The 5 Best Blue Chip Dividend Stocks to Buy Now

By: Ned Piplovic,

Financial markets have been going through significant swings over the past two months. However, while traders are struggling to figure out the direction in which the markets will swing during the next trading session, long term investors can mitigate some of those concerns by investing in one, some or all equities listed below, which are traditionally among the best blue chip dividend stocks for the long term.

All five of the best blue chip dividend stocks below have been paying uninterrupted dividend distributions for decades. They also have significant streaks of consecutive annual dividend hikes, positive asset appreciation over the past 12 months and positive total returns for the past three and five years.

5 Best Blue Chip Dividend Stocks to Buy Now #5

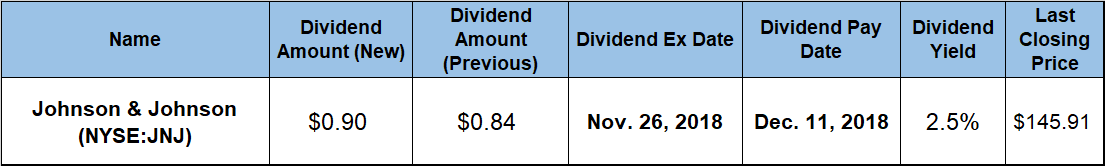

Johnson & Johnson (NYSE:JNJ)

Johnson & Johnson’s share price spiked 6.7% early in the trailing 12-month period before peaking at $148.14 on January 22, 2018, but reversed direction and quickly dropped 20% to its 52-week low of $119.40 by the end of May 2018. However, the share price rose to within 0.3% of the January peak by November 20, 2018. The $145.91 closing price on Dec. 6 was 5.1% higher than one year earlier, 22% above the May 2018 low and more than 50% higher than it was five years earlier.

The current $0.90 quarterly dividend is 7.1% above the $0.84 amount from the same period last year. This new quarterly payout corresponds to a $3.60 annual payout and yields 2.5%, which is nearly 270% higher than the 0.67% average yield of the entire Health Care sector, as well as 31% above the simple average yield of the Major Drug Manufacturers industry segment.

Johnson & Johnson has hiked its annual payout every year since 1963. Over the past two decades, the company enhanced its annual dividend amount more than seven-fold, which converts to an average annual growth rate of 10.4%.

The rising share price and the steadily growing dividend income combined for a 7.6% total return over the past year, 52% over the past three years and nearly 73% over the past five years.

5 Best Blue Chip Dividend Stocks to Buy Now #4

Pfizer Inc. (NYSE:PFE)

The company’s current $0.34 quarterly dividend is 6.3% above the $0.32 payout from the same period last year. The new quarterly amount corresponds to a $1.36 annualized distribution and yields 3%. Pfizer’s current yield is approximately 350% above the 0.67% average yield of the overall Health Care sector. Additionally, the current yield is more than 60% above the 1.88% simple average of the Major Drug Manufacturers industry segment and 14% higher than the 2.65% average yield of the segment’s only dividend-paying companies. Since cutting the quarterly dividend 50% in 2009, the company has doubled its total annual dividend through eight consecutive dividend hikes, which corresponds to an average annual growth rate of 11.4%.

After a minor pullback to a 52-week low of $33.63 in early February 2018, the share price rose 37.5% before reaching its 52-week high of $46.23 on November 30, 2018. The $44.98 closing price on December 6, 2018 was 26.5% higher than one year earlier, 33.7% above the April low and approximately 70% higher than it was five years ago. The dividend growth and asset appreciation combined to reward shareholders with one-, three- and five-year total returns of 29%, 49% and 64%, respectively.

5 Best Blue Chip Dividend Stocks to Buy Now #3

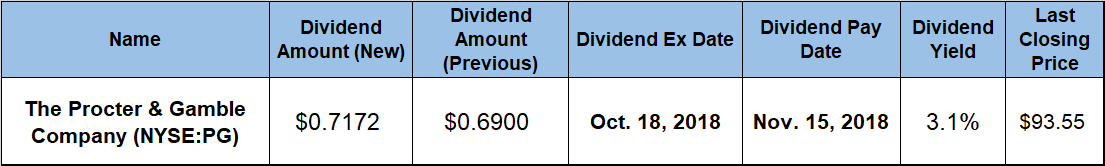

The Procter & Gamble Company (NYSE:PG)

The Procter & Gamble Company’s current record of 64 consecutive annual dividend hikes is the longest streak among large-capitalization companies included in the S&P 500 Index. The company hiked its quarterly dividend payout 3.9% from $0.69 to the current $0.7172 amount most recently for the second quarter payout in May 2018. The current $2.8688 annualized dividend is five-fold higher than it was two decades ago, which indicates an average annual growth rate of 8.4%. The company’s current 3.1% yield outperformed the average sector and industry segment yields by nearly 50% and 30%, respectively.

After declining more than 20% and bottoming out at $70.94 in early May 2018, the share price reversed trend and started rising. While the share price dipped again in late September, the price recovered quickly and advanced towards its new all-time high of $94.51 on November 30, 2018. The share price closed on Dec. 6 at $93.55 – 3.5% higher than one year earlier and nearly 32% above the May low. The total returns over the past one and three years were 5.2% and 30.5%, respectively.

5 Best Blue Chip Dividend Stocks to Buy Now #2

The Coca-Cola Company (NYSE:KO)

The Coca-Cola Company has been delivering steady asset appreciation and a rising dividend income to its shareholders for decades and continues to offer compounded growth over the long term and lower volatility. The company distributed its fourth-quarter dividend distributions on the Dec. 14 pay date to all its shareholders of record prior on the November 29, 2018, ex-dividend date.

The company’s current $0.39 quarterly payout converts to a $1.56 annualized dividend and a 3.15% yield at current share-price levels, which marginally exceeds the company’s own five-year yield average and outperforms the average yield of the company’s peers in the Consumer Goods sector, as well as tops yields of all the companies in the Beverages – Soft Drinks industry segment.

The company started paying dividends in 1893 and has hiked its annual dividend for the past 55 consecutive years. Just over the past two decades, the annual dividend amount rose more than five-fold or at an average growth rate of 8.6% per year.

You can find a more-detailed overview in a recent article about the company on DividendInvestor.com.

5 Best Blue Chip Dividend Stocks to Buy Now #1

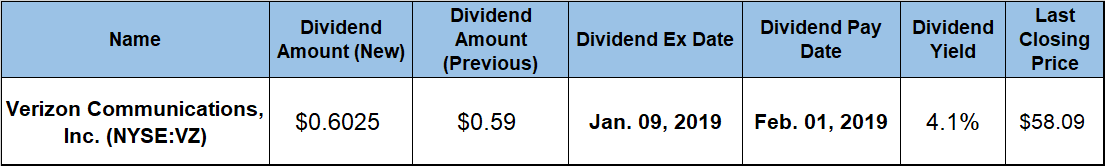

Verizon Communications, Inc. (NYSE:VZ)

Despite moderate volatility over the past 18 months, Verizon’s share price advanced 17% higher over the past year. After an initial 6% decline during the first third of the trailing 12 months, the share price bottomed out at $46.29 on March 23, 2018. After this low, the share price embarked on its current uptrend that rose steadily and then surged ahead since early October towards its 52-week high of $60.65 on November 27, 2018. Since this November peak, the share price fell 4.2% amid the overall market sell-off and closed on Dec. 6 at $58.09. In addition to exceeding the price from one year earlier by 17.3%, the current share price is 25.5% higher than the March low and 21% higher than it was five years ago.

The company’s current $0.0625 quarterly payout corresponds to a $2.41 annualized payout and yields 4.1%. The recent share price ascent suppressed the current yield almost 8% below the company’s five-year yield average. However, Verizon’s current yield is still nearly four times higher than the 1.1% average yield of the overall Technology sector and 75% above the 2.36% average yield in the Domestic Telecom Services industry segment.

The firm has raised its annual dividend 31 times in the past 36 years. During the current streak of 14 consecutive annual dividend hikes, Verizon enhanced its total annual payout 56%, which corresponds to a 3.3% average annual growth rate. The company managed to deliver a total return of nearly 20% over the past 12 months and a total return of 42.3% over the past three years.

Related Articles:

3 Best Dividend Stocks to Buy Now

The 6 Best Dividend Stocks That Yield More Than 5%

Fidelity’s 5 Best Dividend ETFs

5 Best Dividend Mutual Funds to Buy Now

6 Best Dividend ETFs to Buy Now

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic