Five Dividend-paying 5G Stocks to Buy

By: Paul Dykewicz,

Five dividend-paying 5G stocks to buy are expected to ride a growing technology wave that should boost companies that provide key components to usher in advanced communication services.

The five dividend-paying 5G stocks to buy include companies that provide semiconductors, technical equipment, software and related services. The recent retreat in technology stocks is giving investors an opportunity to purchase shares of the five dividend-paying 5G stocks to buy while they are trading at relative discounts to the significantly higher prices just months ago before relaxed fiscal and monetary policy led to growing concerns about inflation.

The annual inflation rate in the United States reached 5.0% for the 12 months ended May 2021, rising from 4.2% for the 12 months ended in April, according to U.S. Bureau of Labor Statistics data. The 4.2 percent jump reported in April standing as the biggest spike for a 12-month period since a 4.9-percent surge in the 12 months ended September 2008.

Five 5G Dividend-paying Stocks to Buy, According to BoA Global Research

The 5G rollout is in its nascent stages and its implications are “barely visible,” but BoA telecommunications analyst David Barden is predicting that the technology will be used in health care, industrials, energy and consumer markets, among others. Despite no “killer app” for 5G yet, Barden expects the right applications to be developed as networking deployment and phone adoption stimulate use amid a generational technology battle between the United States and China.

Long-term possibilities for use of 5G include doctors performing remote surgeries, flying cars, haptic bodysuits that fully immerse players in the game world, machines monitoring and warning of breakdowns and predictive maintenance and smart grids for utility providers, Barden wrote in a research note.

Kevin O’Leary, chairman of Boston-based O’Shares ETFs and a panelist on the “Shark Tank” television program, said in a recent podcast that 5G will emerge as a “really big game changer” and any business that wishes to reach out to its customer and form a direct relationship will benefit from using the technology.

Paul Dykewicz interviews Kevin O’Leary, head of O’Shares ETFs and a “Shark Tank” investor

Kevin O’Leary, called ‘Mr. Wonderful’ on ‘Shark Tank,’ Forecasts Huge 5G Growth

“The [5G] losers are going to be the companies that do not adapt to understand how to acquire customers that way,” O’Leary said. “There are plenty of those. They just haven’t figured out social media. They haven’t figured out what it takes to acquire a customer. They haven’t figured out how to digitally market. They are still trying to do it in the newspaper. Those days are gone.”

Connor O’Brien, CEO of O’Shares ETFs and moderator of the podcast, responded that the days of businesses and individuals buying classified advertisements in print publications to sell products are on the wane. 5G is an “emerging technology” that has not been rolled out extensively across the country yet, O’Brien added.

Connor O’Brien, CEO of O’Shares ETFs

In a nutshell, 5G is the “next generation” of mobile and communications services, said Sylvia Jablonski, chief investment officer of New York-based Defiance ETFs, on the same podcast. The compound annual growth rate of 5G is forecast to reach 70% between 2020 and 2025, Jablonski added.

“5G is 100 times faster than 4G is already,” Jablonski said.

Applications targeted by 5G so far will allow for the creation of a “digitalized economy,” the continued rollout of electric vehicles, machine learning and artificial intelligence and advanced internet connectivity, Jablonski said. Another key use of 5G will be to provide real-time medical data for doctors and hospitals, she continued.

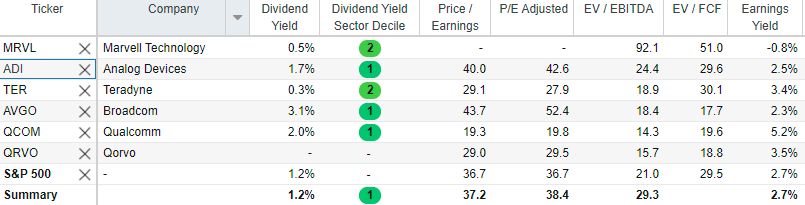

Source: Stock Rover. Click here to sign up for a free, two-week trial for Stock Rover charts and analytics.

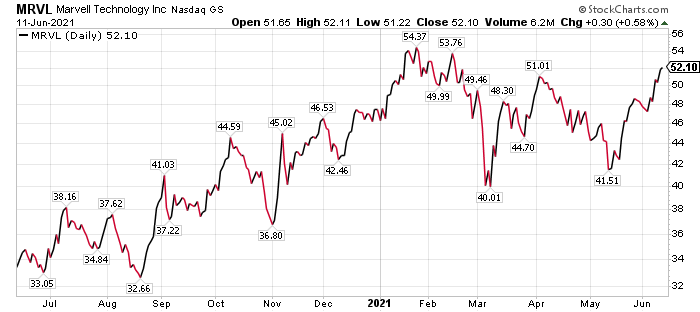

Five Dividend-paying 5G Stocks to Buy Include Marvell Technology

Hamilton, Bermuda-based Marvell Technology, Inc. (NASDAQ:MRVL), a developer and producer of semiconductors and related technology, ranks as one of the five dividend-paying 5G stocks to buy, according to BoA. The stock is poised to growth strongly as market opportunities increase in the second half of 2021 and beyond.

Marvell’s April 20 acquisition of San Jose, California-based Inphi Corporation obtained capabilities such as the production of 10-800G high-speed analog and mixed-signal semiconductor components. The combination led BoA to boost its price objective on the surviving entity to $50 from $58 on April 26.

Even though the acquisition of Inphi is dilutive near-term to Marvell, it improves the long-term compound annual growth rate of the buyer to 16% from 12%, according to BoA. Plus, profitability will be aided as Marvell shows it is well positioned to benefit from 5G deployments in the second half of 2021 across the United States, China and Japan, as demand for cloud services rises.

Marvell, a supplier of mixed signal and analog semiconductor products for storage, computing and communication applications, seems poised for “secular growth” in enterprise data centers, cloud 5G mobile and security markets, BoA wrote.

Nonetheless, Marvell faces threats to achieve the $66 price target BoA gave it, based on integration risks from its recent deals, financial risks stemming from going into net debt on a net cash position and in achieving expected cost synergies in a timely manner. Cyclical industry risks for Marvell include a potential slowdown in legacy hard disk drive and storage assets and competition from larger and well-resourced rivals, BoA cautioned.

Chart courtesy of www.StockCharts.com

Chart courtesy of www.StockCharts.com

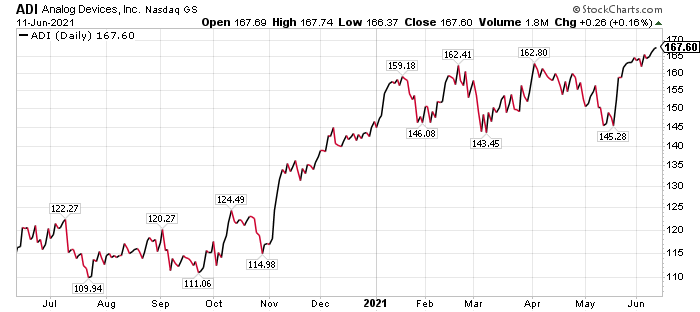

Analog Devices Earns Berth Among Five Dividend-paying 5G Stocks to Buy

Analog Devices, Inc. (NASDAQ:ADI), a semiconductor company headquartered in Wilmington, Massachusetts, specializes in data conversion, signal processing and power management technology. The company gained a spot among the five dividend-paying 5G stocks to buy from BoA and received a price objective from the investment firm of $178. The valuation seemed justified by BoA due to Analog Digital’s “best in class profitability” and differentiated communications exposure.

Potential threats to ADI include a possible economic downturn that could hurt demand for automotive and industrial products, as well as an inability to realize the planned cost synergies in its combination with Linear Tech. Other risks include possible higher-than-historical debt that could limit ADI’s valuation multiples and add risks in a cyclical downturn, concentration on key customers such as Apple Inc. (NASDAQ: AAPL) contributing 10% of its vendor’s sales on an average, as well as much higher amounts during seasonally stronger quarters, according to BoA.

Competition from bigger vendors also poses a challenge, especially from rivals such as Texas Instruments Inc. (NASDAQ:TXN), which have lower-cost production facilities. However, that challenge is not unique to Analog Devices, since other fast-growing technology companies such as Marvell face stiff competition from larger and better-established rivals.

Chart courtesy of www.StockCharts.com

Cell Tower Companies Offer Alternative to Five 5G Stocks to Buy

Bob Carlson, chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets, likes investing in 5G through infrastructure companies. He expressed a preference for companies that own the cell towers on which the transmission equipment is located and that rent space on the structures to the different 5G providers.

Carlson, who also heads the Retirement Watch investment newsletter, said 5G stocks have had a strong rally in the last year, so look to buy sharesa during corrections. Carlson continued that he seeks to avoid 5G provider stocks and instead likes recommending selected cell tower stocks.

Pension fund and Retirement Watch leader Bob Carlson answers questions from Paul Dykewicz prior to COVID-19-related social distancing.

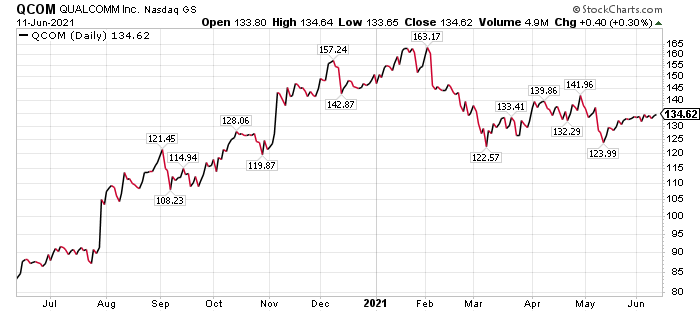

Qualcomm Receives Place With Five Dividend-paying 5G Stocks to Buy

San Diego-based Qualcomm Inc., (NASDAQ:QCOM) creates semiconductors, software and services related to wireless technology. The company owns patents that are important to the 5G, 4G, CDMA2000, TD-SCDMA and WCDMA mobile communications standards.

BoA assigned Qualcomm a $200 price target, while acknowledging it gave the stock a “premium” valuation compared to its mobile and large-cap semiconductor peers. The valuation came about partly due to Qualcomm’s status as a stable, high-margin royalty business, after resolving its legal disputes with Apple. Plus, Qualcomm has amassed a high market shares for 5G baseband and 5G radio frequency (RF) front-end content.

Possible threats to Qualcomm include worse-than-expected conflict resolution terms with Chinese rival Huawei, low adoption rate of smartphones worldwide due to global economic pressure and fierce competition to keep semiconductor pricing down as the company grows its presence in emerging markets. Other potential risks are semiconductor competition, needing to maintain its royalty rate when the market expands to different types of devices, such as tablets and other mobile wireless devices, or different technology generations, as well as any future negative trade policies related to China.

Chart courtesy of www.StockCharts.com

Money Manager Cites Qualcomm as One of Five Dividend-paying 5G Stocks to Buy

Qualcomm is a favorite 5G stock of Hilary Kramer, who heads the GameChangers and Value Authority advisory services. Kramer, who also hosts the nationally aired “Millionaire Maker” radio program, said Qualcomm is the “obvious starting point” for 5G investors.

Kramer said Qualcomm holds the patents on the wireless chips that new devices coming onto the 5G network will need to incorporate in some form. Qualcomm also offers investors an opportunity to benefit from dividend growth.

The company currently offers a dividend yield of 2% but that quarterly payout has swelled 300% in the last decade, twice as fast as the payout rate of Apple, Kramer continued. Investors who hold onto the stock could lock an 8% yield by 2030. That’s what getting into a “technological revolution early” can give investors, she added.

Paul Dykewicz conducts a pre-COVID-19 interview with Hilary Kramer, whose premium advisory services include IPO Edge, 2-Day Trader, Turbo Trader and Inner Circle.

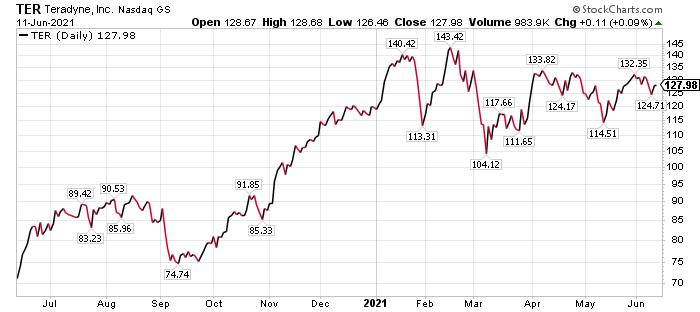

Teradyne Joins the List of Five Dividend-paying 5G Stocks to Buy

Teradyne, Inc. (NASDAQ:TER), a North Reading, Massachusetts-based provider of advanced test solutions for semiconductors, electronic systems, wireless devices and more ensure that products perform as they were designed, also gained a place on the list of six 5G stocks to buy. The company produced revenue of $3.1 billion in 2020 and tries to help manufacturers of all sizes improve productivity and lower costs.

BoA’s $155 price objective on TER is based price-to-earnings (P/E) valuation that at the high end of the company’s long-term trading range. The reasoning is due to Teradyne’s unique exposure to 5G and automation, cyclical recovery in auto and industrial markets, as well as market share in selected testing.

Potential threats to prevent achieving the price objective include cyclicality and market share losses in the core semiconductor testing arena, along with rising competition in the robotics segment, according to BoA.

Chart courtesy of www.StockCharts.com

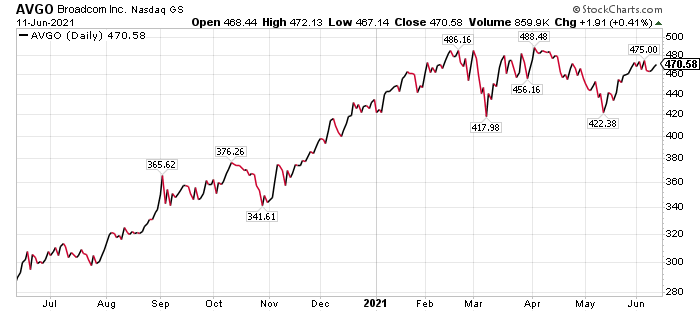

Broadcom Breaks Into the Six 5G Stocks to Buy

San Jose, California-based Broadcom Inc. (NASDAQ:AVGO), a designer, developer, manufacturer and global supplier of semiconductor and infrastructure software products that serve the data center, networking, software, broadband, wireless, and storage and industrial markets, is another 5G stock with a buy recommendation from BoA.

BoA assigned a $550 price objective to Broadcom, but thatt is less than the median for large-cap diversified peers to reflect AVGO’s higher debt leverage and reliance on software M&A. Further threats to Broadcom achieving its price objective come from semiconductor cycle risks including sensitivity to U.S.-China trade relations, high exposure to Apple, along with increased competitive in networking, smartphone, storage and enterprise software markets. Broadcom also is a “frequent acquirer” of assets that add financial and integration risks, revealing vulnerability to its recent strategy of moving into non-core software businesses.

Chart courtesy of www.StockCharts.com

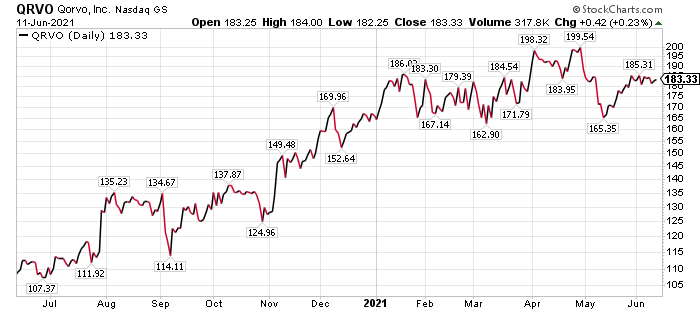

Non-Dividend-paying Qorvo Is Alternative to Five Dividend-paying 5G Stocks to Buy

Qorvo (NASDAQ:QRVO), a Greensboro, North Carolina-based semiconductor company that designs, manufactures and supplies radio-frequency systems for applications that drive wireless and broadband communications, as well as foundry services, is another 5G play that received a buy rating from BoA. The investment firm gave a $215 price objective to Qorvo based a valuation that is at the higher end of the semiconductor company’s long-term range but justified by BoA due to upcoming major product ramp-ups and lessened customer concentration relative to its peers.

Potential threats to Qorvo fulfilling that price objective include possible market share losses in handset power amplifiers (PAs) in which product cycles are just 6-12 months for key customers, customer concentration at Apple and Samsung and gross margin headwinds due to reduced factory use from weaker design-win momentum. Among other possible setbacks are weakened smartphone growth trajectory, semiconductor cyclicality driven by strong macroeconomic conditions and supply chain expansion, as well as lingering COVID-19 headwinds further impacting the supply chain or creating demand destruction, BoA noted.

Prospective catalysts to Qorvo meeting or beating the $215 price objective set by BoA for the stock include: 1) higher RF content growth in new smartphones more than offsetting quarterly unit volatility in the fourth quarter, 2) mergers and acquisitions that diversify the business away from mobile and add more long-life cycle business and 3) substantial share gain against peers in the smartphone market due to increased research and development (R&D) spending.

Chart courtesy of www.StockCharts.com

Five Dividend-paying 5G Stocks to Buy Evade Worst of COVID-19 Crisis

Advances in the COVID-19 vaccination process offer increased hope that new cases and deaths may fall further in the weeks and months ahead. Renewed optimism comes from the Food and Drug Administration (FDA) recently approving a third COVID-19 vaccine, manufactured by Johnson & Johnson (NYSE:JNJ), which requires just one dose rather than two, as the first two vaccine providers do.

COVID-19 cases worldwide have reached 175,106,549 and caused 3,778,734 deaths, as of June 11, according to Johns Hopkins University. Also as of June 11, U.S. COVID-19 cases totaled 33,436,839 and have been blamed in 5998,326 deaths. America has the unenviable distinction as the nation with the most COVID-19 cases and deaths.

The five dividend-paying 5G stocks to buy offer a chance for investors to profit from next-generation communication technology. A recent $1.9 trillion federal stimulus package, increased COVID-19 vaccine availability and an improving economy should help to boost the five dividend-paying 5G stocks to buy sooner or later.

Connect with Paul Dykewicz

Connect with Paul Dykewicz