Six Dividend-paying Mining Stocks to Purchase as Inflation Concerns Mount

By: Paul Dykewicz,

Six mining stocks to purchase as inflation concerns mount during the economic recovery are benefiting from rising prices for cooper, iron ore and steel, along with scant new capacity to meet increased demand.

The six dividend-paying mining stocks to purchase are rising amid record-setting prices worldwide for copper, iron ore, steel and aluminum, according to BoA Global Research. Those prices have jumped more than 20% above their average for the past decade, the investment firm wrote in a recent research note.

It seems likely that wider inflationary pressures may not abate “imminently,” BoA wrote in a May 25 research report. In addition, a range of companies have been highlighting plans to protect their margins by raising prices.

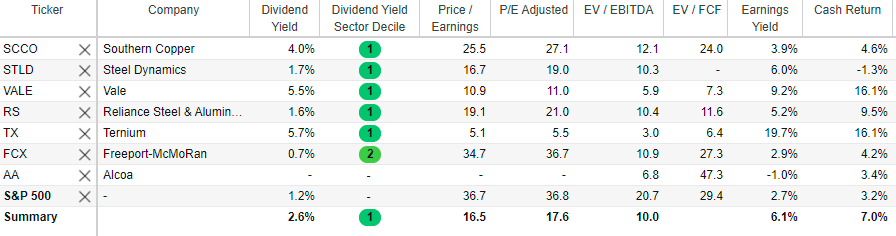

Source: Stock Rover. Click here to sign up for a free, two-week trial for Stock Rover charts and analytics.

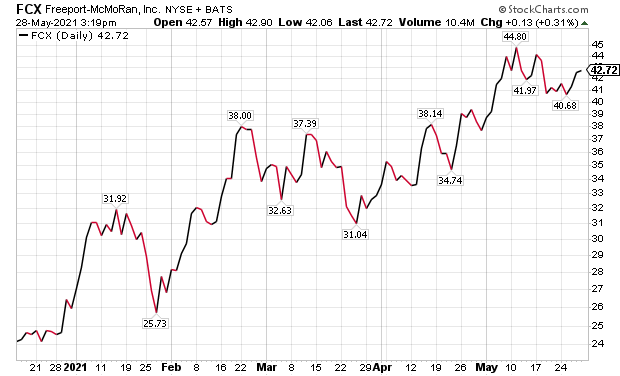

Money Manager Chooses Freeport-McMoRan as One of Six Dividend-paying Mining Stocks to Purchase

“People have fixated on lumber as the leading edge of inflation but don’t be misled: copper is at record levels, too, and the miners that cut costs to weather the pandemic are now basking in dramatic expansion from the top to the bottom line,” said Hilary Kramer, who spearheads the GameChangers and Value Authority advisory services. “Freeport-McMoRan Inc. (NYSE:FCX) is my favorite of the big players. While sales dipped 1% last year, I wouldn’t be shocked to see them soar 55% in 2021.”

Unlike many commodity stocks, Phoenix, Arizona-based Freeport-McMoRan is poised to exploit its scale and widen its margins, continued Kramer, who also hosts the nationally aired “Millionaire Maker” radio program. She predicted the copper, gold and molybdenum mining company’s earnings could jump 400% this year.

The company operates large, geographically diverse assets with significant proven and probable reserves of metals. Its portfolio of assets includes the Grasberg minerals district in Indonesia, one of the world’s largest copper and gold deposits, and mining operations in the Americas, including the large-scale Morenci minerals district in North America and the Cerro Verde operation in South America.

“Strap in and enjoy the ride,” Kramer said.

Paul Dykewicz conducts a pre-COVID-19 interview with Hilary Kramer, whose premium services include IPO Edge, 2-Day Trader, Turbo Trader and Inner Circle.

BoA Highlights Freeport-McMoRan as One of Six Dividend-paying Mining Stocks to Purchase and Sets a $54 Price Target

BoA gave Freeport-McMoRan a $54 share price target and a buy recommendation. The investment firm factored in strong free cash flow (FCF) and net operating loss (NOL) benefits that Freeport-McMoRan received from when its deductions exceeded taxable income. An NOL has value because it can reduce taxable income in future tax years.

Potential threats to BoA’s price objective are: 1) global economic weakness, 2) operating disruptions, 3) execution risk of its cost-cutting or expansion programs, 4) unfavorable regulatory or environmental action, particularly at its Indonesian operations, 5) other pricing pressures on the commodities it produces and 6) unfavorable currency moves.

Possible catalysts to the stock are: 1) better-than-expected copper and gold prices, 2) a more accommodating operating environment in Indonesia and 3) further cost-cutting progress.

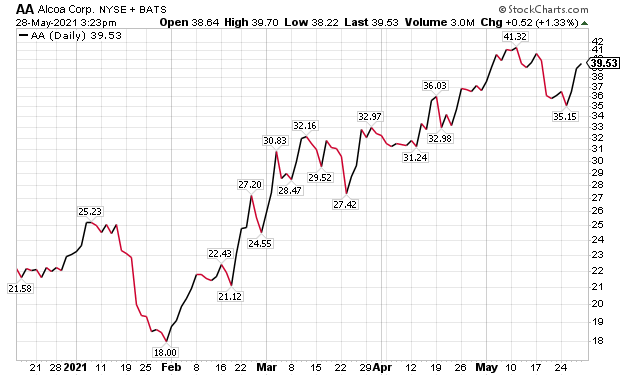

Chart courtesy of www.StockCharts.com

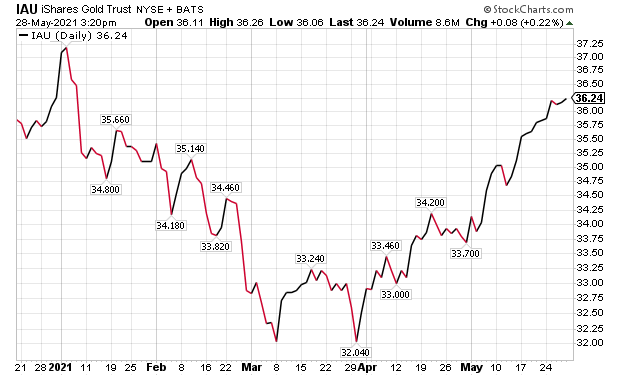

Pension Fund Leader Offers Funds as Alternatives to Six Dividend-paying Mining Stocks to Purchase

Instead of recommending individual mining stocks, consider gold funds, said Bob Carlson, chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets. Gold offers the “most reliable inflation hedge” among the various metals, he added.

“I recommend having a base inflation-hedge in gold through exchange-traded funds (ETFs),” Carlson continued.

Carlson, who also leads the Retirement Watch investment newsletter, told me he likes iShares Gold Trust (NYSE:IAU).

Chart courtesy of www.StockCharts.com

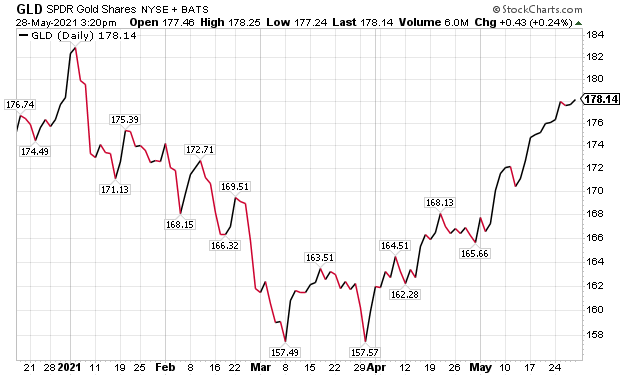

Consider Gold Fund Before Choosing any of the Six Dividend-paying Mining Stocks to Purchase

Many people like SPDR Gold Shares (NYSE:GLD), Carlson told me.

Chart courtesy of www.StockCharts.com

Either fund is a good choice, Carlson counseled.

“Companies in the basic materials and mining businesses historically are good inflation hedges,” Carlson said. “But they are not pure plays in the metals and their inflation-hedging abilities. Investors also are subject to risks such as quality of management, labor issues, competition, regulations and more.”

Pension fund and Retirement Watch leader Bob Carlson answers questions from Paul Dykewicz prior to COVID-19-related social distancing.

