Home Depot Boosts Quarterly Dividend 29% after Strong 2016 Results

By: Ned Piplovic,

Following a positive financial performance in 2016 and an improved outlook for 2017, Home Depot, Inc. (NYSE:HD) declared a 29% increase in its quarterly dividend payout and extended its current record to eight consecutive years of boosting dividends.

A January 2017 www.dividendinvestor.com article highlighted Home Depot as one of three equities that could benefit from any potential boost in the private housing and construction market. Home Depot’s current results and outlook for 2017 appear to support that prediction.

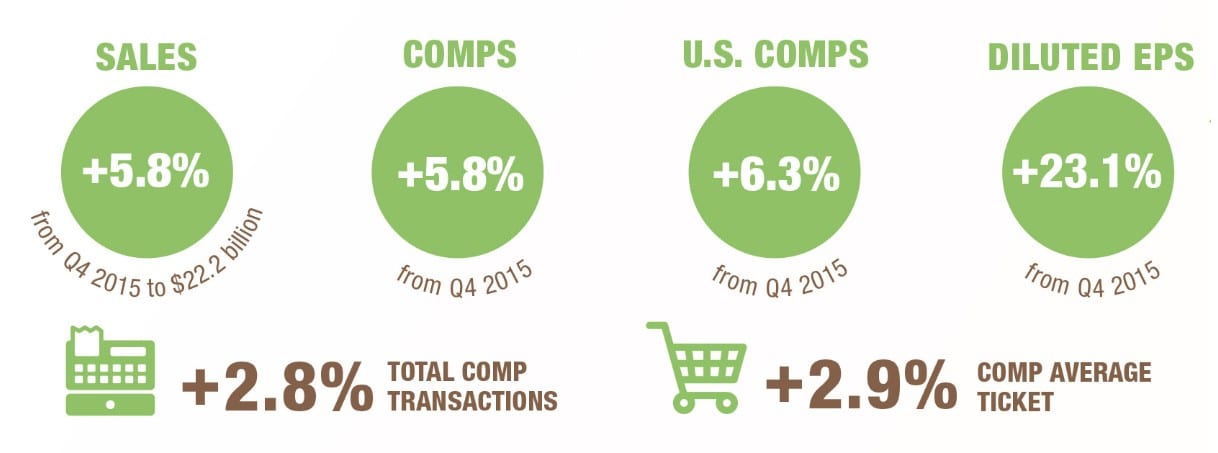

On February 21, 2017, Home Depot reported a fourth-quarter 2016 sales increase of 5.8%, compared to the same period of 2015. Fueled by $22.2 billion in total sales for the quarter, the company realized $1.7 billion in net earnings, or $1.44 per diluted share, which is 23.1% higher than the $1.17 per share it earned in the fourth quarter of 2015.

Dividends

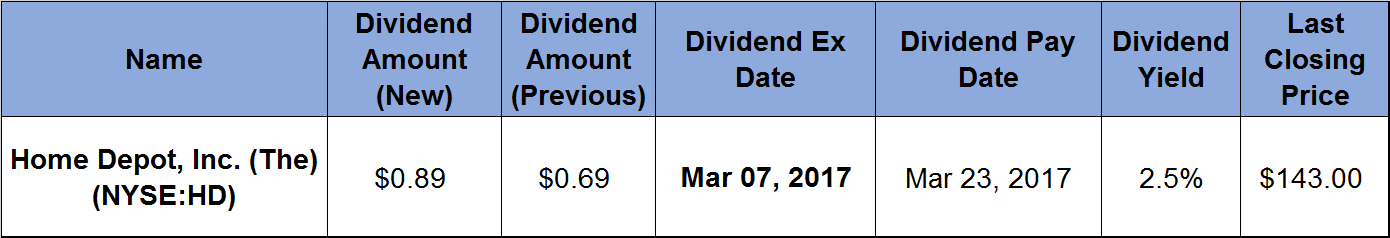

Because of these positive results, the company boosted its quarterly dividend payout by 29% from $0.69 to $0.89. The annualized distribution of $3.56 equates to a 2.5% yield. The current boost is significantly higher than last year’s 17% bump and the 17.6% average annual dividend payout growth since 2009.

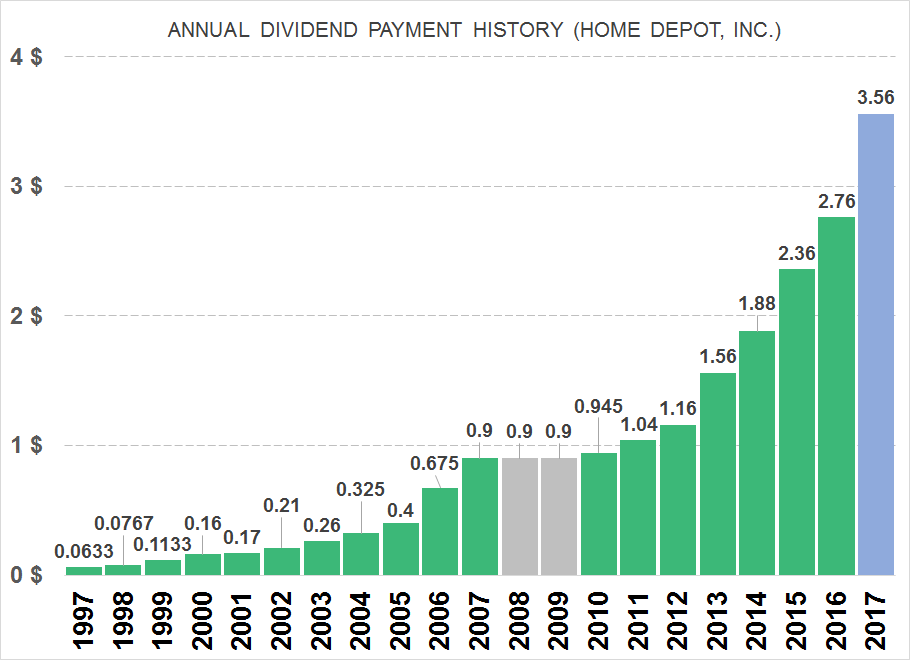

In addition to raising its dividends for eight consecutive years, Home Depot has boosted its annual payout 18 out of the past 20 years.

Below is the chart showing annual dividend payouts for Home Depot since 1996. Green bars indicate dividend boosts, gray bars indicate years with no dividend increases and the blue bar represents the annualized dividend for 2017.

Data source: www.DividendInvestor.com

Share Price

The company’s share price experienced moderate volatility for most of 2016 and fluctuated between $126 and $138 from February through the end of October 2016. After October 24, 2016, the price dropped 6.1% in a little more than a week and reached its 52-week low on November 3, 2016.

Since the November low, Home Depot’s share price rebounded 22%. It reached its new 52-week high of $145.69 during trading on February 21, 2017, but closed at 145.02 at the end of that day. On February 22, 2017, the price closed at $145.25, which became the new all-time high share price for Home Depot.

The company’s share price has grown at an average annual rate of 25.1% since February 2012. Therefore, the share price has tripled over the last five years.

Home Depot’s guidance for fiscal 2017 includes a 4.6% growth of comparable store sales, a 4.6% increase in total sales, a 30 basis-point expansion of operating margin and cash flow in excess of $11 billion. Additionally, the company announced plans for six new stores, approximately $2.0 billion of capital spending and a $5 billion share repurchase plan. The share repurchase plan should help Home Depot achieve its goal of a 10.5% diluted earnings-per-share increase in 2017.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic