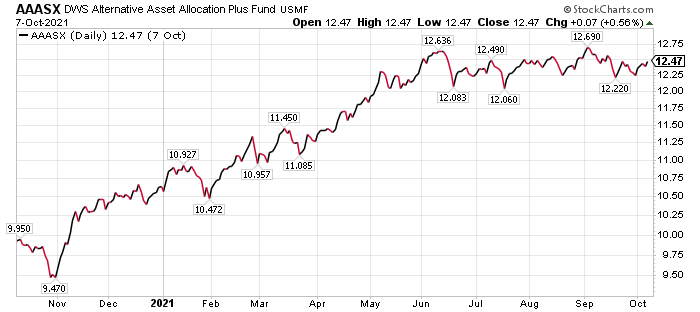

Carlson said he likes DWS RREEF Real Assets Fund (AAASX), which has a number of share classes and each features a different ticker. The best share class for an individual investor depends on the broker or other intermediary through which the fund is purchased, he added.

Chart courtesy of www.StockCharts.com

The fund invests in the four major inflation hedges. Carlson said it tactically changes its allocation to the different categories of hedges based on forecasts of the current economic and inflation cycle. Plus, the fund has analysts who focus on each of the inflation hedges.

“They conduct fundamental analysis of the different subsectors and decide which to own at the time,” Carlson said. “For example, the fund won’t own a basket of commodities that attempts to replicate an index. Instead, it analyzes the outlook for each of the commodities in its investment universe and decides which to overweight and underweight at this time. The fund’s been using this approach for a long time and has a solid record of managing changes in the cycles for each of the real assets it can invest in.”

Pension fund and Retirement Watch chief Bob Carlson answers questions from columnist Paul Dykewicz.

Four Dividend Stocks to Buy as Inflation Hedges Highlights by Cash Cows

One of the most inflation-sensitive sectors for income investors to consider features Business Development Companies, also known as BDCs, said Bryan Perry, who leads the high-yield-focused Cash Machine investment newsletter and the Premium Income, Quick Income Trader, Breakout Profits Alert and Hi-Tech Trader services. BDCs lend capital to small- and medium-sized private businesses, using loans typically of $3-$50 million, he added.

“They make capital readily available quicker than banks, hence their appeal to companies needing immediate funding, Perry said. “In return, they charge interest rates averaging 7%-12%, whereby most loans are of the floating rate variety, indexed to the Consumer Price Index (CPI) or London Interbank Offered Rate (LIBOR).

“As inflation and/or short-term interest rates rise, the loans are adjusted to pay more to the BDC lender. Because BDCs are regulated investment companies, or RICS, they are structured very similar to REITS where they have to pay out at least 90% of income in the form of dividends to shareholders.”

Unlike REITS, they can take equity stakes in the companies they loan to in the form of stock warrants and use leverage and derivatives to enhance income and yield, Perry commented. Due to the current market correction, many BDCs are trading at or right near their 2021 highs, paying yields of 6%-12%, he added.

Paul Dykewicz interviews Bryan Perry, who leads the Cash Machine newsletter.

A couple of BDC recommendations in Perry’s subscription-based high-yield Cash Machine newsletter currently are trading up to their 2021 highs, while one of his REIT recommendations also is pushing towards its previous peak.

Four Dividend Stocks to Buy as Inflation Shields Supported by Catalysts

A long-time fan of REITs and BDCs is Mark Skousen, PhD, a descendant of Benjamin Franklin and the leader of the Forecasts & Strategies investment newsletter and the Home Run Trader, Five Star Trader, TNT Trader and Fast Money Alert advisory services. He has invested profitably in both types of companies in the past and his subscription-based services have positions in them now.

Gold is a traditional hedge again inflation, but the precious metal has yet to rebound from a recent pullback. However, commodities such as steel look better right now, since they are used in construction infrastructure and other big projects.

“Steel prices hit an all-time high of $1,995 per ton last month,” Skousen wrote to his Home Run Trader subscribers on Oct. 4. “Yet demand continues to rise. Part of this is due to the reopening of the world economy.”

The United States and other major countries are proposing many trillions of dollars of infrastructure spending to deep the demand for steel high. At the same time, world steel inventories remain low, added Skousen, who also serves as a Presidential Fellow in economics at California’s Chapman University.

Mark Skousen, a descendant of Ben Franklin who heads the Forecasts & Strategies newsletter, meets with Paul Dykewicz.

BofA Forecasts Real Estate to Rise Amid Risks

BofA Global Research wrote in a recent research note that real estate offers investors an inflation-shield for dividend yield, improving fundamentals and a track record of typically performing well in times such as now. The investment firm added that real estate has been one of the best-performing sectors late in economic cycles.

Other reasons to be positive about real estate, BofA wrote, include:

- Inflation-protected yield: Don’t fight the Fed. If the Fed allows inflation and keeps rates low much longer, look for inflation-proof dividend yield. Of the four highest-yielding sectors, only real estate and energy are not hurt by inflation. Plus, dividends from real estate investment are expected to grow 10% next year to rank second in the S&P 500.

- The sector is a superior way to profit from infrastructure instead of industrials: Real estate has a bigger proportion of traditional capital expenditure beneficiaries than industrials and is less labor-intensive and susceptible to wage inflation than Industrials.

- Post-COVID bear case overblown: Post-COVID risks cited last year were likely overblown. For example, speculation about an urban exodus has been more like a trickle, based on an analysis of BAC credit card data location changes.

- Solid fundamentals: Real estate turned a corner when 2Q 2021 earnings came in 18% above consensus estimates. The sector also ranks No. 1 in providing the best guidance ratio and earnings revisions, amid eroding trends for other cyclicals.

- Insulated from margin pressure: Real estate margins are more insulated from the key near-term earnings risks, such as supply-chain disruptions, wage inflation and a potential tax hike.

- U.S. re-shoring: One key BofA Global Research theme benefitting REITs is peak globalization, where supply-chain disruptions due to COVID-19 have further motivated U.S. companies to cut their dependence on China. Real estate, particularly industrial REITs with exposure to warehouse markets, should benefit from growing demand.

BofA Picks the Four Dividend Stocks to Buy as Inflation Hedges

Top large-cap stock picks at BofA are:

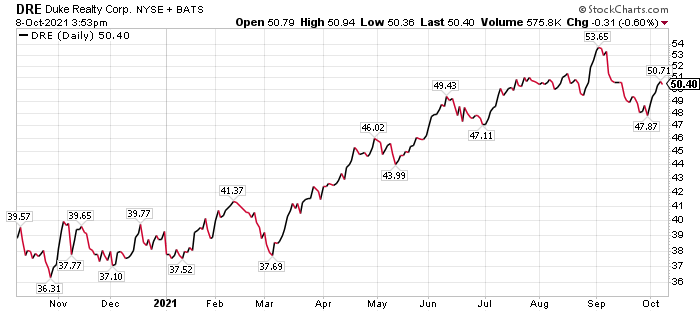

–Duke Realty Corp. (NYSE: DRE), of Indianapolis, Indiana, an owner, developer and manager of industrial properties that feature bulk top warehouses and regional distribution centers;

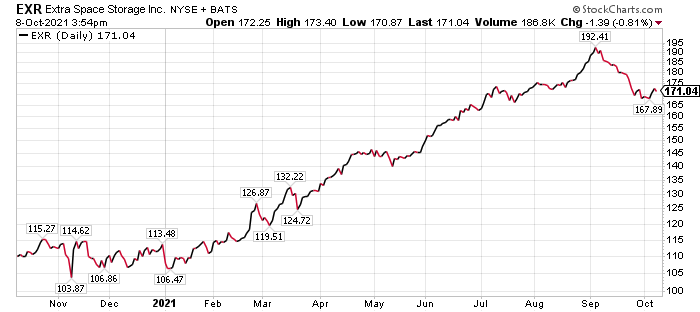

-Extra Space Storage, Inc. (NYSE: EXR), a self-storage unit REIT headquartered in Cottonwood Heights, Utah;

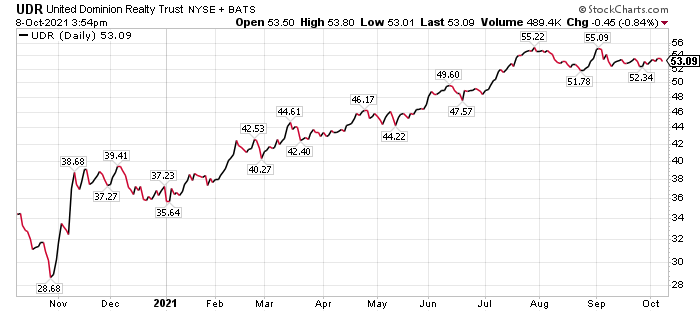

-New York’s UDR Inc., (NYSE: UDR), an operator of luxury apartment communities in hundreds of desirable locations, such as Manhattan’s Upper West Side and San Francisco’s Mission Bay District; and

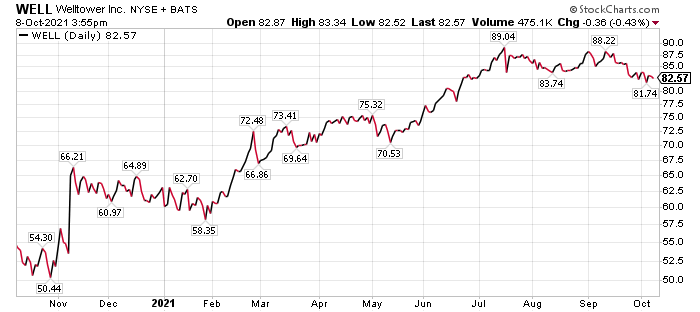

-Welltower Inc. (NYSE: WELL), a Toledo, Ohio, REIT that invests in health care infrastructure.

Duke Realty, focused on logistics real estate since its launch in 1972, offers what its management calls “productivity-enhancing industrial properties.” The REIT owns and manages warehouse and distribution facilities in 20 major U.S. logistics markets nationwide. It also provides sustainable development, property management and leasing services.

BofA’s $58 price objective for DRE is a 15% premium to the investment firm’s forward net asset value (NAV) estimate. This premium reflects the strength of DRE’s warehouse development and operating platform, BofA added.

Chart courtesy of www.StockCharts.com

BoA’s price target for EXR of $218 is based on a 17.5% premium to the investment firm’s forward NAV/share. The premium is based on the strength of the EXR franchise and the company’s technology platform, according to BoA.

Risks to the price target include a significant systemic negative inflection in storage fundamentals and higher interest rates. Potential upside surprises could include more than forecast accretive acquisitions and a better-than-expected fundamental performance fueled by increased consumer demand for self-storage space, BoA added.

Chart courtesy of www.StockCharts.com

BoA’s $61 price objective for UDR assumes the stock trades at a 10% premium to the investment firm’s forward NAV estimate. Risks to reaching that goal include operating conditions in UDR’s markets sliding beyond forecasts, increased project execution and lease-up shortfalls from development projects, timing risk from joint ventures and rising interest rates.

Positive surprises may come from better-than-expected employment and operating conditions in UDR’s markets, as well as lower interest rates.

Chart courtesy of www.StockCharts.com

The $94 price objective for WELL set by BofA accounts for depressed earnings due to the COVID pandemic, as well as expectations of a multi-year period of above average earnings growth due to a rebound in senior housing as the COVID pandemic wanes. The stock’s price may outperform that estimate amid better-than-expected senior housing or medical office building performance, higher-than-forecast dividend growth and reduced interest rates.

But risks remain. They include public-pay reimbursement cuts, a more competitive acquisitions environment, weaker-than-expected senior housing fundamentals, increased tenant credit risk and increasing interest rates.

Chart courtesy of www.StockCharts.com

Consumer Staples ETF Offers Alternative to Four Dividend Stocks to Buy as Inflation Shields

“Higher inflation means rising input costs, and rising input costs can cause pernicious margin compression,” said Jim Woods, editor of the Successful Investing and Intelligence Report newsletters, as well as the leader of the Bullseye Stock Trader and Eagle Eye Opener advisory services.

Investors need to look at companies that can weather rising costs the most, and that means some traditional consumer staples plays, said Woods, who indicated he likes the First Trust Consumer Staples AlphaDEX ETF (FXG) as a path for investors to profit from the consumer staples segment. The ETF tracks an equity index called the StrataQuant Consumer Staples Index.

Chart courtesy of www.StockCharts.com.

“This is a modified, equal-dollar weighted index designed by IDI to objectively identify and select stocks in the consumer staples sector that may generate positive alpha relative to traditional passive-style indices,” Woods said. “The results speak for themselves, as FXG is up 16.4% year to date while the sector benchmark exchange-traded fund (ETF), the Consumer Select Sector SPDR ETF (XLP), is up just 10.4%.”

IDI, an acronym for ICE Data Indices, LLC, constructs the StrataQuant Consumer Staples Index by ranking the stocks in the Russell 1000 Index on growth factors that include three-, six- and 12-month price appreciation, sales to price ratio and one-year sales growth. The stocks also are assessed on value factors, including book value to price, cash flow to price and return on assets.

Paul Dykewicz discusses investments with Jim Woods, editor of Intelligence Report.

Four Dividend Stocks to Buy as Inflation Shields Also Guard Against Worst of COVID-19 Crisis

The Delta variant of COVID-19 has proven to be a highly transmissible threat that is receiving close attention from health experts. In a move that appears renewed optimism, the U.S. Food and Drug Administration (FDA) recently issued emergency use authorization (EUA) for a single booster shot of the Pfizer-BioNTech COVID-19 vaccine.

A booster shot of the Pfizer-BioNTech vaccine can be given to populations that include people ages 65 years and older at least six months after receiving a second dose of that vaccine. The booster also is approved for those aged 18 years and older who have underlying medical conditions, and people aged 18 and older who live or work in high-risk settings.

The Centers for Disease Control and Prevention (CDC) is blaming the variant for recent spikes in case numbers and deaths, despite increasing numbers of people who have been vaccinated against COVID-19. As of Oct. 8, 216,573,911 people, or 65.2% of the U.S. population, have received at least one dose of a COVID-19 vaccine. The fully vaccinated total 186,917,921 people, or 56.3%, of the U.S. population, according to the CDC.

COVID-19 cases worldwide totaled 237,147,819 cases and led to 4,841,663 deaths, as of Oct. 8, according to Johns Hopkins University. U.S. COVID-19 cases climbed to 44,278,838 and caused 712,509 deaths. America has the dreaded distinction as the country with the most COVID-19 cases and deaths.

The four dividend stocks to buy as inflation shields offer potential hedges to help investors duck from the ill effects of rising prices.

Connect with Paul Dykewicz

Connect with Paul Dykewicz