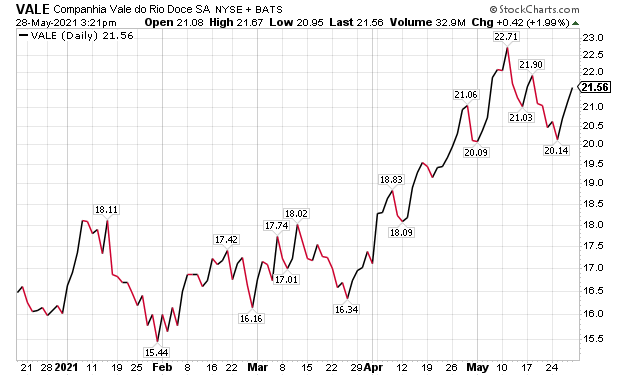

Vale Gains Mention from BoA as One of Six Dividend-paying Mining Stocks to Purchase

Brazil-based Vale (NYSE:VALE) is one of the world’s largest global mining companies and operates in about 30 countries with a mission of transforming natural resources into “prosperity and sustainable development.” Aside from mining, Vale works with logistics using railways, ports, terminals and state-of-the-art infrastructure, along with energy and steel manufacturing.

BoA placed a $30 price target on Vale, based on a blended valuation approach that compared enterprise value as a portion of earnings before interest, taxes, depreciation and amortization (EBITDA), with discounted cash flow (DFC) analysis using a weighted average cost of capital (WACC) of 9.8% with a terminal growth rate of 2%.

Possible threats to achieving BoA’s price objective are: 1) weaker than expected iron ore prices, 2) a global economic slowdown hurting metals prices, 3) appreciation of the Brazilian Real and the Canadian Dollar (80% of Vale’s costs are denominated in the two currencies), without an offsetting rise in metal prices, 4) slowed infrastructure spending or global steel production — mainly in China, 5) higher freight rates that hurt Vale’s competitiveness in China, 6) increased government intervention and 7) more fallout from its Brumadinho tailings dam tragedy.

Potential catalysts for Vale include stronger-than-expected iron ore prices and global economic growth, as well as acceleration of infrastructure spending or global steel production, mainly in China.

Chart courtesy of www.StockCharts.com

Vale Vaults Among Six Dividend-paying Mining Stocks to Purchase

Vale management forecasts growing production of iron ore. BoA reported in a May 25 research note that Vale confirmed potential capacity of 450 million tons (Mt), while reinforcing its strategy of “value over volume” and a view that the market may not slow prior to 2023-24. Vale’s leaders spoke recently of staying disciplined with capital. Projects are in the pipeline, but operators will be cautious in developing them, BoA wrote.

Vale displayed financial strength with its first-quarter results, reporting proforma adjusted EBITDA of $8.467 billion, a record for a first quarter, and net income of $5.546 billion, a whopping $4.807 billion higher than fourth-quarter 2020. The company also boosted free cash flow from operations in first-quarter 2021 to $5.847 billion, up $971 million from fourth-quarter 2020, driven by the improved proforma EBITDA working capital due to strong revenue collection.

The balance sheet at Vale also is strengthening, with gross debt falling to $12.176 billion, down $1.184 billion from the end of 2020. Net debt totaled negative $2.136 billion, with expanded net debt at $10.712 billion.

Investors May Like These Moves by One of the Six Dividend-paying Mining Stocks to Purchase

Two key goals of Vale are to focus on its core business and limit its cash drain. In March, the company concluded the sale of Vale New Caledonia. In April, Vale signed a definitive agreement to buy Mitsui’s stakes in the Moatize coal mine and Nacala Logistics Corridor.

Income investors should appreciate that Vale announced plans in April to buy back up to 5.3% of its outstanding shares. The buyback could be viewed as proof of management’s confidence in Vale’s value creation potential.

On the humanitarian front amid a worsening COVID-19 pandemic in Brazil during 2021, Vale responded to the shortage of supplies for intensive care units (ICUs) by teaming up with other companies to donate 3.4 million critical medicines for intubation. The donation supported 500 hospital beds for a 45-day period. Since 2Q20, Vale has donated $111 million to fight COVID-19 in the regions where it does business.

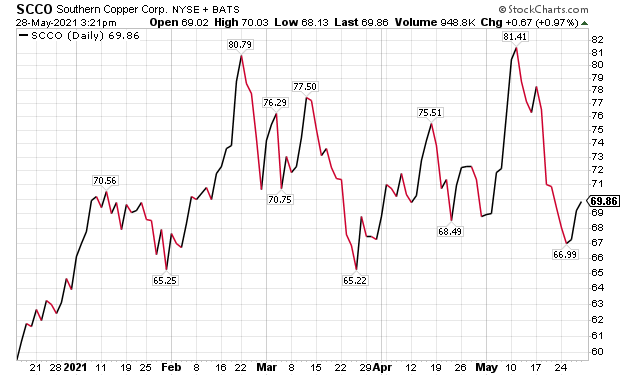

Southern Copper Joins Six Dividend-paying Mining Stocks to Purchase

Phoenix, Arizona-based Southern Copper (NYSE:SCCO), one of the largest integrated copper producers in the world with possibly the largest copper reserves, is among of the six dividend-paying mining stocks to buy as inflation hedges. The company, listed both on the NYSE and the Lima Stock Exchange, is 88.9% owned by Grupo Mexico, a Mexican company traded on the Mexican stock exchange.

The remaining 11.1% ownership interest in Southern Copper is held by the international investment community. Southern Copper operates mining units and metallurgical facilities in Mexico and Peru, as well as conducts exploration activities in Argentina, Chile, Ecuador, Mexico and Peru.

BoA set a price objective of $94 on Southern Copper’s stock, based on a DCF model and a multiple valuation approach that uses an 8.5% WACC and 3% terminal growth. BoA gave an upbeat report about Southern Copper’s strong dividend, a bright outlook for copper and the company’s attractive growth profile.

Six Dividend-paying Mining Stocks to Purchase Face Opportunities and Risks

BoA wrote that potential catalysts to help Southern Copper attain or beat its price objective include: 1) brightening macro outlook, 2) higher-than-expected copper prices and development of projects, particularly Tia Maria, 3) improved global copper demand and 4) reduced political risk in Mexico and Peru.

Red flags that may arise to thwart Southern Copper from fulfilling BoA’s price objective for it are: 1) metal price risk, with 80% of the miner’s revenues coming from copper, 2) operational risks such as strikes and other labor disputes, 3) rising costs, 4) any project delays or cost inflation, 5) political risk and 6) weaker-than-expected copper pricing and demand.

Chart courtesy of www.StockCharts.com

As far as political risks in Peru, the company’s management affirmed its commitment to work with whomever is elected, noting it had more than 60 years of experience operating in the country. Growth alternatives outside Peru focus on the Americas, where management said it was comfortable operating in places such as Chile, Ecuador and Argentina.

BoA noted positive trends for higher copper prices and cited Southern Copper’s low-cost platform and consistent dividend policy. But the investment firm cautioned that political risks in Latin America bear watching, especially the upcoming Peruvian presidential election, which still looks too close to call. Any adverse impact to its mining operations in Peru could hurt SCCO but boost commodity prices. Any real progress at Tia Maria would be incremental to current estimates, since BoA wrote it would not assume any production due to the decades of delays. SCCO could afford to pay “substantial dividends” at these copper prices, BoA noted.

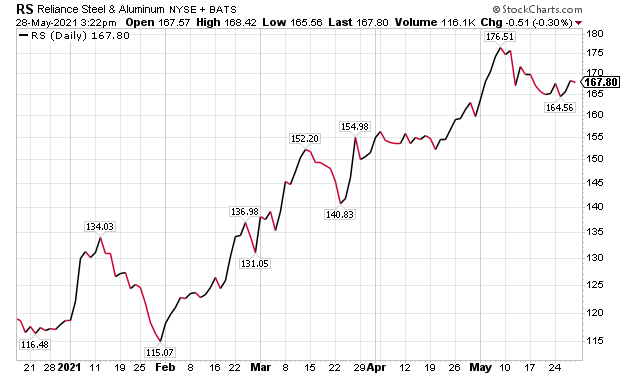

Responsiveness of Reliance Steel Shines Among Six Dividend-paying Mining Stocks to Purchase

Los Angeles-based Reliance Steel & Aluminum (NYSE:RS), a diversified metal solutions provider and the largest metals service center company in North America, operates a network of about 300 locations in 40 states and 13 countries outside of America. The company provides value-added metals processing services and distributes a full-line of more than 100,000 metal products to 125,000-plus customers in a wide range of industries.

Reliance has found a niche in fulfilling small orders with quick turnaround and increasing levels of value-added processing. In 2020, Reliance’s average order size measured $1,910, approximately 49% of its orders included value-added processing and about 40% of those orders were delivered within 24 hours.

BoA gave Reliance Steel a price target of $185 per and praised its cash return to shareholders, as well as support for the share price through buybacks. Plus, the company has a track record of free cash flow generation.

Chart courtesy of www.StockCharts.com

Steel Maker’s Share Price Soars Amid Six Dividend-paying Mining Stocks to Purchase

“Our resilient business model, coupled with outstanding execution in a favorable market, resulted in record financial performance during the first quarter of 2021,” Jim Hoffman, chief executive officer of Reliance Steel, said on April 22 when the company reported its first-quarter 2021 results.

The performance was helped by ongoing strength in metals pricing, led by multiple price hikes for carbon steel products, along with improving demand in many markets. Reliance Steel also leveraged its decentralized operating structure, small order sizes, diversified products, end markets and geographies to achieve a record gross profit margin for the third consecutive quarter of 33.6%.

“The combination of a record quarterly gross profit margin, average selling prices well above expectations and continued focus on expense control contributed to record pretax income of $359.0 million and record quarterly earnings per diluted share of $4.12,” Hoffman said.

BoA wrote that its price target for the company could be affected negatively by a delayed economic recovery, execution risk due to its acquisition strategy and any sharp corrections in prices. Potential catalysts for the stock, BoA noted, are: 1) aggressive buybacks or dividend increases, 2) higher metal prices and 3) more attractive consolidation opportunities than currently modeled. Further upside could come from mergers and acquisitions (M&As), as well as stronger pricing and demand than currently forecast.

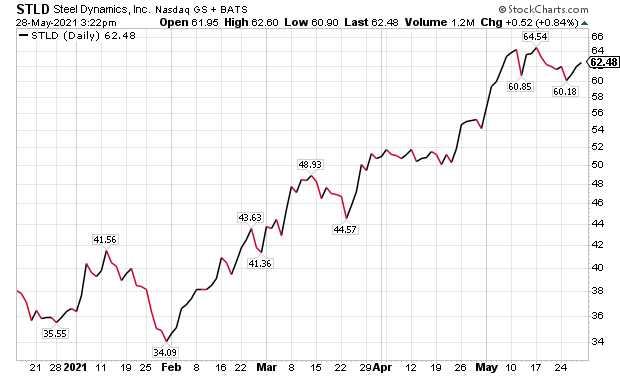

Steel Dynamics Secures Spot Among Six Dividend-paying Mining Stocks to Purchase

Steel Dynamics, Inc. (NASDAQ/GS: STLD), of Fort Wayne, Indiana, is one of the biggest domestic steel producers and metals recyclers in the United States, based on estimated annual steelmaking and metals recycling capability. Steel Dynamics, with facilities throughout the United States and in Mexico, produces steel products, including hot roll, cold roll, and coated sheet steel, structural steel beams and shapes, rail, engineered special-bar-quality steel, cold finished steel, merchant bar products, specialty steel sections and steel joists. In addition, Steel Dynamics produces liquid pig iron and processes and sells ferrous and nonferrous scrap.

Steel Dynamics announced on May 14 that company founder Mark D. Millett, its president and chief executive officer, also will become chairman of the board, effective immediately. In a related move, Keith E. Busse, a company founder, stepped down as the chairman but remains a director.

BoA calculated a $68 share price objective on Steel Dynamics, based on valuation modeling and assumptions. Uncertainty about the price target comes from steel and scrap price volatility, possible project delays, the course of the economic recovery and potential excess supply.

Chart courtesy of www.StockCharts.com

Ternium Takes Final Slot Among Six Dividend-paying Mining Stocks to Purchase

Luxembourg-based Ternium (NYSE:TX) manufactures and processes a wide range of steel products using advanced technology. With 17 production centers in Argentina, Brazil, Colombia, United States, Guatemala and Mexico, the company manufactures high-complexity steel products that supply the main industries and markets in the region.

Ternium describes itself as Latin America’s top flat steel producer, offering high-value-added steel products for customers in the automotive, home appliances, HVAC, construction, capital goods, container, food and energy industries. After reaching record EBITDA in the first quarter of 2021, Ternium management offered guidance of producing a sequentially higher EBITDA in the second quarter primarily due to an increase in realized steel prices, offset partially by higher cost per ton due to increased iron ore, scrap and slab costs affecting the company’s inventories.

Chart courtesy of www.StockCharts.com

Following the pandemic-induced drop in steel consumption during the first half of 2020, rising demand for steel has outpaced the speed of the recovery in global steel production, BoA wrote. This situation has driven a “significant increase” in steel benchmark prices around the globe for the last nine months, the investment firm added.

“Iron ore benchmark prices are also reaching multi-year highs,” according to BoA, adding guidance from the company’s management calls for conditions to normalize in the second half of 2021, as steel capacity use increases, government stimulus programs continue and the pandemic effects begin to wane due to vaccination programs.

Ternium expects to begin operating a new hot rolling mill in Mexico during June 2021, with ramp-up during the second half of 2021. The move should contribute to the company’s expanded product range and improve productivity levels in its industrial system, according to BoA.

BoA Gives Price Target of $54 Per Share to Ternium

BoA’s 12-month price target for Ternium is $54 per share, based on a 50/50 blend of DCF analysis and a 2.5x 2021E EV/EBITDA multiple valuation. The valuation falls below its historical average of 4.3x, due to stronger-than-typical estimated results for 2021, based on record global pricing.

Potential catalysts for BoA’s price objective for Ternium include: 1) a benign outcome from the United States–Mexico–Canada Agreement (USMCA) 2) a smooth Argentine economic recovery, 3) higher steel prices than forecast, 4) demand beating forecasts. Possible threats to the price target are: 1) worsening economic conditions in Argentina, 2) a negative outcome from the USMCA agreement for Mexican exports, 3) sustained or heightened tariffs on steel, 4) any operational disruptions and 5) lower-than-expected prices.

Non-Dividend-paying Alcoa Offers Another Choice Aside from Six Dividend-paying Stocks to Purchase

Pittsburgh-based Alcoa Corp. (NYSE:AA) boasts that it invented the aluminum industry in 1888 and continues to innovate with new technologies and processes. For instance, Alcoa has one of the world’s largest bauxite mining portfolios, features a global alumina refining system, operates an aluminum smelting network, offers a cast products network, features a flexible energy portfolio and aims to to maximize synergies.

Alcoa’s management expressed a desire to enhance productivity, efficiency, innovation and sustainability to provide the best products and outcomes for its customers and shareholders. On the competitive front, its management said at the BoA conference that China’s production “curtailments” supported aluminum fundamentals, with few global projects currently on the drawing board, since additional growth in the Middle East or outside of China would be hard-pressed to replicate China’s low production costs.

BoA’s $56 share price objective on Alcoa shows aluminum’s price strength, as well as big upside from the stock’s current share price. Alcoa also is taking actions to reduce its pension and debt liabilities, which ultimately aid the company’s free cash flow outlook. Potential pluses to Alcoa attaining or beating BoA’s price objective include: 1) higher aluminum and/or alumina prices, 2) better-than-expected cost containment and 3) global demand growth.

Chart courtesy of www.StockCharts.com

Alcoa Is Not Without Risks as a Rival to Six Dividend-paying Mining Stocks to Purchase

Potential pitfalls to Alcoa reaching the price target set by BoA include: 1) aluminum price slippage, 2) excess supply from slowing global demand and lack of curtailment progress, 3) high pension costs that add to costs and liabilities, 4) rising costs for raw materials such as electricity, oil, caustic soda and coke, 5) power contract negotiation risk, since electricity is a key component of costs, 6) power disruption risk and other unforeseen weather-related woes and 7) political and country risk with international operations.

The company’s future pension contributions have been trimmed to $75-90 million annually and consideration has been given to annuitizing pension plans to eliminate longevity risk. However, company officials said it may cost money to reposition the portfolio.

The management team also spoke of returning cash to shareholders in the future, without providing details. BoA wrote that Alcoa could hit its targeted debt thresholds by the year’s end, based on current aluminum price projections.

Such a situation could serve as a “positive catalyst” for Alcoa’s shares, according to BoA.

“We retain a bullish outlook for aluminum, and found the comments on limited supply threat interesting,” BoA wrote. “Given Alcoa has shut significantly over the years, it is encouraging to see it able to restart select relatively with low-cost capacity while others cannot.”

Six Dividend-paying Mining Stocks to Purchase Could Be Shielded from COVID-19 Calamity

Recent headway in the COVID-19 vaccination process offers renewed hope that new cases and deaths could wane further. Further optimism flows from the Food and Drug Administration (FDA) approving a third COVID-19 vaccine. The Johnson & Johnson (NYSE:JNJ) vaccine only requires one dose rather than two, comparedd to the first two market entrants.

Worldwide, COVID-19 cases have reached 169,147,111, with 3,515,183 deaths, as of May 28, according to Johns Hopkins University. By the same date, U.S. COVID-19 cases totaled 33,234,214 and caused 593,845 deaths. America has the dreaded distinction as the nation with the most COVID-19 cases and deaths.

The six dividend-paying mining stocks to purchase give investors a hedge against inflation, as well as offer a chance to profit from a $1.9 trillion federal stimulus package, increased COVID-19 vaccine availability and an improving economy. Such catalysts seem sure to build momentum for the ssix dividend-paying mining stocks.

Connect with Paul Dykewicz

Connect with Paul Dykewicz